F3 Uranium’s CEO Dev Randhawa’s unerring mission is to deliver growth for his shareholders.

We recently met with the F3 Uranium CEO in London and enjoyed rigorous discussion about the need to increase nuclear power, uranium market dynamics and F3’s recent Patterson Lake North discovery. Randhawa was particularly chipper when discussing their recent high-grade uranium discovery and the significance of the grades encountered.

Dev Randhawa is a massive proponent of nuclear energy’s ability to help meet the world’s future energy demands and feels his company, F3 Uranium, has the potential to be instrumental in securing the uranium supply to facilitate nuclear power generation.

“I believe we need cheap, clean power; that’s what nuclear power is” – Dev Randhawa

Despite his very specific interest in nuclear power, Randhawa is realistic about nuclear energy’s place in a diverse energy generation mix.

It is now clear no one clean energy source can solely meet the world’s energy demands. However, nuclear provides many benefits over other forms of energy.

The first benefit of nuclear power the F3 Uranium CEO highlights is cost. Dev explains that once a nuclear energy plant is established, input costs are very low and resultant energy is cheap.

The second relates to the reliability of nuclear compared to renewables sources. As demonstrated here in the UK in recent years, although wind and solar inputs costs are zero, there is no guarantee the sun will shine or the wind blows.

F3 Uranium

F3 Uranium is a uranium project generator and exploration company with 16 projects across the Athabasca Basin in Canada. The region is famous for the world’s highest grade uranium discovery, the MacArthur Lake.

F3’s close proximity to premiere uranium producers means they have access to extensive infrastructure and improved project economics. Dev highlights the benefits of operating in an area near uranium processing plants.

