Pound continues recent surge

The pound rose against the euro today following the ECB’s announcement that it will step up its bond buying over the first quarter of 2021.

At 1230 GMT, when the ECB made its policy announcement, GBP/EUR was at 1.1661. However, at 1500 GMT on Thursday, one British pound was worth €1.1686.

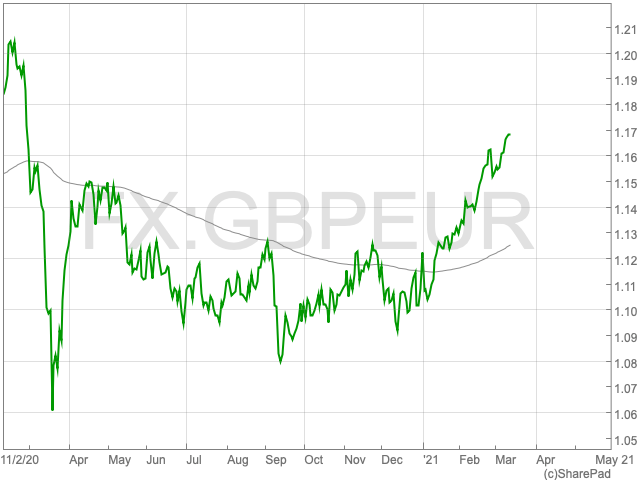

The pound’s rise against the euro on Thursday is a continuation of a trend which has seen the UK currency surge over recent months.

In the middle of March 2020 the GBP/EURO exchange rate was just above 1.05. After a period of volatility between March and September, the pound found itself at 1.08 against the euro.

Over the past six months the pound has seen an 8.23% rise against the Eurozone currency. The pound has also risen strongly against the dollar over the same period, up 9.11%.

Today’s move followed the European Central Bank (ECB) confirming that its interest rate of 0.5% would remain unchanged.

The ECB also said it expects purchases under the pandemic emergency purchase programme (PEPP), its bond buying stimulus, would “be conducted at a significantly higher pace” over the next quarter, in an effort to contain rising bond yields.

The bond buying program has the effect of pushing down bond yields, which act as a benchmark for borrowing across the region.

A number of factors are responsible for Sterling’s recent resurgence. In February, the pound edged 1.16 against the Euro, as optimism surrounding the UK economy grew stronger due to vaccine roll-outs surpassing expectations.

Michael Brown, expert at international payments and foreign exchange firm Caxton FX, commented on the currency’s upward trajectory.

“It continued the steady ascent started a week prior and nearing the 1.17 handle once more,” Brown said.

“This, and the recent 1.1705 high, will prove a tough bar for the pound to jump, though the UK’s continued outperformance in Covid vaccinations means we should indeed break these levels in due course.”