Whether you are a healthcare and pharmaceutical aficionado or not, the Polar Capital Global Healthcare Trust should be considered by all investment trust investors seeking a vehicle with a solid track record of strong performance that consistently beats the benchmark.

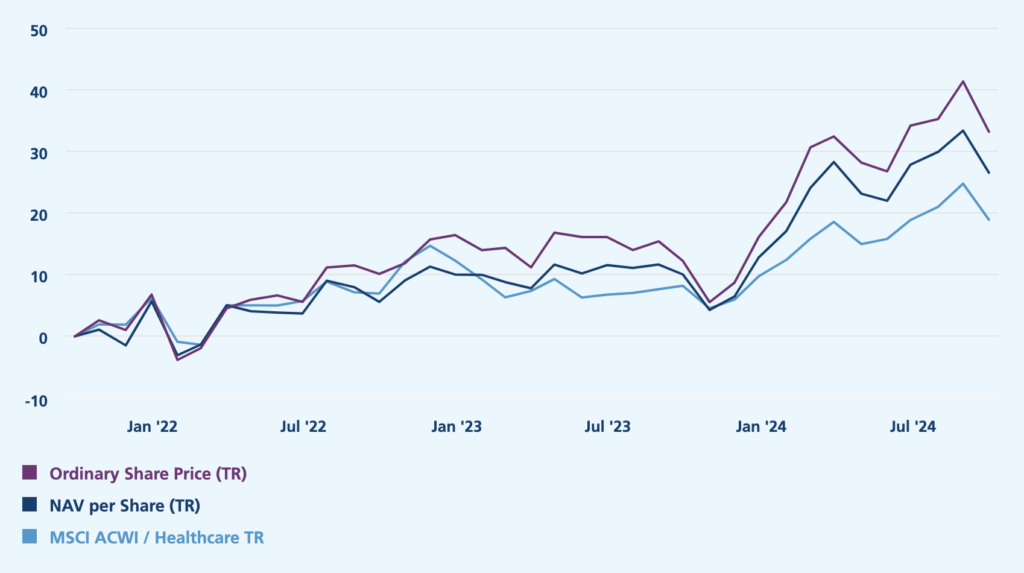

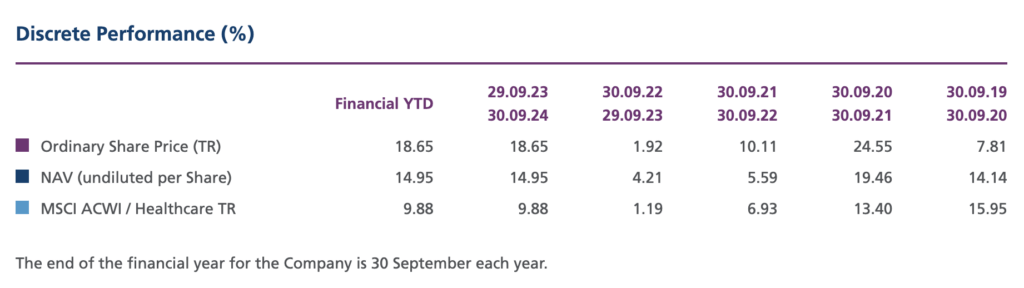

Over the three years to September 2024, this investment trust has produced a share price total return of 33.2% compared to the MSCI ACWI / Healthcare benchmark return of 18.9%.

The trust invests in leading healthcare and pharmaceutical companies with an attractive mix of mega caps and small caps to ensure investors are provided with a diverse portfolio of steady cashflows blended with some of the most exciting growth prospects in the sector.

The Polar Capital Global Healthcare Trust’s performance pays testament to a robust research process driven by Polar Capital’s healthcare team comprised of eight experts with deep experience in the sector.

Healthcare investing requires a high level of sector-specific expertise that other industries may not. The sector offers many exciting opportunities, but many companies offer potential without the intrinsic strengths to produce shareholder returns. By investing in this trust, investors secure a partner to help navigate the sector and filter down companies into a portfolio of 25-60 high-conviction ideas selected by managers with deep experience in the sector.

Polar Capital Global Healthcare Trust 3- year performance

The trust is underpinned by a healthcare industry poised for sustained, long-term growth. This trend is driven by an ageing global population observed in both developed and emerging nations. The trust highlights that as people live longer, there’s an increasing need for expanded healthcare services and infrastructure worldwide.

The portfolio is built around six core themes: Healthcare delivery disruption, Innovation, Consolidation, Emerging markets, Outsourcing, and Prevention.

The breadth of these core themes lends to the trust’s diversified holdings in established drug companies such as Eli Lilly & Co, UnitedHealth Group, Novo Nordisk, Roche, and AbbVie. These companies are responsible for a large proportion of the world’s pharmaceutical innovations and production and provide investors with reliable cash flows while securing exposure to the growth prospects of a pipeline of potentially blockbuster new drugs.

Innovation & Disruption

“Innovation is the lifeblood of the healthcare sector and it is flourishing,” says Gareth Powell, Head of Healthcare at Polar Capital.

Polar Capital Global Healthcare Trust’s recent performance has in part been driven by its focus on innovation and the availability of new drugs and therapies to improve patient outcomes.

The trust has identified developments in obesity, atrial fibrillation, respiratory diseases and Alzheimer’s. It has taken action to ensure the portfolio harnesses growth in these areas and the upcoming earnings cycles for the mega-cap pharmaceutical companies that have brought them to market.

These particular areas clearly excite the Polar Capital team, and the market shares this enthusiasm. Eli Lilly shares surged this year amid the launch of the Alzheimer’s drug Donanema and Novo Nordisk has benefited from new obesity drugs. As of 30 September, Eli Lilly was the trust’s top holding after gaining around 50% year-to-date.

These successes for Polar Capital Global Healthcare Trust’s shareholders represent the team’s approach to the healthcare sector, which balances securing exposure to earnings growth while ensuring an attractive valuation.

The recent initiation of Novo Nordisk demonstrated the trust’s measured approach. Novo Nordisk has blazed a trail with the launch of blockbuster weight loss drugs Wegovy and Ozempic, which helped send the stock to record highs earlier this year. It would have been tempting to jump in amid the hype in late 2023 and early 2024, but Polar waited until a pullback during volatility in August to add the stock to its portfolio.

Growth companies

While large-caps comprise the lion’s share of the portfolio, Polar Capital reserves 20% to invest in new and upcoming companies at the forefront of innovation.

One such area that will find its way into this section of the portfolio is the the introduction of AI and machine learning to healthcare that promise innovation in a wide range of settings including diagnostics and specific care settings.

Polar Capital believes this new round of innovation is the final ingredient to spark the next bull market in healthcare shares.

Healthcare is a broad church, and this is represented in the Polar Capital Global Healthcare Trust’s portfolio, which offers the excitement of new innovations underpinned by steady returns from the world’s largest drug companies, which make up a large proportion of the portfolio.