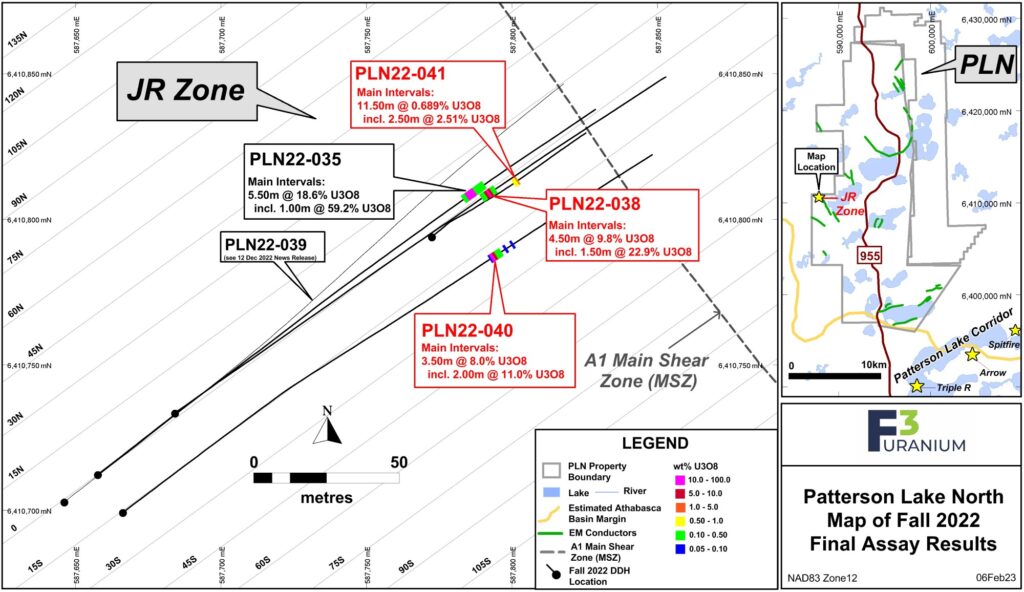

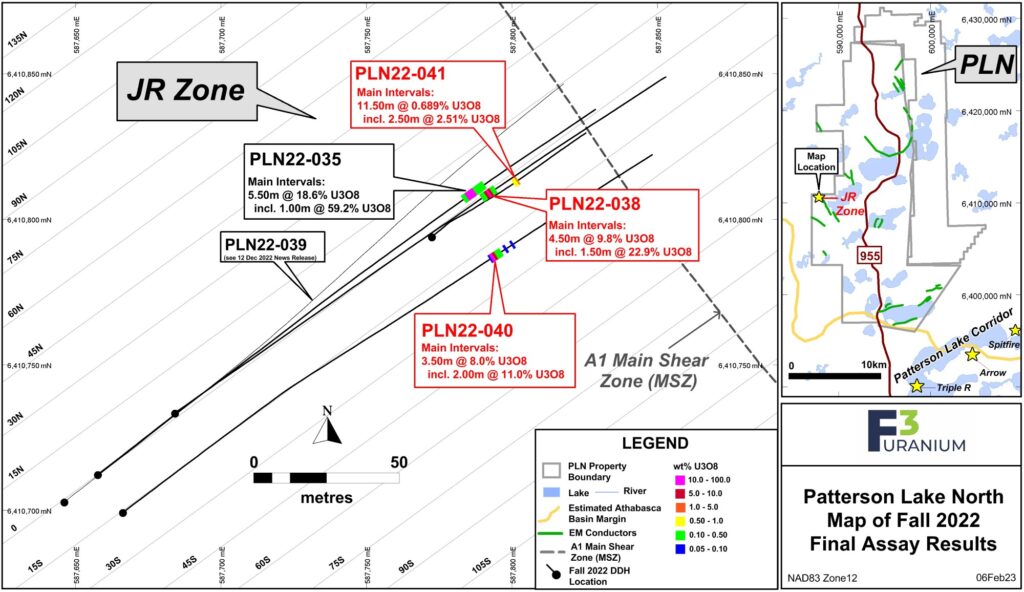

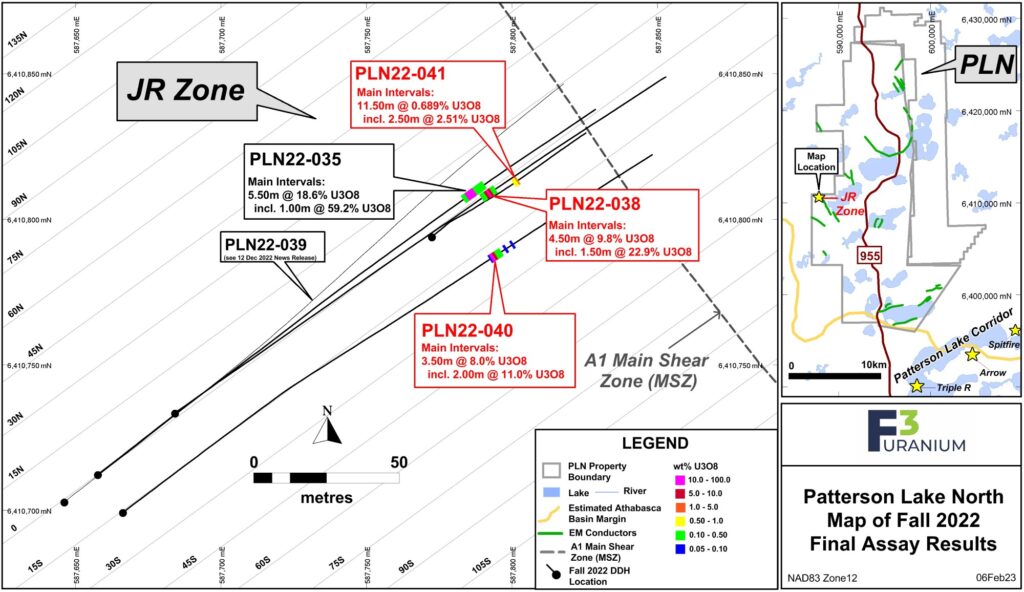

Although all 16 projects have been identified as potential valuation opportunities, the focus is on their Patterson Lake North (PLN) project. The importance of PLN was evident and our conversation with F3 centred on this asset.

In late December 2022, F3 Uranium announced assay results at the PLN project that encountered one continuous 15.0 m interval averaging 6.97% U3O8 including a high-grade 5.5 m interval averaging 18.6% U3O8. In addition, the assay revealed an ultra-high core of 59.2% over 1.0m.

F3 Uranium’s shares soared on the news and Dev detailed why.

The geology in the Athabasca is very different to other uranium-rich region such as Niger or Australia.

Athabasca uranium deposits are typically concentrated in compact formations and inconsistently located along a corridor. This means finding the deposits in Athabasca is trickier than in other jurisdictions, typified by continuous mineralisation formations.

The value in Athabasca uranium deposits lie not in their size, but their grade.

And the F3 Uranium team has a history of high-grade discoveries.

F3 Uranium Technical Team

Randhawa has ensembled a world-class technical team with recent success of commercially viable uranium discoveries in close proximity to F3’s assets.

F3 Uranium’s technical team was instrumental in the Triple R discovery which has the potential to be one of the lowest cost uranium mines in the world. The current Triple R resource is 2.68mt at 1.94% U3O8.

F3 believe an experienced technical team is crucial for shareholder value creation.

Should the current PLN programme be anywhere near as successful as Triple R, the implications for F3’s shareholders will be profound. It will achieve the growth Dev has set out to achieve.

“The question is,” Dev says, “is how many beads of uranium we will find. We’re not going to know that until at least 50 holes have been drilled.”

The drill campaign currently being executed by F3 Uranium is an exciting period for the team and their investors.

F3’s share price reacted positively to early results from PLN and have since retraced, possibly providing an entry for investors seeking to embark on the F3 journey.

The presence of high-grade uranium at PLN has proved they have identified a highly prospective area. The next stage is establishing the size of a potential resource.

We ask the future plans for F3 and his strategy, should PLN prove to be an economically viable uranium producing mine. Dev reminds of us F3’s business model as a project generator but doesn’t rule out a scenario where PLN is developed by F3 beyond the early exploration phase.

The model dictates once F3 has extracted as a much shareholder value from the PLN project using F3’s internal resources, a partner is brought into to continue the journey towards production.

F3’s management have deep experience inking agreements with Korean and Japanese corporation and will know how to secure value in any PLN partnership.

Crystallising the value in PLN will be a milestone for F3 which would provide the liquidity to turn their attentions to one of their other 15 projects.