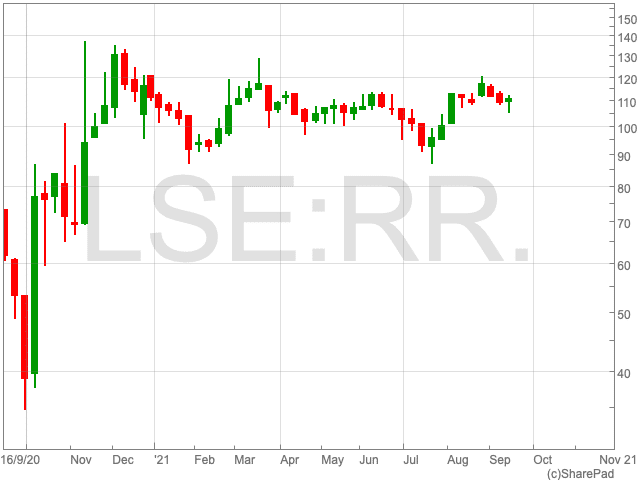

Rolls-Royce Share Price

The Rolls-Royce share price is up by 4.27% on Thursday as the engineering company confirmed it will attempt to set a world record of 300mph later this year with its first all-electric plane. The move comes on the back of a rocky spell for the FTSE 100 company in recent weeks and months, after a promising start to the year.

This has been true across the board when it comes to companies involved in the airline industry due to its unpredictability. This article will examine what the company’s near-term outlook is, along with its longer-term future following the exciting news of today.

Travel Industry

While it feels impossible to predict, the vaccine roll-out continues to progress, and reports from airlines and other relevant firms are showing numbers picking back up.

This slow but steady progress allowed Rolls-Royce to record an underlying profit of £307m, albeit way off the £1.63bn recorded the year before.

Rolls-Royce has taken a number of precautionary measures in order to keep its balance sheet in check, including a corporate restructuring and raising capital, while its long-term debt will not be due until 2024. These factors have allowed the Rolls-Royce share price to climb by 66.7% since the beginning of the year.

Electric Plane

Rolls-Royce’s all-electric plane will attempt a world record of 300mph later in 2021 following its completion of its debut 15-minute flight.

The flight went ahead at a military testing site using a battery pack that the engineering firm said was the most “power-dense” ever put together for an aircraft.

Warren East, Rolls-Royce’s chief executive, said: “The first flight of the Spirit of Innovation is a great achievement.

“This is not only about breaking a world record; the advanced battery and propulsion technology developed for this programme has exciting applications for the urban air mobility market and can help make ‘jet zero’ a reality.”