PREM lies on the verge of first lithium production and enjoys strategic investment that could well be increased in the near future.

As an avid enthusiast in FTSE AIM companies, Premier African Minerals (LON: PREM) currently constitutes my best ever investment, having risen from circa 0.03p from my initial trade in early September 2019 to 0.55p at present — an increase of over 1,700%.

And I’ve been adding slowly to this position ever since, having advocated for CEO George Roach’s excellent opportunity across multiple publications.

Of course, I don’t profess to have a crystal ball — and similar ultra-speculative calls haven’t ended so well; a similar sized investment in Savannah Resources has essentially been on a road to nowhere over the same timeframe, though I expect similar share price movement when Europe eventually wakes up to the critical minerals supply gap.

To be clear, penny stock investing is not for the faint-hearted; the risk-reward ratio is significantly elevated on the AIM market, which is full of highly speculative companies not yet generating income and for whom one RNS can decimate or skyrocket the share price.

And when it comes to exploratory miners, the risks are even worse — as many battle-scarred veterans can attest. Share placements, poor drilling results, capital problems, political shifts, and a veil concealing investor information are all common problems. Of course, this won’t come as a surprise to any seasoned investor hunting for opportunities.

Lithium explorers like PREM are particularly risky as early investments because even with the best will in the world (and often backed by Chinese money) mines can take years to be brought to production, and the non-fungibility of lithium means that quality can be difficult to ascertain compared to the traditional hard commodities such as oil, iron, or gold.

A short history of PREM

With this in mind, it’s worth noting that while PREM shares have returned 149% over the past five years, very long-term investors have lost money since its 3p+ peak in June 2015.

Premier African Minerals launched its IPO on the AIM market in 2012, offering an 1,800-hectare tungsten mining operation, and for about a year all seemed well. The share price surged as the company seemed ready to begin production, but this was moderated by share placements as PREM sought to stop widening losses and expand into lithium mining at its then-new Zulu claims.

In 2019, the miner was hit by political instability, when Zimbabwe’s National Indigenisation and Economic Empowerment Fund caused PREM’s tungsten mines to cease production and sent its share price into the doldrums; as a high-risk investor, this was my buy-in point.

But optimism is once again with the FTSE AIM lithium explorer. To be clear, PREM also operates interests in tungsten, manganese, and potash projects across Africa. But the crown jewel remains its Zulu Lithium and Tantalum Project in Zimbabwe, which by some measures is the fifth-largest high-quality lithium deposit in the world.

Zulu in brief

I have in the past nominated PREM as London’s answer to Australia’s Pilbara Minerals — another lithium miner I have followed for years, and which has seen similarly meteoric value rises. Of course, PLS has been in production for some time now, but at long last PREM is very nearly there.

PREM owns a 100% interest in the Zulu project, which as well as being globally significant, is likely the largest undeveloped lithium mine in Zimbabwe, a country which already has some of the largest proven hard rock lithium reserves in the world.

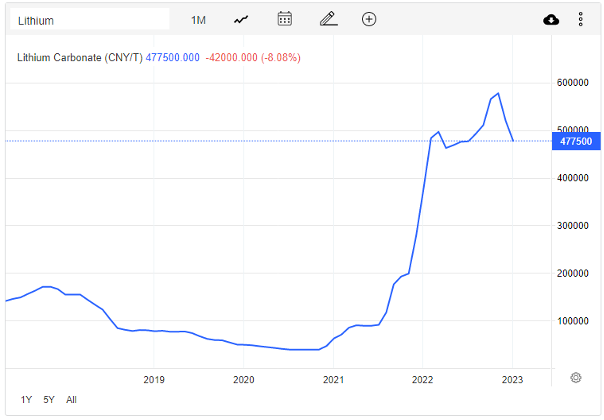

Further, lithium carbonate prices remain at historically elevated levels, at 477,500CNY/tonne in China. And the world’s largest lithium producer, Albemarle, expects prices to leap another 40% from current levels by the end of the year.

Roach has consistently targeted Q1 2023 as the quarter when PREM will metamorphize from lithium explorer to producer. Today, he confirmed ‘we are into the home stretch with pilot plant construction and site activity is frenetic with multiple work streams all targeting the same near-term completion date…activity in the pilot plant assembly areas is now on a 24/7 basis. In the absence of any unforeseen issue, I expect that first shipments of SC6 will commence in Q1 as projected.’

Technical details are available in full on LSE, but for brevity, results include 6.2m of lithium oxide grading 1.15% and tantalum pentoxide grading 32 parts per million from 209m, and 6.3m of lithium oxide grading 1.5% and tantalum pentoxide grading 73ppm from 268m.

It should be noted that there is a large backlog of assay results to be processed and Roach accepts that ‘it is not possible to accurately predict either the feed grade of spodumene rich material reaching the floatation circuit, nor to predict the final concentrate grade, or final tonnage production rate. That is the nature of a pilot plant.’

The company is targeting annual production from the pilot plant of 50,000 tonnes of spodumene concentrate (SC6), though the CEO enthused in a November interview that this could technically reach 70,000 tonnes, with further capacity possible as modules are added. As Roach notes, ‘the design capacity on the floatation circuit anticipates a mass pull of up to 30% at a design feed rate of 40 tons per hour of milled material. This represents a potential 12 ton per hour of spodumene rich concentrate.’

