Lloyds share price is set to be a winner from soaring inflation in 2022 as the banking group enjoy the benefits of a hiking cycle in major global economies.

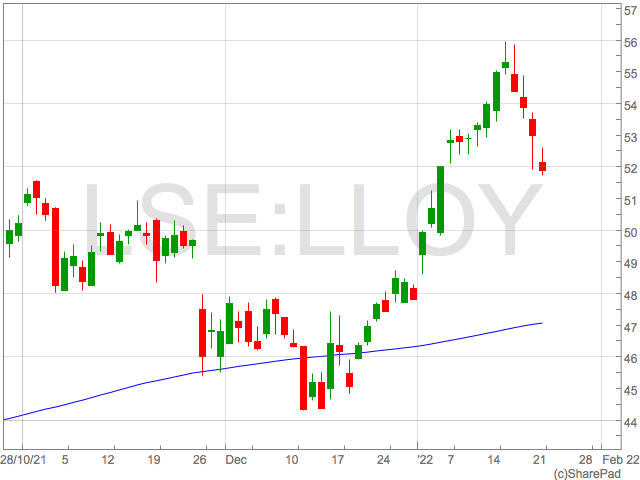

Lloyds shares have already had sterling start to 2022 adding 9% to trade at 51p. This is despite a significant retreat from the highest levels of the year for Lloyds share price.

There has been an ongoing and unavoidable discussion around inflation which started early last year. However, this is now starting to play out in markets with the threat of multiple interest rate hikes.

As inflation runs rampant, investors are recalibrating their expectations for Fed rate hikes. Federal-funds futures, a proxy for market expectations of interest-rate changes, now suggest a 98% chance of a rate hike by July 2022, up from 62% in November. pic.twitter.com/SLsb6AjIxb

— Steve Hanke (@steve_hanke) January 15, 2022

Concern has been most evident in the share prices of US technology stocks and the volatility in the tech-heavy NASDAQ index that counts the world’s largest tech companies as it’s constituents.

Fortunately for investors in Lloyds shares, the factors driving volatility in tech companies are the same factors helping Lloyds improve their profitability.

These are of course the associated benefits of higher interest rates on the Net Interest Margin of banks that thrive in higher interest rate environments.

Lloyds shares

Lloyds shares began their rally as soon as the Bank of England made a surprise interest hike in December and continue to reach intraday highs around 56p, before falling back.

With the debate raging whether the Federal Reserve will hike 3 or 4 times in 2022, it is almost certain the Bank of England will also embark on a series of rate hikes through 2022.

The tightening of monetary policy will have a deep impact on the economy as well as the positioning of investors.

Indeed, Lloyds shares may have the additional benefit investors rotating away from growth stocks to those that offer value in a dash for safety.

And Lloyds shares certainly fall into the category of being a value stock.

On both price-to-book and price-to-earnings multiples, Lloyds trades at a significant discount to the wider benchmark.

Notwithstanding the higher levels of profitability, the allure of relative value the company presents will certainly help support the Lloyds share price in 2022 and make it a winner during periods of high inflation.

Investor should note, however, a prolonged period of high inflation that damages household spending power and increases loan defaults – and possibly the housing market – will lead to negative outcomes for Lloyds shares.