The FTSE 100 gave up ground on Tuesday morning following the announcement of Jay Powell retaining his position as the Chairman of the Federal Reserve and weak commodities prices dragged the index.

Jay Powell’s confirmation for a second term at the Federal Reserve caused concerns monetary policy would tighten faster than if second choice Brainard was to take up the role. This sent the dollar higher, gold lower and drove selling in equities on Tuesday.

Oil prices slipped taking the FTSE 100’s oil majors and the entire index down with it as India and the United States released oil reserves to cool fuel prices, before staging a rebound.

“A slump in the oil price as the US taps into its strategic reserves helped put the FTSE 100 on the back foot on Tuesday,” says AJ Bell investment director Russ Mould.

“The air has been coming out of the market like a slowly deflating balloon over the last week or so but it has accelerated this morning, not helped by a sell-off in US technology stocks overnight.

“This was linked to fears of more rapid tapering of financial stimulus and hikes to interest rates after Jerome Powell was re-nominated for another term as chair of the US Federal Reserve.

“The fourth wave of Covid being endured in parts of Continental Europe is prompting the reintroduction of restrictions and resulting civil unrest, threatening its economic recovery.”

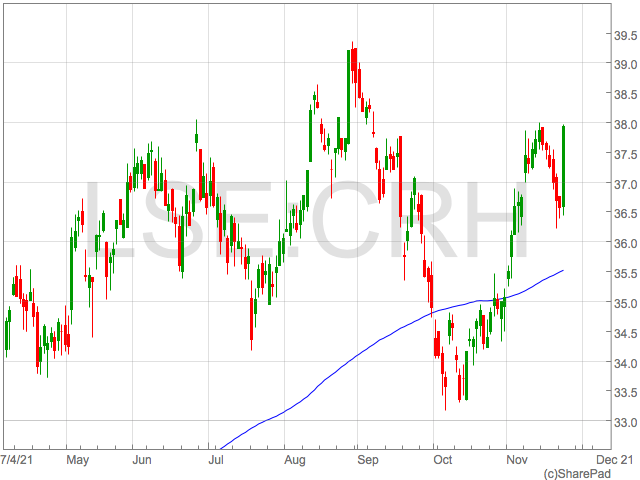

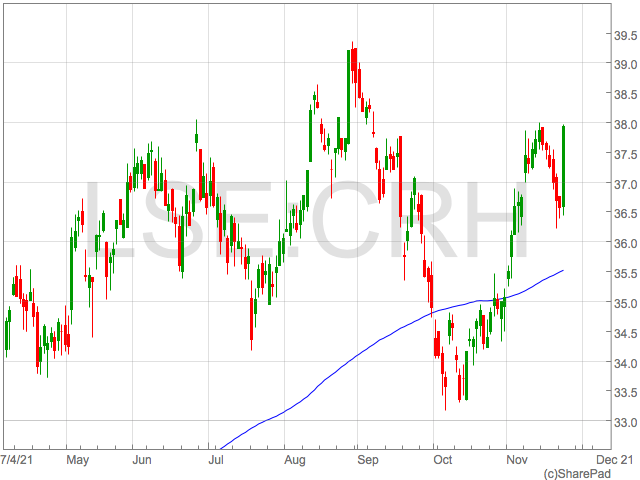

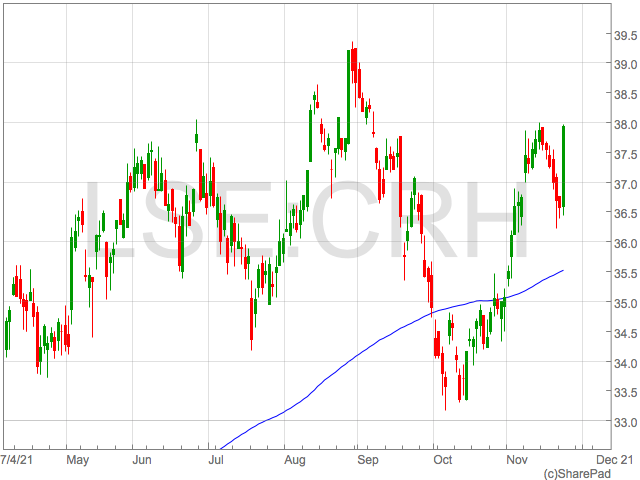

Elsewhere, CRH was the top riser after the construction firm said nine-month sales rose 11% and had a positive view on their outlook.

“CRH continues to perform well with good underlying demand and pricing progress across our key markets,” said CRH Chief Executive, Albert Manifold.

“Our uniquely integrated and solutions-focused business model has supported further margin expansion across our businesses, while our strong cash generation and disciplined approach to capital allocation provides further opportunities to create value for all of our stakeholders.”

“Looking ahead to the remainder of the year, we expect to deliver another record performance for the Group, with full-year EBITDA in excess of $5.25 billion.”