Disclaimer:

This publication is intended to be of general interest only and does not constitute legal, regulatory, tax, accounting, investment or other advice nor is it an offer to buy or sell shares in the Company (or any other investments mentioned herein).

Nothing in this publication should be construed as a personal recommendation to invest in the Company (or any other investment mentioned herein) and no assessment has been made as to the suitability of such investments for any investor. In deciding to invest prospective investors may not rely on the information in this document. Such information is subject to change and does not constitute all the necessary information to adequately evaluate the consequences of investing in the Company.

The shares in the Company are listed on the London Stock Exchange, and their price is affected by supply and demand and is therefore not necessarily the same as the value of the underlying assets. Changes in currency rates of exchange may have an adverse effect on the value of the Company’s shares (and any income derived from them). Any change in the tax status of the Company could affect the value of the Company’s shares or its ability to provide returns to its investors. Levels and bases of taxation are subject to change and will depend on your personal circumstances.

Past performance is not a reliable indicator of future returns. Any return estimates or indications of past performance cited in this document are for informational purposes only and can in no way be construed as a guarantee of future performance. No representation or warranty is given as to the performance of the Company’s shares and there is no guarantee that the Company will achieve its investment objective.

Overview

Majedie Investments (MAJE), managed by Marylebone Partners, pursues a liquid endowment-style investment strategy designed to deliver an annualised return of at least 4 per cent above UK consumer price inflation over rolling five-year periods.

The approach is long-term and fundamentally driven. Like the leading US university endowments, it seeks to emulate, the strategy avoids market timing and instead emphasises patient capital allocation, drawing on a combination of actively managed equities and a select range of complementary asset classes. Unlike many endowment portfolios, however, Majedie avoids illiquid assets such as private equity, venture capital and real estate. All holdings are marked to market, preserving liquidity and transparency.

The portfolio is organised across three segments: specialist external managers (spanning equity and absolute-return strategies), direct investments, and special investments. The latter provides exposure to differentiated opportunities that are unlikely to feature in conventional portfolios.

Since Marylebone Partners assumed responsibility for the trust at the end of January 2023, Majedie has comfortably exceeded its CPI + 4 per cent objective. Over the three calendar years to 31 December 2025, the trust generated an NAV total return of 44 per cent and a share price total return of 58 per cent, compared with cumulative UK CPI inflation of 11 per cent. The trust employs no gearing. Dividends remain a core component of total return, with quarterly distributions targeted at 0.75 per cent of quarter-end NAV, equivalent to an annualised yield of 3 per cent.

Quarterly investment performance

During the first quarter of Majedie’s financial year (October to December 2025), the Company’s NAV rose by +4.3 per cent1, with positive returns recorded in each month despite unsettled market conditions. While investors remained focused on the trajectory of monetary policy, geopolitical developments and the sustainability of valuations in artificial intelligence-related equities, Majedie’s performance was driven primarily by stock- and strategy-specific factors.

The ten largest contributors to performance comprised a broad mix: three equity-focused external managers, one absolute-return manager, four direct investments and two special investments. This breadth of contribution reflects a highly differentiated portfolio and underlines its appeal as an absolute-return proposition, particularly on a risk-adjusted basis.

One of the more striking features of recent performance has been the even distribution of returns across strategies, regions, sectors and style factors. Outcomes driven by diverse and idiosyncratic sources tend to be more resilient than those reliant on a single theme or favourable market timing. In that respect, the quarter’s results are encouraging not only in absolute terms, but also for what they suggest about the portfolio’s ability to navigate a range of market environments.

Performance by strategy

External Managers

External managers largely avoided the weaker segments of the market. Among equity-oriented strategies, Paradigm BioCapital Fund (US biotechnology) made the strongest contribution, benefiting from renewed interest in the sector amid increased M&A activity, regulatory approvals and expectations of lower interest rates. The Helikon Long/Short Fund (European special situations) also performed well, supported in particular by positions in gold mining equities.

Additional gains came from the Contrarian Emerging Markets Fund, focused on emerging market credit, and from a new allocation to the Fearnley Energy Alpha Fund, a low net exposure long/short strategy based in Oslo.

Direct Investments

The largest positive contribution from direct holdings came from Global X Copper Miners ETF. While atypical relative to Majedie’s usual preference for individual equities, the position was established to capture what we regarded as compelling value across the copper mining sector, while avoiding company-specific risk. Other contributors included Computacenter and IMI. Allfunds Group, a recent addition to the portfolio, announced it was in strategic discussions with Deutsche Börse. The principal detractor over the period was Stabilus, a European automotive supplier.

