The FTSE 100 continued convincingly broke through 7,500 on Wednesday morning, touching 7,555 and the highest level since January 2020.

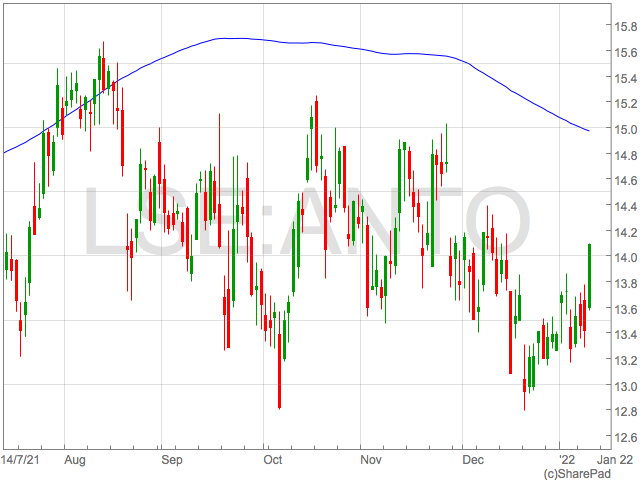

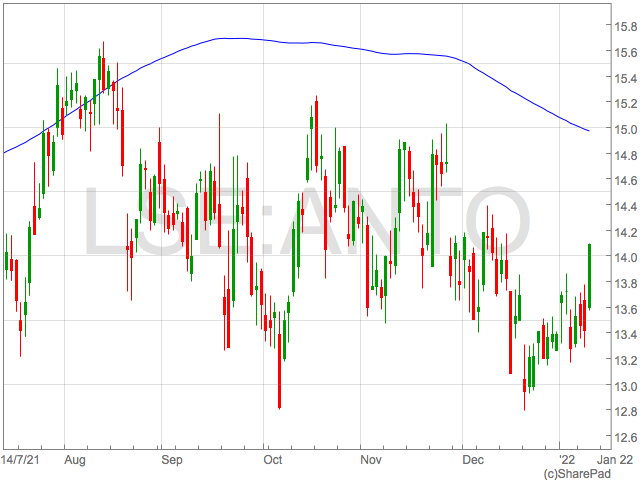

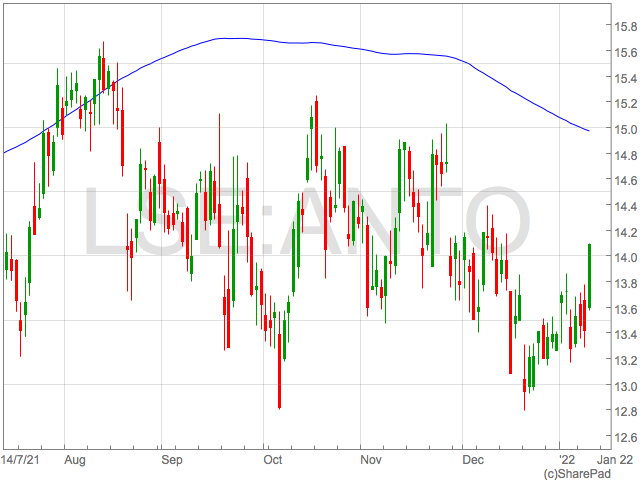

The rally was driven by stronger miners that dominated the FTSE 100 top risers in Wednesday trade. Anglo American, Rio Tinto, BHP, Glencore and Antofagasta were among the top gainers as commodity prices surged supporting mining share prices.

A culmination of hopes China’s steel making industry would continue to recover, and disruption in Brazilian iron ore production pushed Iron ore Futures on the key Dalian Exchange in China to the highest level this year.

Copper futures traded on the London Metals Exchange also rose to trade above $9,600 per tonne. Copper miner Antofagasta was the FTSE 100 top riser at the time writing, gaining 4.8%.

“The FTSE 100 traded 0.6% higher, with miners dominating the index’s top performers. The top six risers were all metal producers, and this sector is a bellwether for global economic activity,” said Russ Mould, investment director at AJ Bell.

Improving sentiment

The general risk-on rally began in Asia overnight and the optimism continued into the London session, following comments from Fed Chair Powell on the trajectory on inflation, and suggestions interest rate hikes in the US may not be as dramatic as previously thought.

“Volatility is down, equities are up. Investors look to be regaining their confidence after a choppy start to 2022 with all the main indices across Europe and Asia pushing ahead, following a similar performance on Wall Street last night,” said Russ Mould.

