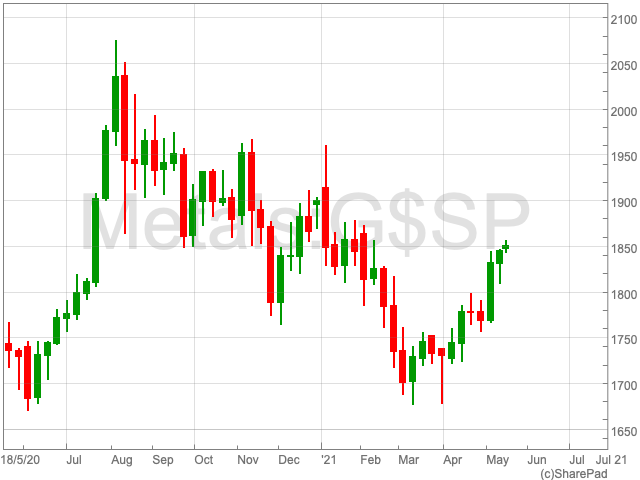

Gold composite up by 0.7% to $1,850.02

The price of gold rallied to its highest level in over 12 weeks on Monday as investors were spooked by fears over inflation in America.

The price of gold, having risen to $2000 last summer, before retreating as announcements around vaccines emerged, is up to its highest point since early February. An increase of 0.7% to $1,850.02.

The precious metal historically performs during periods of inflation or expected inflation.

Last week it was confirmed that US consumer prices surpassed economists’ expectations, rising by 4.2% in April, above their level 12 months ago.

It is the highest level of inflation since 2008 and well above March’s figure of 2.6%.

“What we are seeing is a perfect storm of supply and demand side factors, from monetary and fiscal stimulus boosting consumer spending, to supply bottlenecks related to the pandemic which are increasing costs,” said Kevin Lester, CEO of Validus.

As a result, global stocks endured their worst performing week since February.

Greatland Gold

Greatland Gold saw its share price rise on Wednesday as it confirmed the commencement of the underground decline at the Havieron Gold-Copper Project in the Paterson province of Western Australia.

This news, according to a statement released by the company, sets Havieron on course to become a large, multi-commodity, bulk tonnage, underground mining operation.