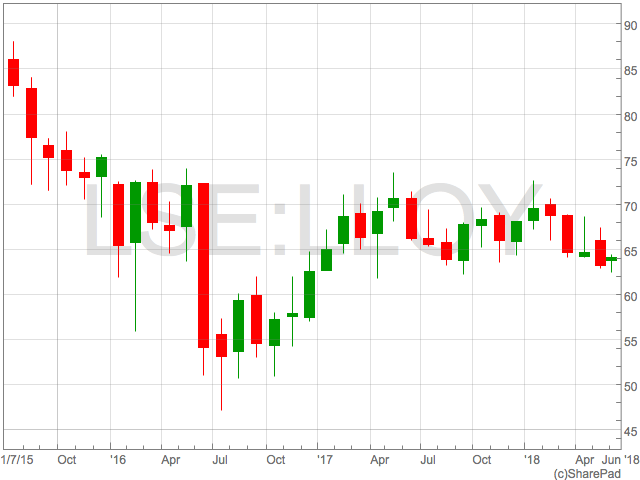

Lloyds share price has remained in a tight range since the beginning of 2017, finding strong support in the 62p – 62.50p and resistance at 73p-74p.

The 200 day moving at 66.7p represents a potential magnet for the price in the short term, sitting neatly in the middle of the 2018 trading range. Technical traders will also be aware 14-day RSI has recently touched 30, signalling oversold, and has rebounded.

Strong results

The group boosted investor sentiment by raising its 2017 dividend by 20 percent at the start of the year, and announcing a £1 billion share buyback.

In February the group reported relatively strong results, with statutory profit before tax up significantly to £5.3 billion, an increase of 24 percent on the year before. Underlying profit also increased by 8 percent to £8.5 billion, leading the group to boost its ordinary dividend per share by 20 percent.

The banking group may also be set to benefit from a rising UK interest rate over the next couple of years. Despite it being expected to rise to just 2 percent by 2020, this would be an improvement on its current level and offer a boost to Lloyds.

Contract tender

Lloyds has also gained the interest of several of the big investment management groups, after putting an investment contract up for tender.

Goldman Sachs Asset Management joined rivals in the battle to win the £109 billion investment contract earlier this week, with BlackRock, JPMorgan Asset Management and Schroders all having already been selected to take part in a second round of bids in April. The contract is one of the largest ever to be put up for tender in Europe and has been managed by Standard Life Aberdeen since 2014.