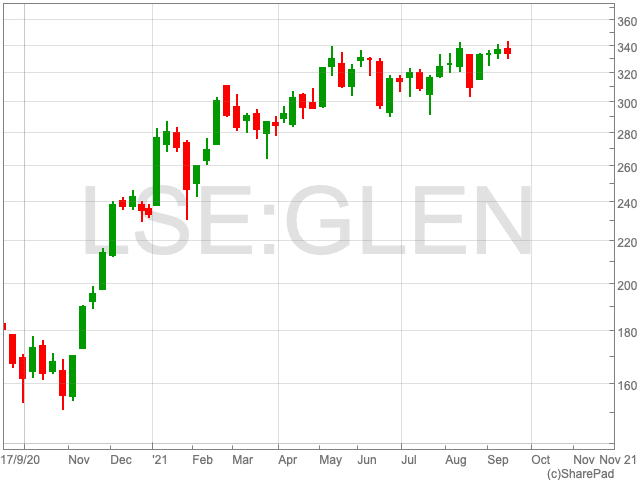

Glencore Share Price

The Glencore share price has performed outstandingly well over the past year, adding 80.43% in that time period. It is even separated itself from other miners in the FTSE 100 with the size of its gains.

The mining giant has pledged to making a generous payouts while its new CEO is putting the company on the path to a low-carbon energy future.

While this is certainly the medium to long-term plan, the Glencore share price could receive a welcomed boost in the short-term, according to an analyst from Morgan Stanley.

Analyst’s View

Coal is somewhat of a taboo in the world of investing. Companies, it seemed, were gradually transitioning away from using the commodity as it becomes unpallatable and unprofitable. However, Morgan Stanley, having analysed Glencore, feels record coal prices could lead the mining company to “outsized returns”.

An analyst at the investment bank is of the view that Glencore will continue to perform well thanks to favourable economic conditions despite issues surrounding coal.

“In spite of thermal coal’s medium-term demand headwinds, current record prices are evidence that ‘commodities of the past’ can have sharp up-cycles and generate record margins, absent meaningful supply growth,” the analyst said.

“Current supply constraints look likely to persist through first half 2022 with demand remaining robust on winter restocking in key markets.”

“Our commodities team sees upside risks to their estimates and expects tightness into 2022. This is enabling coal producers to generate significant profit margins.”

Morgan Stanley gave Glencore an ‘overweight’ rating, along with a price target of 360p. This suggests an 8.4% increase in the current value of 332p.