The launch of the new vehicle in July marked the start of a new type of space race.

The Seraphim Space Investment Trust (LON: SSIT) invests in a portfolio of early and growth stage private space tech businesses. According to Morgan Stanley, this new and fast growing sector could be generating more than $1.1 trillion in annual revenue by 2040.

Demand for the new shares was so high that the applications had to be scaled back with the IPO raising £150m of fresh capital. There was also a further £28.4m invested via direct subscriptions in connection with the acquisition of the initial seed portfolio.

This consisted of stakes in 15 unlisted companies held in the Seraphim Space Fund. These included businesses such as: LeoLabs, which provides a visualisation of objects in low Earth orbit; AST SpaceMobile that fills in the gaps for existing mobile phone networks; and Altitude Angel, an aviation company that develops unmanned aircraft.

Four other stakes in unlisted companies worth around £70m were also due to be acquired from the same source by the end of the year. This process is now well underway with the investments in Spire Global, a pioneer of the nanosatellite market, and quantum encryption specialist Arqit now complete.

Once fully invested the new vehicle is expected to have a portfolio of 20-50 holdings spread across the US, UK and Europe. It will target NAV total returns of at least 20% per annum over the long-term.

Manager Seraphim Space has been operating in this area since 2016. It’s Seraphim Space Fund, the world’s first venture capital fund focused on new space technologies, is currently demonstrating an internal rate of return of 31%.

There is no doubt that the types of unlisted businesses that the investment trust is targeting have a lot of potential, but with such a concentrated portfolio the performance will depend entirely on whether the managers can identify which companies will go on and succeed.

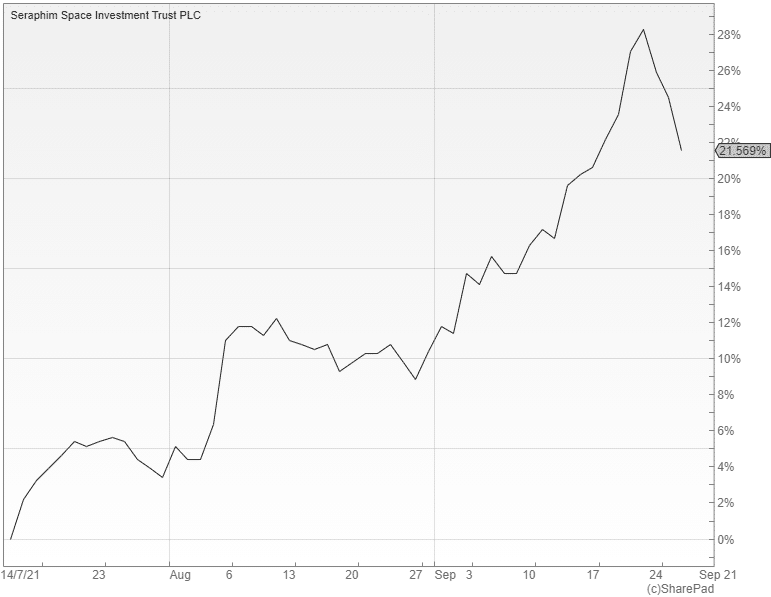

Seraphim is currently trading on a massive estimated 28% premium to NAV, whereas many well-diversified global private equity investment trusts are available on wide double digit discounts and offer far better value.