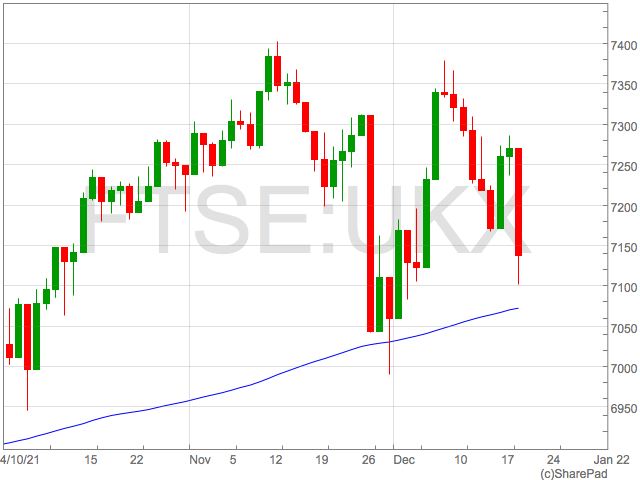

The FTSE 100 sank on Monday morning as fears over the spread of Omicron and global growth sapped all confidence out of markets causing severe selling in European shares.

The FTSE 100 was down 1.9% at 7,171 and German DAX off 2.76% in early trade on Monday. The Italian FTSE MIB was 2.7% weaker at 25,892.

The selling eased through the session and bargain hunters stepped in to take indices off their worst levels as the session progressed.

The economic issues caused by the spread of Omicron spooked markets following a week where central banks began to tighten monetary policy. German and France have implemented travel restrictions, whereas the UK refused to rule out a lockdown over Christmas.

‘’The rampant nature of Omicron and its potential impact in sharply slowing global growth is continuing to unnerve investors, with the FTSE 100 opening sharply lower, down 2% in early trade. With the vaccine maker Pfizer estimating that the pandemic will last until 2024, uncertainty about the year ahead is rippling through the markets. Countries are bracing for waves of infection to hit, watching the new variant rip through communities in South Africa and the United Kingdom,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

The Hospitality sector has already been heavily hit as people cancelled Christmas get-togethers and concerns will now shift back to travel and the propensity of people to book holidays over the vital festive period trading period.

The strife was evident in travel shares with Rolls Royce and IAG down 5.5% and 4.8% at the time of writing.

Growth downgrade

Not only did markets have to contend with the uncertainties of Omicron, but the downgrade of US growth by Goldman Sachs.

Goldman Sachs lowered their growth target after Joe Manchin rejected Biden’s plans for a $2 trillion spending stimulus through the Build Back Better program.

As a result, Goldman Sachs has lowered it’s growth forecast from 3% to 2% for 1Q, 3.5% to 3% in 2Q, and from 3% to 2.75% in 3Q.

Whilst the downgrade isn’t earth shattering, the timing is terrible. Investors have just learnt there will be reduced stimulus provided by the Federal Reserve and this stimulus is now being withdrawn from an economy with lower growth forecasts.

This played out in European equities as well as US futures on Monday morning.

Few gainers

It will be no surprise few stocks ground put gains on Monday morning. Those gains on the FTSE 100 included pharma company Dechra and precious metals miners Polymetal.

“It says something when the only two risers in the FTSE 100 were Polymetal – a play on precious metal prices, with gold living up to its reputation as a store of value as it holds firm at just under $1,800 per ounce – and Royal Mail. The latter will no doubt benefit as consumers rush to place last-minute online orders for Christmas presents, avoiding the high street for fear of getting Covid,” said Russ Mould, investment director at AJ Bell.