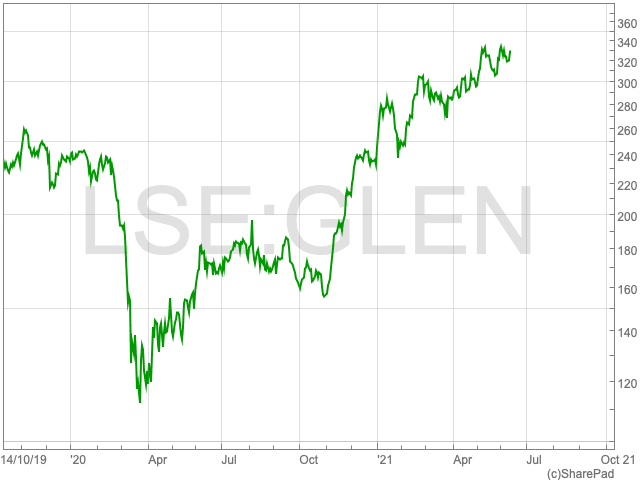

Glencore Share Price

The Glencore share price (LON:GLEN) has performed well since the turn of the year and going back further, on the back of a global commodities boom. The FTSE 100 company has seen demand for its produce soar as the world economy comes back to life. Having spent large parts of May range bound, the Glencore share price is up by 33% to 327.65p since the turn of the year. Going back further, it is up by 951.14% over the past 12 months.

Rising demand for metals, particularly copper and zinc, has aided Glencore’s profits throughout the past 12 months. However, there are reasons for this which may not bode so well for the future. For example, the constant concern around inflationary pressures which could push the price of Glencore’s commodities higher. Additionally, as demand grows, Glencore may have its work cut out to keep up.

Metal Prices

The immediate future of the Glencore share price is dependent to some extent on metals prices. Furthermore, during Q1 of 2021, Glencore sourced 301,200 tonnes of copper and 282,600 tonnes of zinc. The mining giant is most heavily weighted towards these metals therefore Glencore’s revenues will likely follow their paths. When the Glencore share price dipped during the beginning of June, copper prices dropped below $10,000, while gold saw big falls too.

Zinc

Up until March 2021, zinc production production across the world rose by 6.2%, while the usage of the metal soared by 10.3%. For the entire year, zinc production is estimated to increase by 4.5% to 13.8m tons.

This means, according to Dr. Heinz-Jürgen Büchner, director Industrials & Automotive, IKB Deutsche Industriebank AG, that the zinc price will reach $2,900 per ton, with a fluctuation range of +$500, by the end of Q3 2021. Its current level is just above $3,000.

Copper

Regarding the red metal, a copper agency based in Chile called Cochilco, has raised its price forecast for 2021 as it anticipates a deficit in the global market for the near-term.

Cochilco upgraded its average copper price projection to $4.30/lb for this year, a dollar more than its original forecast made in January.

Its estimation for the average price of copper for 2022 has also been upgraded to $3.95/lb, up from $3/lb.

Cochilco executive vice-president Marco Riveros said: “The macroeconomic scenario [for the rest of 2021] of the main copper-consuming economies is positive for the demand of the metal. The depreciation of the US dollar consolidates downwards after the rise in unemployment in the US during March and fiscal policies and expansive monetary policies,” Riveros said.

“On the other hand, the global supply of concentrates of copper remains low, which has led to treatment charges and refining to minimal levels. While China would continue to drive the demand, the growth of refined copper imports would tend to be moderate during 2021.”

Both copper and zinc will play a significant role in the global economy’s recovery from the pandemic and their price targets look strong for the coming months. This looks good for the the Glencore share price going forward. However, risks, such as not being able to meet demand, and high inflation, remain.