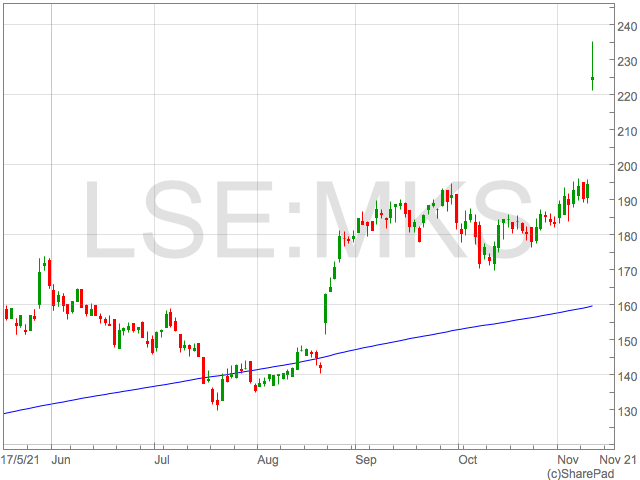

Marks and Spencer shares made strong gains on Wednesday morning after the group said they expected profit for the year to be ahead of expectations.

M&S said they expected profit before tax and adjusting items for the year to be in the region of £500m.

Marks and Spencer shares surged over 15% in early trade on Wednesday following the results.

Profit for the 26 weeks to 2nd October also rose with profit before tax rising to £187.3m. This was a significant swing from a loss of £87.6m last year and £158.8m profit in the same period in 2019, before the pandemic.

Food sales grew by 10.4% whilst Clothing and Home sales continued to disappoint, down 1%.

“Something spectacular must have happened since August for Marks & Spencer to upgrade earnings guidance once again. Back then, it believed pre-tax profit for the year would be above the upper end of a previously guided £300 million to £350 million range. Now it’s talking about profit hitting £500 million which is quite some jump,” said AJ Bell investment director Russ Mould.

“Food sales are doing incredibly well, particularly instore. It has really nailed the proposition with decent quality products and an ever-widening range of items. Quality is the key word as it caters for a specific type of customer who is happy to pay that bit extra for something nice.

“Its online joint venture with Ocado has also helped the business reached a broader audience, such as individuals who want higher quality products but don’t want the faff of visiting a store.

“Clothing continues to be a mixed bag, but the company comes across as more confident about its prospects. Overall sales aren’t growing but operating profit is, thanks to selling more items at full price.

Despite the promising outlook for M&S, they did allude to the fact that supply chain issues were going to drive costs higher but their forecast increase in sales negated a material impact as they embark on a supply chain efficiencies.

“Given the history of M&S we’ve been clear that we won’t overclaim our progress. Unpacking the numbers isn’t a linear exercise and we’ve called out the Covid bounce back tailwinds, as well as the headwinds from the pandemic, supply chain and Brexit, some of which will continue into next year,” said Steve Rowe, M&S Chief Executive.

“But, thanks to the hard work of our colleagues, it is clear that underlying performance is improving, with our main businesses making important gains in market share and customer perception. The hard yards of driving long term change are beginning to be borne out in our performance.”