For the sceptical, PREM remains relatively active on social media, so investors do not need to take Roach for his word and can see the delivery and installation of the pilot plant as it progresses. However, this initial plant covers only a small part of the entire Exclusive Prospecting Order claim.

As a caveat, while first production seems very likely by the end of March, small delays are not uncommon when setting up mining plants. As the saying goes: rush once, pay twice.

Comparison to Kodal Minerals

Given PREM’s African location and London listing, it’s inevitable that there will be comparisons to Kodal Minerals; however, I think this is perhaps a little unfair. KOD’s lithium asset in Mali is 3,000 miles from PREM’s, and its recently signed deal with Hainan Mining is significantly different than the deal PREM has with Suzhou.

However, my personal perspective is that Kodal has given up a majority ownership of its assets in return for certainty of returns; and the deal it signed was overall very favourable.

Meanwhile, PREM has a strategic partner in fellow Chinese investor Suzhou TA&A Ultra Clean Technology Company, which owns 13.38% of the company, has injected $35 million into the pilot plant, and has signed an offtake deal for 50% of all spodumene initially produced. PREM is free to sell the remaining 50% to the highest bidder.

Incidentally, Roach holds 7.1% of the company’s shares, always an encouraging sign. And an often-missed detail — Suzhou cannot reduce its overall shareholding without losing its offtake rights to a commensurate degree. To my mind, this leaves PREM with a higher level of risk than KOD, but with a strong chance of much higher rewards.

And crucially, production is beginning imminently at Zulu, while KOD’s Bougouni Project is at least a year away from its first shipment.

For clarity, I hold both companies in my model portfolio as long-term investments.

China and valuation speculation

I speculate that Suzhou is planning either a full buyout or a much larger strategic position in Premier African Minerals, using only have publicly available information to form my case.

On 12 January, multi-billionaire Chairman and 35% Suzhou stakeholder Pei Zenzhue (the surname is a transliteration so will be spelt differently elsewhere) made a visit to the country to inspect recent progress made. Billionaires do not inspect sites operated by £122 million companies without a specific reason.

It’s worth noting that Suzhou plans to use its half of PREM’s spodumene to supply Yibin Tianyi, China’s leading lithium chemicals producer, which it owns jointly with CATL, the world’s largest EV battery maker. And through a holding company, Zenzhue also owns a 5.8% stake in CATL.

According to a local paper, the billionaire enthused that ‘the local Zulu team is very hardworking and I am quite impressed. Zimbabwe is a safe investment destination, and I am confident that this lithium project will be a success.’ Notably, he also has a $30 million investment in Mutoko to the east of the country. And Suzhou also has a strong history of shrewd lithium investments, including in Mineral Resources and AVZ Minerals.

After recent new laws banning raw exports from artisanal miners, Roach has made clear that the Zulu deposit should ‘benefit the country, the fiscus, people and as we go forward we should be able to see that there is further processing of lithium bearing minerals; undertaken and done in this country.’

For their part, Zimbabwe Deputy Minister of Mines and Mining Development Polite Kambamura has argued that ‘if we continue exporting raw lithium we will go nowhere. We want to see lithium batteries being developed in the country.’ The minister is eyeing a $12 billion industry by the end of 2023, and it’s possible that Zenzhue’s visit was to calm any fears over increased Chinese involvement.

One advantage of Chinese politics is that business strategy adheres far less stringently to the boom-and-bust mining supercycle. Indeed, western-listed miners are actually decreasing investment in maiden resources as the world goes into recession, as investors fret over the short-term depressive effect on commodity prices, even though the longer-term supply gap means prices are only heading one way over the longer term.

And Chinese companies play the long game. One thing the Kodal deal has shown is that factories in the country are desperate for quality lithium sources and are particularly attracted to ex-Australia lithium because their dependence on the western producer could become a problem as Sino-US tensions escalate over tech, Ukraine, and Taiwan.

And if all the lithium mined in Zimbabwe is eventually processed in the country rather than in China, the 50% not bound to Suzhou could find its way to Europe or the US, and at the very least could be subject to a bidding war between the continents.

However, Zenzhue could also be playing both sides of the chess board. In September, CATL announced that it was investing €7.5 billion on its second European battery manufacturing plant in Hungary, the country’s largest ever investment. Meanwhile, Chinese investors are also planning to construct a $450 million battery-metals industrial park inside Zimbabwe. The Sabi Star, Arcadia, and Bikita projects already all enjoy serious Chinese investment to the tune of hundreds of millions of dollars.

Outside of Zimbabwe, dozens of lithium explorers have been subject to Chinese buyouts or increased strategic investment; Bacanora, Goulamina, Lithea, the list goes on and on. Indeed, Canada recently forced Chinese businesses to divest their stakes in three Canadian lithium companies, citing national security.

And as lithium demand rockets, my view is that 13.38% of PREM and 50% of its lithium is not going to be enough for long. 3p per share seems a realistic possibility within the next 12 months.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.