The FTSE 100 saw a small increase of 0.1% in Monday trade as Russia and Ukraine prepared to negotiate terms for a ceasefire, and a COVID outbreak rocked Asian markets.

European shares posted much stronger gains than the FTSE 100 with the German DAX up 1.8% at 13,879 and French CAC gaining 1.1%.

The FTSE 100’s underperformance can be attributed to weakness in the commodity shares caused by concerns around the health of the Chinese economy, following news Shenzen had started a week long lockdown.

“Worries about a China slowdown have also helped drive mining stocks lower on the FTSE 100 today, with Rio Tinto, Anglo American and Glencore among the biggest fallers on the index in early trade,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

Rio Tinto shares fell 3.6% after the miners decided to acquire the rest of Turquoise Hill for $2.7bn. This move was to help along Rio’s mining project in Mongolia, Oyu Tolgoi.

“Like the project itself, this transaction is not expected to go smoothly. Rio may have to dig a lot deeper to win over Turquoise Hill’s shareholders,” said Russ Mould, investment director at AJ Bell.

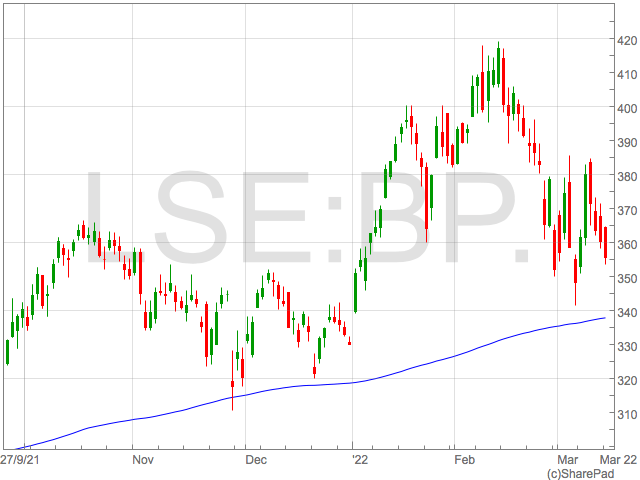

Oil majors were heavily hit by as falling oil prices slipping with BP and Shell giving up 1.3% and 1.2% respectively.

The price of Brent Crude further declined to $109 per barrel as traders assess the impact of discussions between OPEC and the IEA.

“The stage is still set for a fluctuation in price, given concerns that OPEC+ counties may not easily be able to increase supply, while a breakthrough in the stalled Iran nuclear talks remains elusive,” said Susannah Streeter.

UK Banks

Heavy weights like Lloyds and Barclays have supported the gains in the FTSE 100 on Mondays investors look forward to Thursday’s Bank of England rate decision. There are expectations the Bank of England will again increase rates which will further support banking profitability.

Lloyds’ share were up 3.6% to 47.1p and Barclay’s shares were up 4.2% to 168p.

Talks of diplomacy have also given airline and travel related shares a boost, as IAG and Melrose saw an increase in share prices on Monday.

“British Airways owner International Consolidated Airlines Group, and engineer Melrose, with its large commercial aerospace business, lifted more than 4% on the open,” said Streeter.

BATS

British American Tobacco fell 1.3% to 3,026p after the cigarette manufacturers exit Russia whilst still paying their 2500 employees.

The tobacco makers have recently revised their financial guidance for 2022 to constant currency group revenue growth of 2% to 4%. Ukraine and Russia accounted for 3% of the group revenue in 2021.