Evraz shares are trading down 30% at the time of writing as Russia launches a full scale invasion of Ukraine, sending troops into the country and launching rocket attacks on cities.

The flagrant disregard for Ukraine’s sovereignty by Putin has rocked European markets, in particular those with operations or links to Russia, including FTSE 100 Evraz.

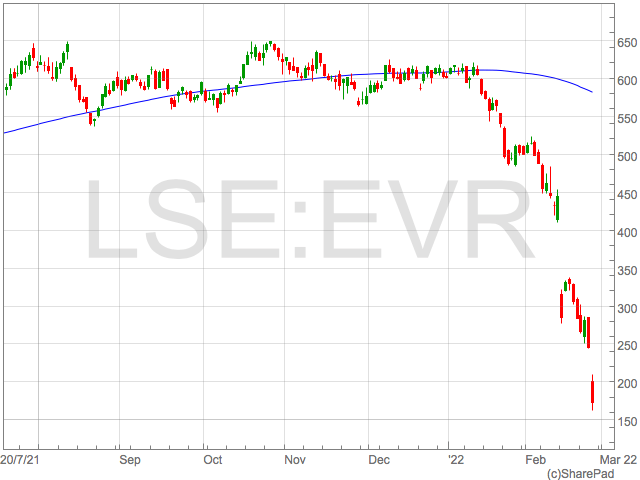

The Evraz share price was down 30% on Thursday and has collapsed by 71% so far in 2022. Indeed, the company is trading more like a penny share than a FTSE 100 constituent. Such a sharp decline in Evraz shares will likely grab the attention of bargain hunters, but is now a good time to buy Evraz shares?

With such a high degree of uncertainty around the situation on the ground, and what impact sanctions will have on Russian businesses, considering taking a position in Russia-Exposed companies will be pursuit only for the brave.

“Investors hate uncertainty and whilst it’s inevitable that the west will respond to Russia’s aggression, what’s unclear right now is by what severity and how the situation could escalate further. As a result, investors are seeking asset protection and don’t want to take on any risk to their portfolios,” said Walid Koudmani, chief market analyst at financial brokerage XTB.

Evraz shares have suffered due their substantial steel-making operations across Russia. Of Evraz’s total Q4 crude steel production of 3,384,000 tonnes, 2,904,000 tonnes were produced in Russia.

The West is promising serve sanctions on Russia which will likely target their commodity exports which would ravage the ability of Evraz to export steel and destroy their revenue and prices achieved for their output. Steel could well be high on the West’s list of exports to targets as curbing their oil exports would harm their own economies as much as Russia’s.

One only has to look at what the West has done to the Iranian oil industry and economy with the implementation of sanctions.

Adventurous short-term traders may look to the Evraz share price for a ‘dead cat bounce’, but the longer term outlook for Evraz shares is highly uncertain and buying Evraz should be considered extremely high risk.