Special Investments

Performance within the special investments portfolio was mixed. Orizon, a Brazilian waste management company, delivered a strong return following improved earnings and a bolt-on acquisition. The co-investment in Oxford Biomedica also performed well, with the company entering discussions regarding a potential cash offer from EQT. VF Corporation continued its recovery, while CVS Health sustained the gains achieved earlier in the year. Not all positions met expectations over the quarter, though we remain constructive on the long-term return potential of the programme.

Market Environment

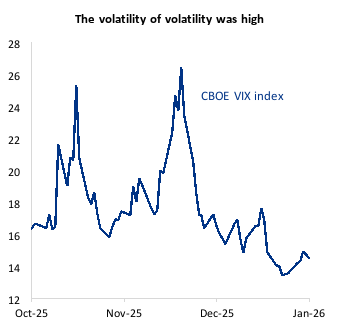

Market conditions over the quarter were unsettled. October saw a sharp, if short-lived, rise in volatility, with the VIX index briefly exceeding 25 as investors reassessed interest rate expectations amid concerns over US fiscal deficits, a potential government shutdown and heavy bond issuance.

In November, attention shifted to growing divergence among global central banks. The US Federal Reserve remained cautious on the timing of rate cuts, the Bank of Japan signalled further tightening, and the European Central Bank adopted a less accommodative tone. This lack of synchronisation unsettled equity and bond markets and contributed to increased currency volatility, notably a weaker US dollar.

By December, volatility had subsided. Economic data and corporate earnings generally surprised to the upside, reviving hopes of eventual rate cuts and supporting a year-end rally. Markets embraced a renewed ‘Goldilocks’ narrative, with the VIX ending the year close to its lows.

Credit spreads finished the quarter broadly unchanged. Precious metals reached new highs as real yields eased and geopolitical tensions persisted. Industrial metals, including copper, benefited from a softer dollar and tightening supply conditions, while energy prices declined.

Source: CBOE, Bloomberg.

Portfolio Outlook

Our objective remains unchanged: to compound shareholders’ capital at an attractive rate above inflation, while minimising the risk of permanent capital loss. Achieving this requires more than simple participation in rising markets. The liquid endowment approach depends on accessing differentiated sources of return and insisting on a margin of safety when deploying capital.

The post-pandemic investment landscape is characterised by structurally higher interest rates and greater dispersion both across and within asset classes. Such conditions are less forgiving of error but more rewarding of selectivity.

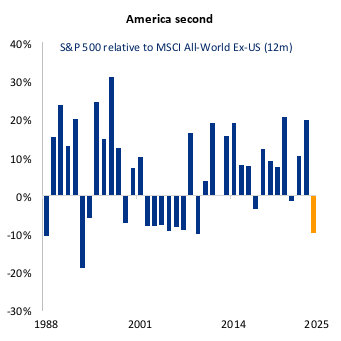

We believe our focus on highly idiosyncratic opportunities positions Majedie well to continue delivering inflation-beating returns, even if broad equity markets struggle to replicate the exceptional gains of recent years. By contrast, market performance has become increasingly dependent on a small group of very large technology companies and their ability to generate adequate returns from unprecedented investment in artificial intelligence.

While we do not doubt the transformative potential of AI, we see little justification, given our mandate, for concentrating risk in a single theme where expectations are elevated and outcomes unusually uncertain. In our view, the opportunity set beyond the AI-related mega-cap stocks is broader and often less risky, supported by lower valuations and greater earnings visibility.

Source: Bloomberg.

Accordingly, the portfolio has gravitated towards mid-cap companies—particularly outside the United States—and towards situations where identifiable catalysts reduce reliance on subjective market sentiment. In this environment, discipline and selectivity are paramount. That means concentrating capital in our highest-conviction ideas, grounded in company-specific fundamentals. The past year has shown that it is possible to generate attractive absolute returns without compromising investment principles or assuming undue risk.

Business Development

On 12 November we received regulatory approval for Marylebone Partners to become part of Brown Advisory. The team has since relocated to Brown Advisory’s Hanover Square offices and integration is progressing. There will be no change to Majedie’s mandate, investment decision-making autonomy or the relationships with its shareholders.

