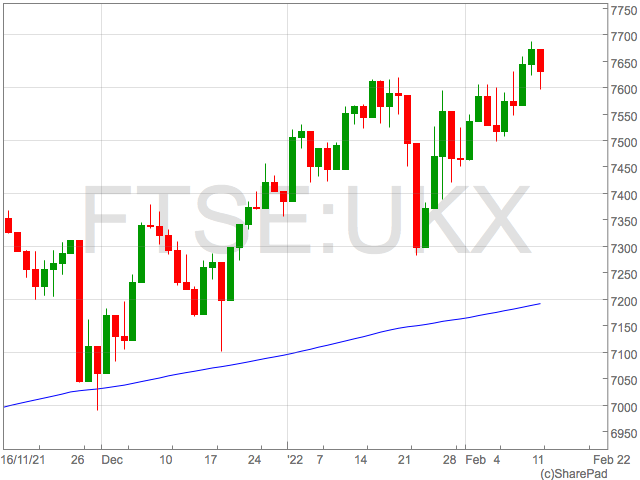

The FTSE 100 eased on Friday after a strong week of gains that saw the index trade at the highest levels since the beginning of the pandemic.

The FTSE 100 was trading 7,627, down 0.4% going into the close on Friday. Although the index was down on Friday, the FTSE 100 rebounded from sharper selling earlier in the session to trade marginally above key support levels around 7,620.

Trade was led by US equities which sank overnight on fears around inflation and interest rates. This meant the FTSE 100 opened lower, but later tracked the recovery in US futures higher during the session.

UK GDP

Markets learnt of the UK’s strong economic performance in 2021 on Friday but the bumper reading did little to inspire confidence.

Investors seemed unimpressed with the UK’s 7.5% growth in 2021 with domestic facing sectors such as housebuilders barely moving.

GDP is backward looking economic indicator and despite grinding out 1% growth during the ‘lockdown by stealth’ in Q4, both households and investors will be looking forward to conditions in 2022 with soaring inflation and the prospect of multiple rate hikes.

“Will 2022 see the UK quickly shake itself off after December’s blip or will supply constraints and those rising prices keep the lid on things? One percent growth in Q4 is pretty good going when you think about those empty high streets dressed up for a Christmas party that never took place. Household consumption has been a key factor in the UK’s growth story, the question is will households still have the fire power as additional budget pressures exert a choke hold,” said Danni Hewson, AJ Bell financial analyst.

Overseas earners

With the majority of shares in the FTSE 100 down on Friday, those that showed some signs of positivity were predominately companies that earn a large proportion of their revenue overseas.

Unilever rebounded from selling yesterdays as investors contemplated the company’s strategy and decision to proceed with share buybacks and hold off on any major acquisitions. Unilever shares were 3.3% higher at the time of writing.

Energy companies continued their rally on Friday as BP and Shell gained. Miners were mixed as copper miner Antofagasta pushed 2% higher but Rio Tinto, Glencore and Anglo American fell.

Betting companies Entain and Flutter also gained as investors positioned for the relaxation of betting laws in the US.