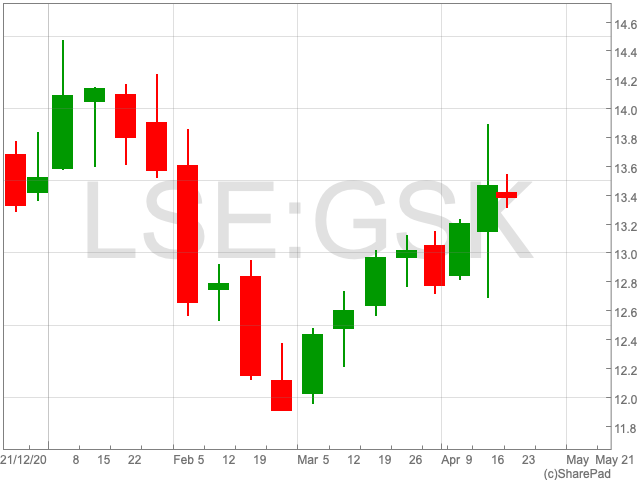

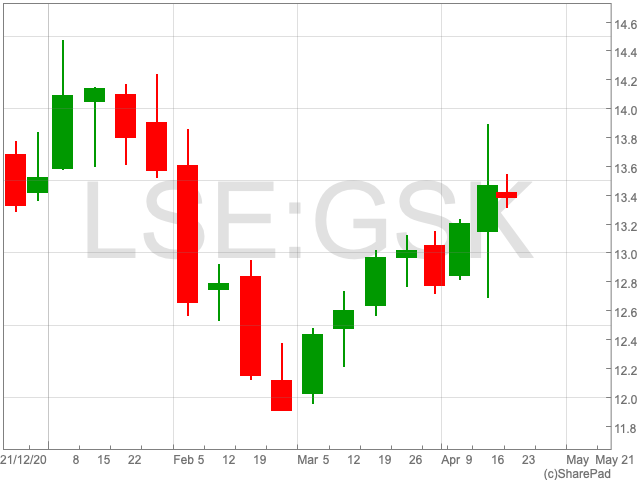

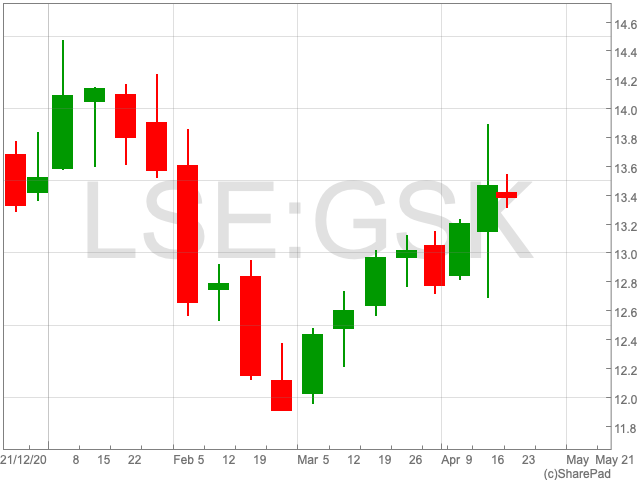

GSK Share Price

Less than a year ago the GSK share price (LON:GSK) was sitting at 1,742.2p per share, more than 30% above its current price of 1,339.2p. After a long drawn-out slide over the past 12 months, the pharmaceutical company has seen the early stages of a recovery since March, which was helped after it emerged that activist hedge fund Elliot Management had taken a large stake in the company. However, over the past five years, GSK’s share price is down, and so investors could view the company with some scepticism.

Elliot Management

Following GSK’s laggard performance during the past year, Elliot Management, the activist hedge fund, took a multibillion-pound stake in the company. The move creates question marks over the GSK’s future, some of which could lead to positive outcomes for shareholders. GSK close 5% higher last Thursday after the New York-based firm, run by billionaire Paul Singer, disclosed its investment.

The investment came on the back of widespread disillusionment by shareholders with the company’s hierarchy, namely chief executive Dame Emma Walmsley, who made the decision to break apart its consumer health business from its pharma and vaccine division.

Since Walmsley took the helm in April 2017, GSK shares are down by nearly 20%. While rivals AstraZeneca and Pfizer, who are both producing Covid-19 vaccines, saw double digit increases in the value of their stocks. Walmsley’s position could come under threat although Elliot has remained coy regarding its intentions.

While there are mixed feelings about Walmsley, with some shareholders hoping for new leadership, while others back the CEO, any personnel changes over the coming months could go some way to influencing the company’s outlook.

Dividend

Even as there has been volatility in its earnings, GSK has maintained its total dividend of 80p per year for the last five years. The group intends pay the same amount in 2021, but beyond that point will introduce a new policy with the overall payout “expected to be lower than at present”.

As the company refocuses on its drugs production, which is an expensive endeavour, it could well be forced into a less generous shareholder payout in thee future.