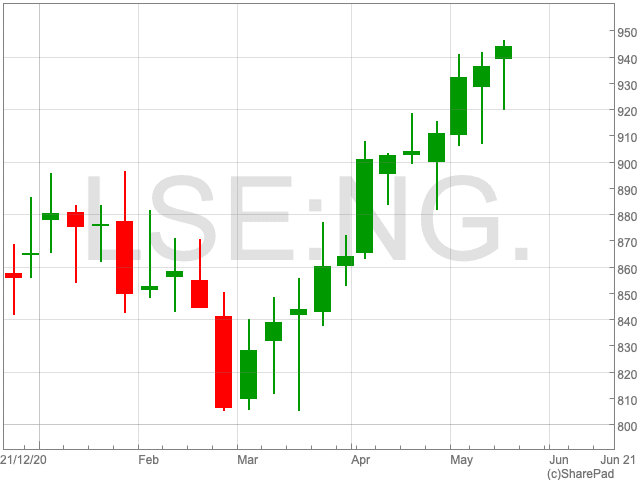

National Grid Share Price

The National Grid share price (LON:NG) is on a roll. It has risen continuously throughout March, April and into May. Since the turn of the year it is up by 9%. The recent rally continued today as the FTSE 100 company announced its results, including a venture into the US offshore wind space. National Grid is catching the eyes of investors.

National Grid Moves into Offshore Wind

National Grid has entered into a partnership with RWE, the German energy company, developing offshore wind projects off the coast of the United States. The venture is the next stage of National Grid’s strategy to work on electricity, after it acquired Western Power Distribution last month for £7.8bn.

Its pivot towards offshore wind energy comes as America sets its sights on aggressive growth towards 30 gigawatts by 2030. The deal, in addition to other infrastructure investments, may boost the FTSE 100 company’s earnings by 15%, according to Berenberg, the Hamburg-based broker.

A transition to US offshore wind will widen National Grid’s exposure to electricity markets, while it intends to sell a majority stake in its UK gas network.

Results

National Grid also confirmed on Thursday that its profit before tax rose by 19% to £2.1bn. Its pre-tax profit fell by 3% on an underlying basis, as the company took on extra costs due to the pandemic, including its business in America, where it made greater debt provisions for customers.

Th company said its results were better than was expected, as it anticipated a bigger hit to its underlying profit. Investec analyst Martin Young told the Financial Times that he still “see attractions” on the company’s story. Chief executive John Pettigrew praised the “strength and resilience of our business model”, while reaffirming its desire to secure long-term growth.