by Eric Chan, Investment Manager, abrdn Asian Income Fund Limited

Eric Chan pens his thoughts on his recent trip to Australia, where he spoke to some of our holdings and potential prospects around their businesses and the broader macro outlook there.

Purpose of the trip

I wanted to get a better feel of where our holdings are and how they see the operating environment heading into 2024. I was also keen to speak to managements of some prospects that we are monitoring, as well as gain deeper insight into the broader macro themes that are driving sentiment and economic activity.

Key takeaways

Big macro theme: Immigration

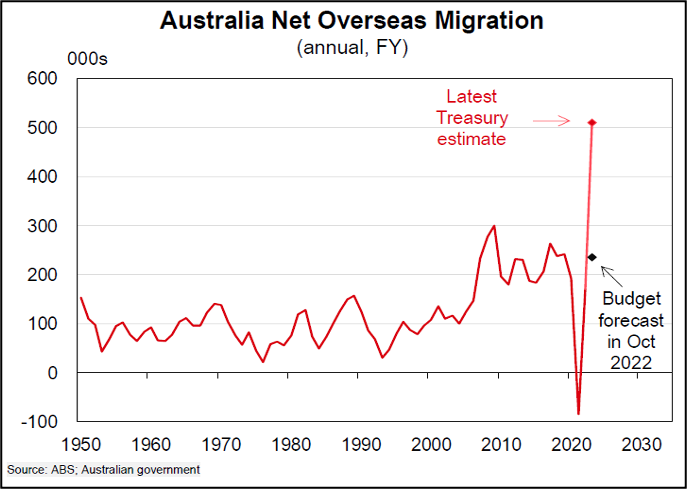

Through 2023, a key macro theme has been the sharp rise in inward migration to around half a million people, from an expected 235,000 forecast in October. This will potentially underpin the economy’s growth and will likely put upward pressure on property prices, as well as provide some relief from the acute labour and skills shortage. While household consumption has slowed considerably, the population growth will help stem the decline in consumer spending, while preserving resilience in absolute terms. While minimum wage increases and Enterprise Bargaining Agreements will keep wage inflation sticky into 2024, thus keeping the central bank’s policy stance relatively hawkish, the influx of workers in a labour-constrained economy might help alleviate some of the pressure.

BHP: Progressing well away from coal

Well-thought transition path: Our meeting with the resources group BHP was encouraging in terms of how it is thinking through its transition plan of moving away from coal-related assets and messaging this to connect with the affected communities better. Thermal coal has always had a stigma to it, but being public about its engagement on how best to address this and how they are caring for the transition to new jobs of old coal workers has helped to alleviate the stigma. BHP still retains one thermal coal asset but it is because it could not find a buyer for it. The group will close the mine by 2030 which it sees as an optimal time to close from a value perspective and give it time for a transition of its workforce. Meanwhile, there were also other positives from the meeting. The group indicated that it would keep the dividend payout to a minimum 50% of earnings and regarded this level as sacrosanct, ensuring a stable level of dividend streams for shareholders. Its capex guidance is an indicative range for pipelines and extends to 2026, with A$10 billion this year followed by A$11 billion for the two years after.

“I’ve always found my trips to Australia incredibly insightful and a great way to reset one’s views and perspectives when looking at the market from overseas. With Australia being such a strong domestic-driven market, the on-the-ground insights, local stories, and personal conversations with companies give greater colour into the investments that we have made and inspires new ideas and themes that otherwise may have been missed by investors looking at the market from afar.”

Outlook

The domestic backdrop remains challenging, given a slowing economy, elevated inflation and a tight labour market. We expect earnings risk over the short to medium term as economic activity softens and as the consumer adjusts to higher interest-servicing costs. However, the recent trip has made us relatively more hopeful that the economy is approaching an inflection point and we will look to opportunistically add to quality companies that are ready to benefit from a turnaround in the economy.

We remain biased towards businesses with strong pricing power and defensive business moats, and we favour businesses with clear growth prospects that are leveraged to long-term structural shifts. Our holdings’ defensiveness (i.e. their robust balance sheets and prospects for generating healthy through-the-cycle earnings and dividend growth) is also a positive. Many of our companies are also leaders in governance and sustainability, positioning them well to adapt to the future. This will ensure that the portfolio remains resilient despite the current uncertain times.

Companies selected for illustrative purposes only to demonstrate the investment management style described herein and not as an investment recommendation or indication of future performance.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- The Company may charge expenses to capital which may erode the capital value of the investment.

- Movements in exchange rates will impact on both the level of income received and the capital value of your investment.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

- The Company invests in emerging markets which tend to be more volatile than mature markets and the value of your investment could move sharply up or down.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

Other important information:

Issued by abrdn Investments Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Both companies are authorised and regulated by the Financial Conduct Authority in the UK. abrdn Asian Income Fund Limited has a registered office at JTC House, 28 Esplanade, St Helier, Jersey JE4 2QP, JTC Fund Solutions (Jersey) Limited acts as the administrator, and the Collective Investment Fund is regulated by the Jersey Financial Services Commission.

Find out more at www.asian-income.co.uk or by registering for updates. You can also follow us on social media: X (formerly Twitter) and LinkedIn.