“Driving confidence were remarks by Federal Reserve chairman Jay Powell that the central bank would do everything it could to stop inflation running out of control.”

Highlighting the risk-on nature of today’s trade, Mould pointed to declines in defensive shares as investors rotated to cyclical stocks.

“Risk appetite appears to have returned given how more stodgy companies like BT, Reckitt Benckiser and Imperial Brands were among the fallers on the FTSE. Instead, investors were more interested in bidding up some of the tech plays which have been beaten up recently, including Scottish Mortgage,” said Mould.

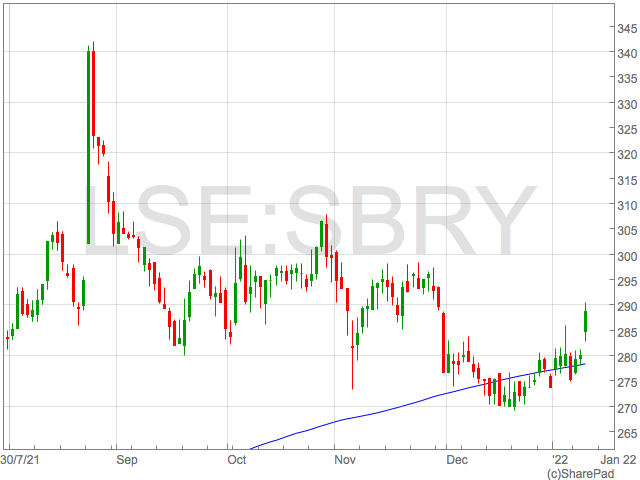

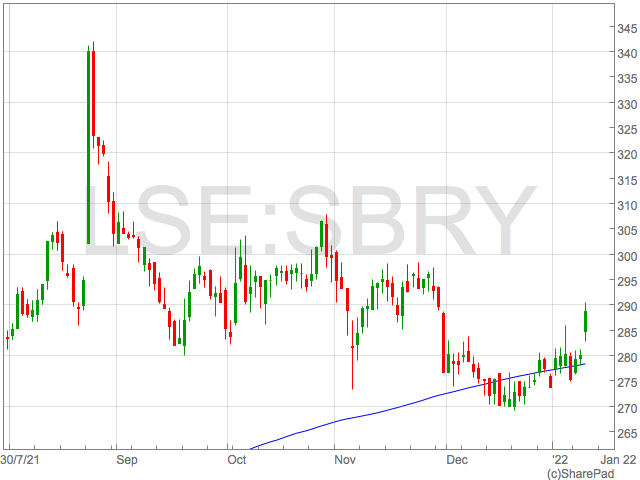

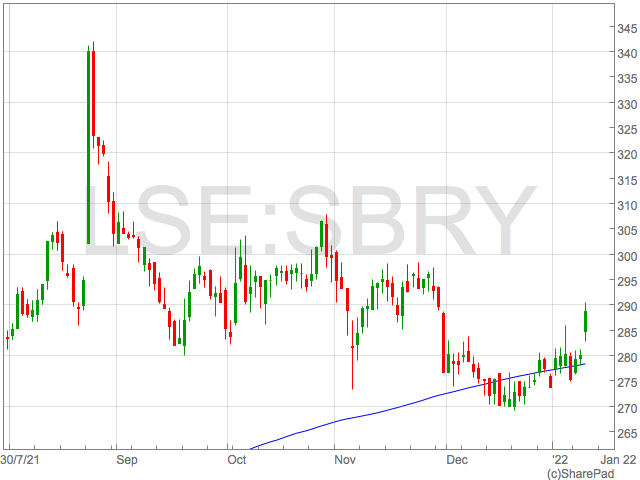

“Also in vogue were a slew of consumer-facing companies riding high after upbeat trading statements. These included Sainsbury’s which upgraded its profit guidance, and Whitbread which said it continued to trade ahead of the market.”

Sainsbury’s posted an upbeat festive trading report that showed they had gained market shares paying testament to their efforts to take in the discount supermarkets such as Aldi and Lidl.

“Sainsbury’s is the latest supermarket directly trying to take on the discounters, with massive investment in reducing prices helping the supermarket up its market share,” said Sophie Lund-Yates, equity analyst at Hargreaves Lansdown.

“The group also benefitted from another year of customers wanting to treat themselves over the festive season, as rules were relaxed and people went all-out, piling trollies and virtual baskets high.”