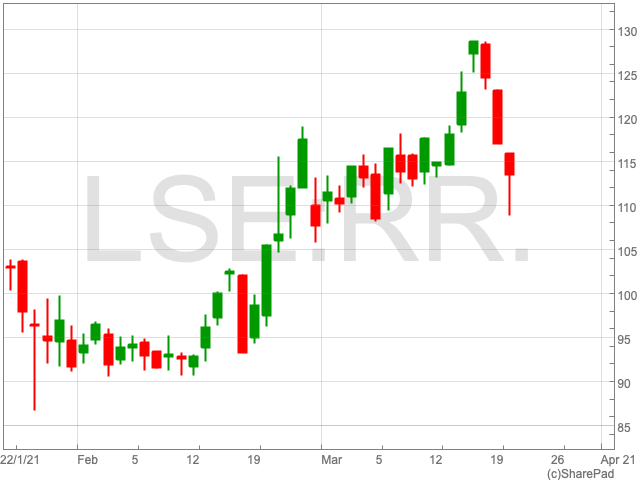

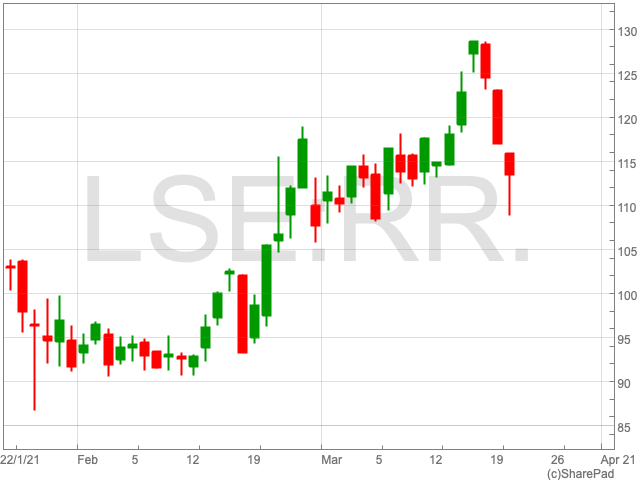

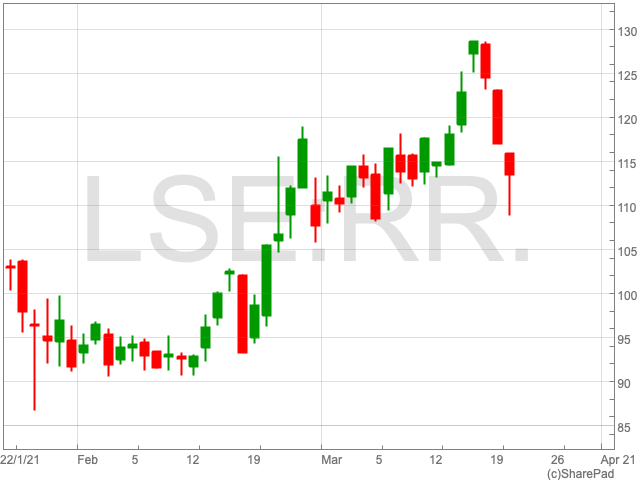

Rolls-Royce Share Price

The Rolls-Royce share price (LON:RR) took a beating today, down by 3.9% to 113.10p, as rumours of a prolonged international travel ban intensified. The move follows a recent upward trend which saw the company’s value per share move from 91.58p to 127.2p in just over one month. The positive movement came as vaccine roll-outs in the UK, Australia and the USA appeared to be going smoothly. While the stock was earning renewed interest on account of its momentum, its outlook has now been called back into question, as government policy regarding international travel remains up in the air.

Airline Industry

The slower pace of the vaccine rollout in the EU, a spike in infections in mainland Europe and the emergence of new variants has complicated the picture for Rolls-Royce. There is a real risk that the company will not get the summer it was hoping for, according to AJ Bell investment director Russ Mould.

“The risk, and one being increasingly acknowledged by Government ministers, is this summer is even worse than last for the travel space as the UK keeps restrictions in place to avoid undermining its hard-won success with the vaccine,” Mould said.

This could mean more of the same in 2021 following the company’s huge losses the previous year.

Performance

Rolls-Royce swung to a £4bn loss in 2020 as the coronavirus pandemic severely impacted the airline industry, while its cash outflow was £4.2bn. Rolls-Royce predicted its cash outflow will turn positive during H2 of 2021 to £2bn. The engineering company has also taken strong acton to reduce its costs by an added £1bn, including 7,000 job losses during 2020, with the aim of saving a total of £1.3bn by 2022.

Rolls-Royce, as well as taking steps to lower its costs, has strived to strengthen its liquidity position, which could see the company through further disappointing news regarding the travel bans. In addition to its forecasted £2bn inflow in 2021, the company has access to £9bn in liquidity, including £3.5bn in cash and £5.5bn in undrawn credit.

While Rolls-Royce is in a position to sustain itself for a long period, a ban on non-essential travel during the busy summer period would still be devastating for the business. The company would need to raise more money which would have a detrimental impact on its share price, as it did the first time around.