The main UK index slumped on Friday as the FTSE 100 was trading down 1% to 7,424 on the back of concerns over rising interest rates and surging inflation could damage economic growth.

Oil prices rose 1.7%, bringing the price of a barrel of Brent crude to $112 and crossing the $110 mark after the EU announced its intent to ban Russian oil.

However, rising oil prices were good news for BP and Shell, as it supported the companies’ shares to gain 2.3% and 1.5% to 428p and 2,327p respectively.

FTSE 100 Housing Stocks

Halifax announced the Housing Price Index with an increase of 1.1% in April, bringing the average price of a UK home to £286,079.

The rise in HPI for April marked the 10th consecutive monthly rise in the longest run since 2016.

Halifax also said that rising interest rates and tight household budgets are set to hamper the market in the coming years, which may have resulted in investors fleeing from housing development stocks on the FTSE 100.

Russ Mould, Investment Director, AJ Bell stated, “Despite a 10th consecutive month of growth for house prices the mood music around this number is definitely subdued with growth at least starting to slow and warnings that rising rates and inflation will soon dent demand. The property market may finally be about to be reacquainted with gravity.”

Persimmon, Berkeley and Taylor Wimpey shares were trading down 2% to 2,054p, 1.9% to 4,040p and 1.8% to 124p respectively.

REIT shares fell too, with Segro, Land Securities and British Land shares losing 4.8%, 2.1% and 1.5% respectively.

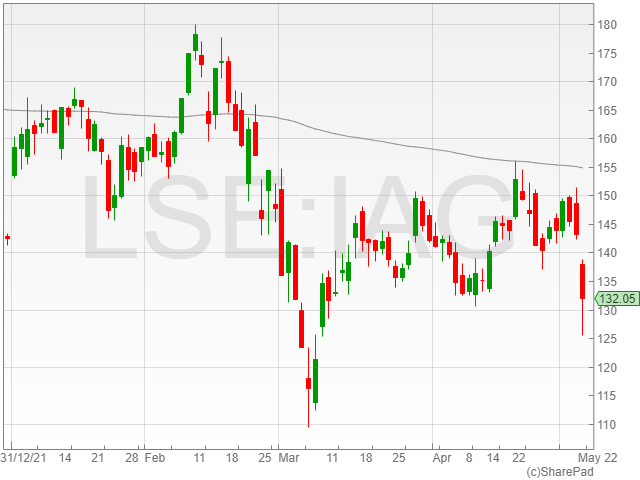

International Consolidated Airlines

International Consolidated Airlines shares plummetted 8% to 132p as the airline company missed market forecasts in its Q1 results despite recovering demand.

IAG reported a post-tax loss of €787m, which decreased from €1.07bn in Q1 2021, as the group noted a 3x fold in total revenue to €3.44bn from €968m.

IAG said it expects to be profitable from the second quarter onwards and for the full year of 2022.

“After the chaos of the past two-and-a-bit years, most households would love to have a break from everyday life and enjoy a taste of paradise. Travel companies have been patiently waiting for the day when bookings went up and Covid-related restrictions faded away,” said Russ Mould.

“We’re now edging towards this point in many parts of the world. Unfortunately, there’s a new stumbling block in the form of a potential recession.

InterContinental Hotels Group

InterContinental Hotels Group shares fell 1% to 4,929p after the company said lockdowns in China are hampering their performance in the Greater China region.

However, IHG did report a 61% rise in revenue per available room, which is a key metric in the hotel industry in its first-quarter trading update.

“InterContinental Hotels is seeing the average rate per available room creep up versus a year ago and demand has been strong,” added Mould.

“Were it not for the pain of inflation, these travel companies would be singing from the rooftop. As it stands, both still face a fragile trading period ahead and it could be a while before they reach pre-Covid levels of business.”

Mining shares dragged the FTSE 100 down as Glencore, Rio Tinto, Antofagasta and Anglo American all saw their shares fall between 0.2% to 2% on Friday.

However, Endeavour Mining shares rose 2.5% to 2,073p after the group said it kicked off 2022 on “strong footing” with revenue increasing in the first quarter on stronger gold prices.

The miner recorded an 8.5% rise in average realised gold price YoY to $1,911 an ounce in the first quarter of 2022, from $1,762.

Higher gold prices helped quarterly revenue rise 14% annually to $686m from $601m as well for Endeavour.

FTSE 100 Price Targets

UBS and Goldman Sachs raised Shell to a ‘buy’ rating and increased its price target to 2,550p and €39, respectively.

Mondi shares gained 2.1% to 1,599p after Jefferies raised its price target from 1,700p to 1,775p and gave it a ‘buy’ rating.

Hikma Pharmaceuticals shares fell 1.3% to 1,663p after Morgan Stanley cut its price target to 2,100p from 2,300p.

Flutter Entertainment shares dropped 0.9% to 8,426p despite HSBC raising it to a ‘buy’ rating and upgrading its price target by 200p to 14,900p.

Deutsche Bank cut Hargreaves Lansdown’s price target to 1160p from 1250p leading its shares to lose 3.2% to 856p.

Barratt Developments shares were trading down 2% to 478p as the HPI made an impact and Berenberg cut its price target to 790p from 810p.

Next shares sunk 1.8% to 5,930p as Goldman Sachs reduced the retailer’s price target by 300p to 8,200p.

RBC raised HSBC’s price target to 590p from 550p, however, HSBC shares fell 0.3% to 506p.