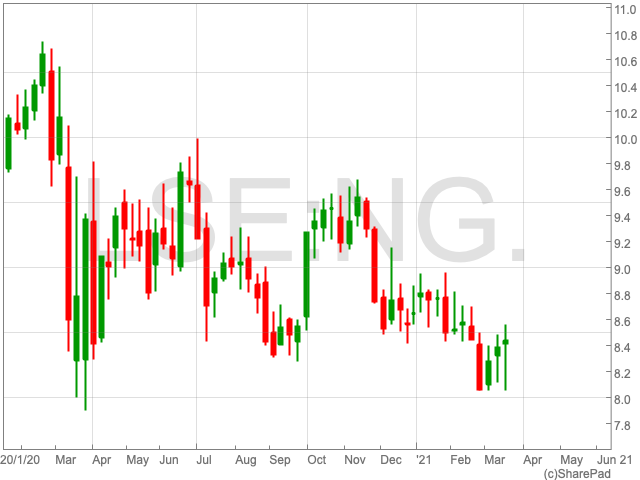

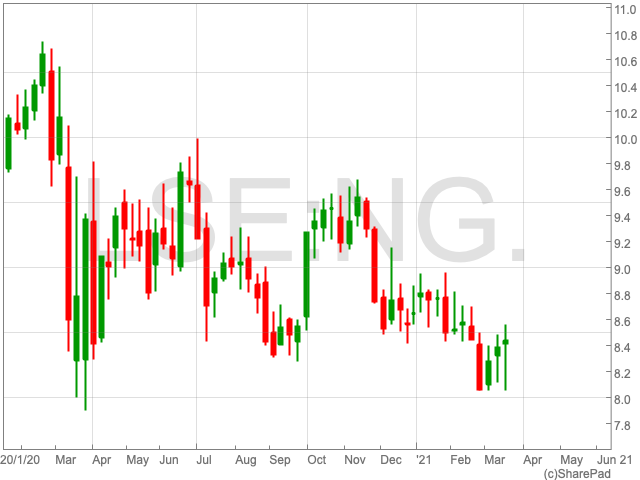

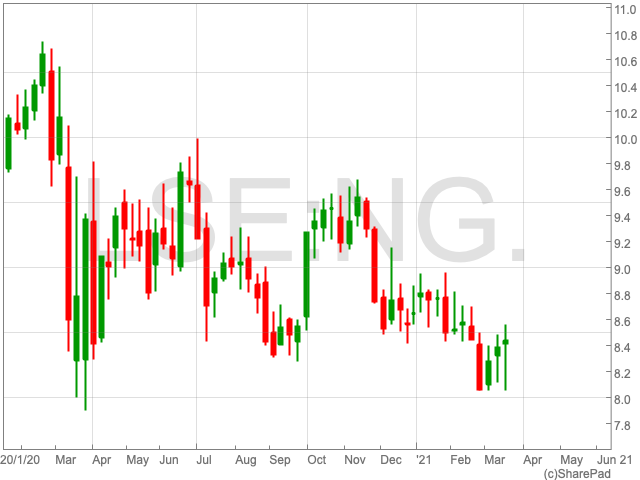

National Grid Share Price

The pandemic has proved to be a testing time for a broad swathe of FTSE 100 companies, including National Grid. On 21 February 2020 its share price sat at 1,063.8p before plummeting to 860.4p per share by 13 March. Over the past 12 months, however, National Grid steadied somewhat, down by 2.48%. Since the turn of the year, the utility company is down by 2.68%.

Dividend

National Grid has one of the highest dividend yields out of all UK companies and has been the stock of choice for those seeking income from their investments. In 2019 and 2018 the company paid out total dividends of 48.57p and 47.34p respectively, at yields of 5.6% and 5.7%. The utility company paid out an interim dividend of 17p in January and will announce its final dividend on 31 March 2021.

While historically the dividend has been sustainable over a number of years, which is a positive sign, this is not a guarantee that it will be in the future. Last year the company paid out over 100% of its profit in dividends, which is not sustainable, although it was under unusual circumstances.

For the company to continue paying a sizeable dividend it will need to secure its income levels for the coming years. This could come down to its strategy of becoming more weighted to electricity than other forms of energy.

Renewable Energy

National Grid could be well poised to capitalise on the ongoing rise of electrical vehicle usage, and the more general move away from fossil fuels, after the company agreed to purchase Western Power Distribution (WPD). National Grid confirmed its plans to acquire PPL’s WPD electricity distribution assets, for an equity value of £7.8bn.

Laura Hoy, an equity analyst at Hargreaves Lansdown, commented: “From a strategic standpoint, it makes sense as the world shifts away from fossil fuels usage.”

“Not only are homes consuming more, but the boom in electric cars represents an opportunity for NG, and the WPD acquisition puts it one step closer to seizing it. But having the capacity to deal with a surge in electricity usage and being allowed to profit from it are two different things.”

The acquisition will take National Grid’s electricity assets from 60% to 70% and position it as a major player in the electric vehicle industry, which could bode well for its long-term prospects.