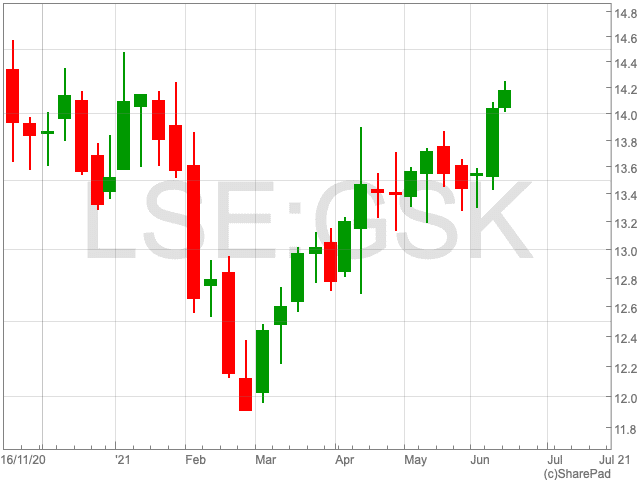

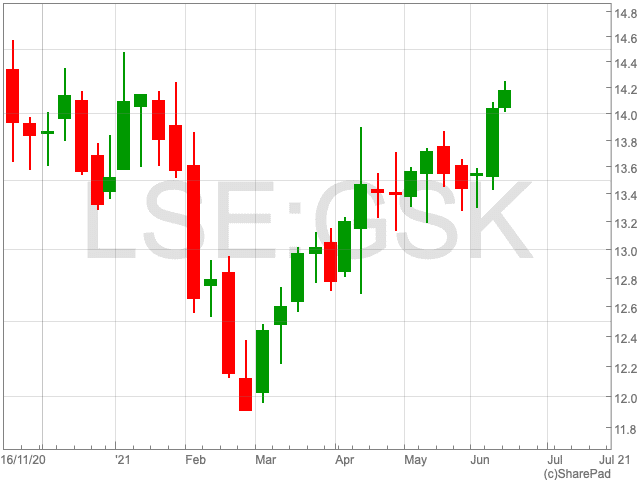

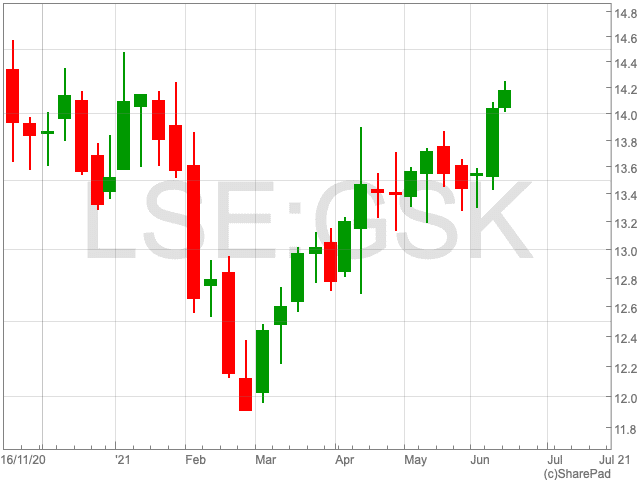

GSK Share Price

It has been a tough past 12 months for the GSK share price (LON:GSK), as the pharmaceuticals company has significantly underperformed the FTSE 100. However, despite being down by 11.42% over the past 12 months, the GSK share price has regained some momentum. Having added over 3% since the beginning of the year, it now stands at $1,418, its highest point since 2020.

GSK trailed its major rivals, each bringing their variations of the coronavirus vaccine to the market, and its revenues fell, causing investors to turn away from the company. However, more recently it has managed to push on. Investors will be curious to know if it can sustain this mini-resurgence both in the short and long-term.

US Biotech Deal

On Tuesday an announcement emerged that could somewhat appease investors who have been previously displeased by the pharmaceutical giant’s recent performance. GSK has put pen to paper on a deal to pay a US biotech firm $2.1bn to work together on a cancer treatment.

The British pharma firm will pay an American biotech company an upfront payment of $625m to collaborate on an antibody treatment in its second phase trials for advance solid tumours.

GSK will become the only pharma group to have antibodies that target three checkpoints, which are capable of shutting down the immune system, which fights against cancer. It plans to find a more effective solution to treat a variety of cancers, by combining its recently approved Jemperli with these antibodies. GSK will begin looking into these combinations next year.

Pressure from Investors

The biotech deal comes as GSK sets outs its plan for the future of the company next week following its consumer health business ‘spinning off’ in 2022. Pressure remains on Emma Walmsley, the chief executive of GSK, to give hope to investors around the future prospects of its drugs manufacturing.

Elliott Management, the American hedge fund, is leading the way having invested billions into the company. The company has a record of being robust in getting the most out of its investments which could serve GSK well moving forward.

While the mood around the GSK share price is not exactly an optimistic one, it is possible to see where the catalyst for a bull run could come from now and into the future.