The FTSE 100 fell 0.8% to 7,127 during late morning trading on Wednesday as fears ramped up over China’s role in the Russia-Ukraine conflict.

Miners and oil companies are amongst the top fallers of the FTSE 100 today as concerns rose around the impact on demand for commodities of China were to be dragged into the conflict by supplying Russia with aid and face sanctions from the West.

The combined impact of China’s potential assistance to Russia in the war, alongside the country’s Covid-19 lockdown in Shenzhen saw analysts point towards trouble for mining companies.

“Ongoing uncertainty over whether China will provide military assistance to Russia also weighed on sentiment, with the Shanghai SE index down nearly 5% and the Hang Seng falling nearly 6%,” said Russ Mould, investment director at AJ Bell.

“Disruption to the Chinese economy is not good news for commodity producers which have relied on the region to buy their metals and minerals for the past few decades.”

“Heightened concerns explain why miners had a bad day on the market – and if they’re falling, you can be almost certain that the resources-heavy FTSE 100 will be dragged down.”

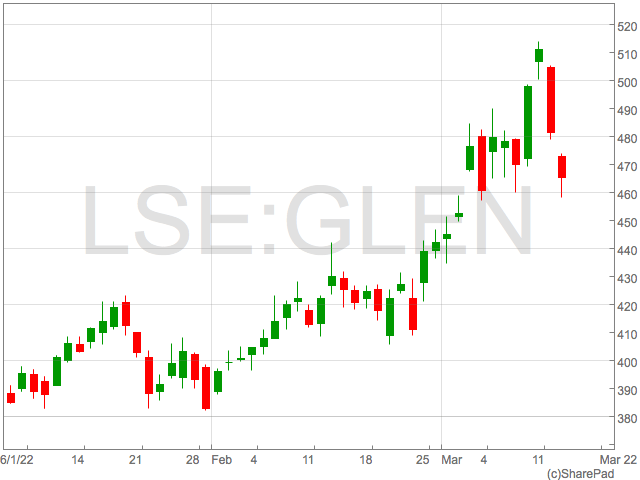

Polymetal, Glencore, Rio Tinto, Antofagasta shares are all trading down 17%, 3.9%, 3.7% and 2.6% respectively.

China exposure

Standard Chartered fell 4.4% to 469p, as its ties to China saw its value pulled down in the spiralling Asian markets.

Oil is down 8% to $98 per barrel, also a consequence of the rising COVID-19 cases in China as the country is one of the largest importers of Brent Crude. BP and Shell were down 1.7% and 0.9% respectively and were a major drag on the FTSE 100 in terms of the numbers of points take off the index.

Various utilities providers were amongst the top gainers on the FTSE 100 as the cost of living is expected to increase in the UK as a outcome of the Russia-Ukraine war and investors repositioned into defensive sectors.

Consumer staples giant Reckitt Benckiser Group rose 2.2% to 5,823p.

Informa saw an increase of 2.2% to 562.7p after a jump from £1.6 billion to £1.8 billion in revenue.

The FTSE 100 top riser was Pearson climbing 7.8% to 820p as it continued its rally after it recently declined a 854.2p cash offer bid from asset management company Apollo.