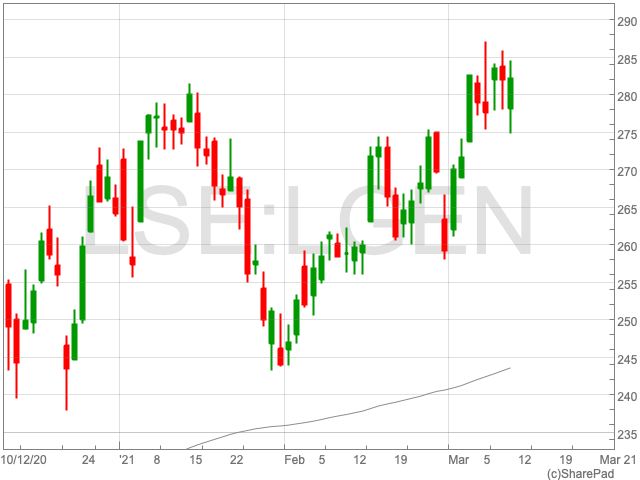

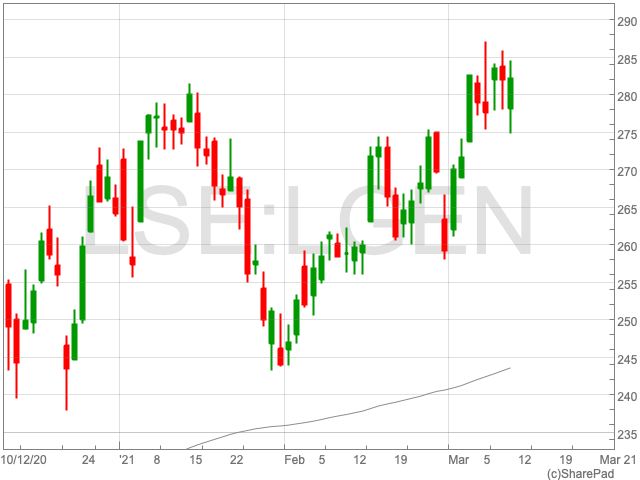

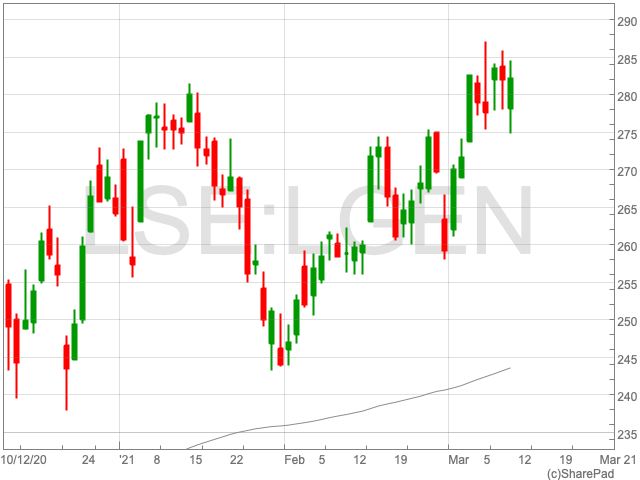

Legal and General Share Price

Legal and General’s (LON:LGEN) share price is up by 8% since the beginning of the year to 282p per share. Since the extent of pandemic became clear in March 2020, when Legal and General’s share price fell to 157.05p per share, the company’s stock value has increased by nearly 80%.

Financial Results

Legal and General confirmed on Wednesday that its profits fell for the financial year gone, although the firm says it is still on course to meet its five-year ambitions. The asset manager announced its operating profit fell by 3% to £2.2bn, while profit before tax was dipped by 12% to £1.6bn.

Legal and General’s board maintained its high yielding dividend, at 17.57p per share, throughout the pandemic. The company’s shares yield around 6.5%, one of the highest out of the FTSE 100 index. On the other hand, there is a possibility its high yielding dividend could take money away which could otherwise be invested.

Return on equity fell to 17.3% from 20.4% the year before, which Legal & General described as ‘resilient in light of market volatility’. The company’s Price-to-Earnings ratio stands at 9.3, while Aviva’s and Prudential’s are 6.5 and 12.2 respectively.

Outlook

While other sectors, like oil produces, are coming under pressure from innovative companies, Legal and General’s insurance industry can boast stability. Therefore the company can be expected to smoothly benefit from the ending of lockdowns and a general sense of economic optimism.

It has been reported that Legal and General has been assigned a “hold rating” from thirteen research firms that are covering the company. Three gave a sell recommendation, four issued a hold and five have issued a buy recommendation on the insurance company.