FTSE 100 was largely flat on Monday trading as gains from telecom and mining shares helped lift the index which was being dragged by drops in Experian and some retailing stocks.

China’s lockdowns have driven slowing growth this quarter and raised investors concerns about the health of the world’s second largest economy. China reported that retail sales fell by 11.1% in April followed by a 2.9% drop in industrial production and a rise in the unemployment rate from 5.8% to 6.1%.

Earlier on Monday, the European Commission revealed an increase in its inflation forecast due to the energy market conditions resulting in a decline in European growth this year to 2.7% from the forecast of 4% stated three months ago.

The rippling effect of the slowdown in the economy is expected to extend to 2023 with a growth forecast of 2.3% in the EU, a decrease from 2.8% earlier.

The European Commission stressed the rising energy prices and expects inflation to hit 6.9% in this quarter and average around 6.1% in 2022 which is almost double of 3.5% which was predicted in the Winter 2022 interim Forecast.

Even though inflation is the cause behind rising commodity prices, the price of Brent crude fell 0.6% to $111 a barrel on Monday.

However, Shell and BP shares were still trading up 0.5% and 0.3% to 2,314p and 416p respectively.

FTSE 100 Risers

Telecom Stocks

Telecom shares gained with news of UAE’s e& invested in Vodafone, extending the surge in shares across other FTSE 100 telecom companies.

Vodafone Group shares rose 2.3% to 120.5p following the announcement of Emirates Telecommunications Group buying 9.8% of Vodafone’s shareholdings.

Russ Mould, Investment Director, AJ Bell, said, “Now Abu Dhabi telecoms group e& has taken a big slice of Vodafone.”

“This comes hot on the heels of talk that activist investor Cevian Capital has also taken a big stake with a view to getting Vodafone to sell some operations, consolidate its position in key markets, return more cash to shareholders and bring more telecoms experience onto the board. Furthermore, there has been chatter that Vodafone was in talks to merge its UK operations with competitor Three UK.”

Telecom peers, BT and Airtel Africa shares gained 1% to 183p and 2.3% to 140.8p, respectively, as investors flocked to telecom stocks.

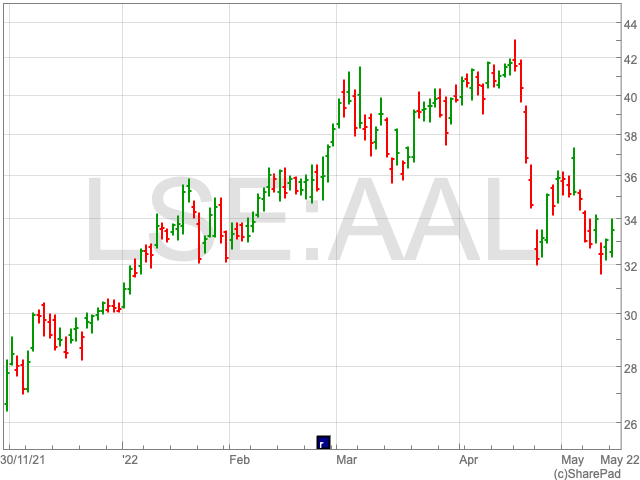

Mining stocks lifted the FTSE 100 on Monday with Fresnillo, Glencore, Antofagasta and Anglo American shares trading up 3.4%, 2.5%, 2.2% and 1.4%.

FTSE 100 Fallers

Aviva is completing the return of capital through the allotment and issue of 3.69bn B Shares relating to the B Share Scheme today along with a return of capital to shareholders.

Kingfisher shares lost 3% to 248p following the announcement of Kingfisher’s Screwfix wanting to open 80 new shops across the UK and Ireland.

Experian shares were trading down 1.8% to 2,648p as the group revealed its agreement to buy a 51% stake in Mova Sociedade de Emprestimo entre Pessoas SA from private investor Erico Sodre Quirino and Chief Executive and Founder Roberto Tesch for $7.9m.

Experian also placed a call option to acquire the other 49% stake between 2026 and 2028.