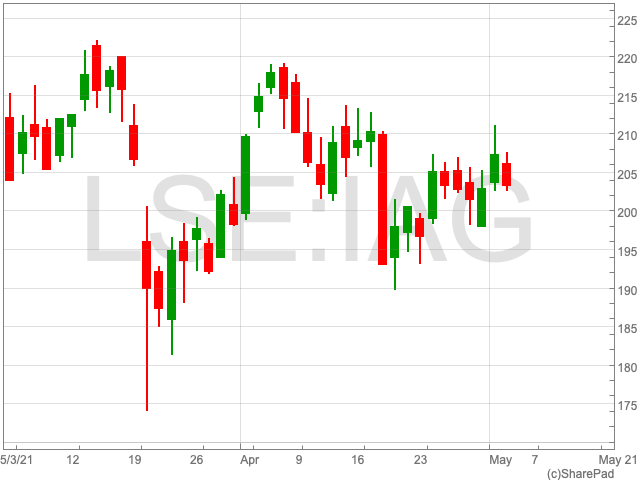

IAG Share Price

Going back as far as November 2020, the IAG share price (LON:IAG) was valued at 92p. Now, as a roadmap out of lockdowns have been set forward, and the vaccine roll-out is running smoothly, the FTSE 100 company is valued at 203p per share. IAG, owner of British Airways, added further value to its share price yesterday too, as the UK looks set to announce which countries have made it on the ‘green list’. While there is still uncertainty around the speed of the economy reopening, investors may consider an investment at the current price a risk more worth taking.

Up Again From Here?

There was good news for airlines yesterday, who may dare to dream of a somewhat normal summer, as the EU suggested it could open up to fully vaccinated tourists. “Time to revive EU tourism industry and for cross-border friendships to rekindle – safely,” EU Commission President Ursula von der Leyen tweeted. One drawback is that all passengers will be required to have had a vaccine.

In addition, reports are suggesting that the UK government will set forward ‘green list’ of between ten or 12 countries, including Malta, Gibraltar, Portugal and Israel, that passengers will be able to travel to.

Major tourists destinations including Spain, Greece and France are also rumoured to be on the list. The government’s travel plans involve a traffic light system of red, amber and green classifications for countries depending on the perceived COVID-19 risk.

IAG was also bolstered by the EU’s decision to allow entry for vaccinated people from low-risk countries.

“Foreign holidays are looking like they could actually happen this year, lifting demand for travel and tourism stocks, which were severely battered across the crisis,” said Sophie Griffiths, analyst at OANDA.

JP Morgan’s View

Sharecast has reported that JP Morgan upgraded IAG shares to ‘overweight’ from ‘neutral’ as the prospects for 2022 onwards “look promising as global air travel starts to normalise”, despite there being challenges ahead.

“We anticipate turbulence on this journey but consider IAG an attractive long-term investment,” JP Morgan said.

“It is still unclear when widespread intra-European travel will be allowed, but by late summer we would expect a meaningful pick-up across the region,” the investment bank added.