We believe the benefits of the partnership will become increasingly evident over time.

In a further demonstration of alignment, the management fee on Majedie was reduced by 10 basis points (up to a market capitalisation of £150 million). With the debenture now repaid and additional advantages from the Brown Advisory relationship emerging, we believe the trust is well positioned. We have recently increased our own personal investment.

Important Information:

This document has been prepared by Marylebone Partners LLP (“Marylebone”) in its capacity as alternative investment fund manager of Majedie Investments PLC (“the Company”). The document has been approved and issued by Marylebone as a financial promotion for distribution in the United Kingdom. Marylebone Partners LLP is part of Brown Advisory and is authorised and regulated by the Financial Conduct Authority (Firm Reference Number: 596118). Marylebone is registered in England and Wales (Company Number: OC381480) and has its registered office at: 1 Giltspur Street, Farringdon, London EC1A 9DD. The Company is registered in England and Wales (Company Number: 109305) and has its registered office at: Dashwood House, Old Broad Street, London, EC2M 1QS, United Kingdom.

This document is intended to be of general interest only and does not constitute legal, regulatory, tax, accounting, investment, or other advice nor is it an offer to buy or sell shares in the Company (or any other investment mentioned herein). Nothing in this document should be construed as a personal recommendation to invest in the Company (or any other investment mentioned herein) and no assessment has been made as to the suitability of such investments for any investor. In making a decision to invest prospective investors may not rely on the information in this document. Such information is subject to change and does not constitute all the information necessary to adequately evaluate the consequences of investing in the Company. Investors should not subscribe for any shares in the Company on the basis of the information in this document. Investors should refer to the information contained within the Company’s Key Information Document (KID) and the latest Annual or Half-Yearly Financial Reports before making any decision to invest. Investors should also seek independent professional advice before making any decision to invest in the Company.

Capital at risk. The value of shares in the Company (and any income derived from them) can go down as well as up and you may not get back the amount that you have invested. The shares in the Company are listed on the London Stock Exchange and their price is affected by supply and demand and is therefore not necessarily the same as the value of the underlying assets. Changes in currency rates of exchange may have an adverse effect on the value of the Company’s shares (and any income derived from them). Any change in the tax status of the Company could affect the value of the Company’s shares or its ability to provide returns to its investors. Levels and bases of taxation are subject to change and will depend on your personal circumstances. The Company can borrow money to make investments (known as ‘gearing’), which can enhance returns in a rising market but will magnify losses if the value of the Company’s investments falls. You should consult your own professional advisers on the tax implications of making an investment in, holding or disposing of any of the Company’s shares, and on the receipt of dividends.

Past performance is not a reliable indicator of future returns. Any return estimates or indications of past performance cited in this document are for information purposes only and can in no way be construed as a guarantee of future performance. No representation or warranty is given as to the performance of the Company’s shares and there is no guarantee that the Company will achieve its investment objective.

For more information on the Company, and the risks associated with an investment in the Company’s shares, please refer to the Company’s Key Information Document (KID) and the latest Annual or Half-Yearly Financial Reports, copies of which are available at: https://www.majedieinvestments.com/.

This document is not intended for distribution in whole or in part in or into the United States, the European Economic Area, Australia, Canada, Japan, the Republic of South Africa or any other jurisdiction where the distribution of this document could be unlawful. The distribution of this document in other jurisdictions may be restricted by law and the persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws or the laws of any such jurisdiction.

Marylebone has taken all reasonable care to ensure that the information contained in this document is accurate at the time of publication, however it does not make any guarantee as to the accuracy of the information provided. Marylebone has no obligation to provide further information, to update the information or correct any inaccuracies identified. While many of the thoughts expressed in this document are presented in a factual manner, the discussion reflects only Marylebone’s beliefs and opinions about the financial markets in which it invests portfolio assets following its investment strategies, and these beliefs and opinions are subject to change at any time. Where information provided in this document contains “forward-looking” information including estimates, projections and subjective judgment and analysis, no representation is made as to the accuracy of such estimates or projections or that such projections will be realised. Comparison to an index, where shown, is for information only and should not be interpreted to mean that there is a correlation between the portfolio and the index.

To the fullest extent permitted by law, neither Marylebone nor the Company shall have any responsibility or liability whatsoever (for negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document. Should you undertake any investment or activity based on information contained in this document, you do so entirely at your own risk.