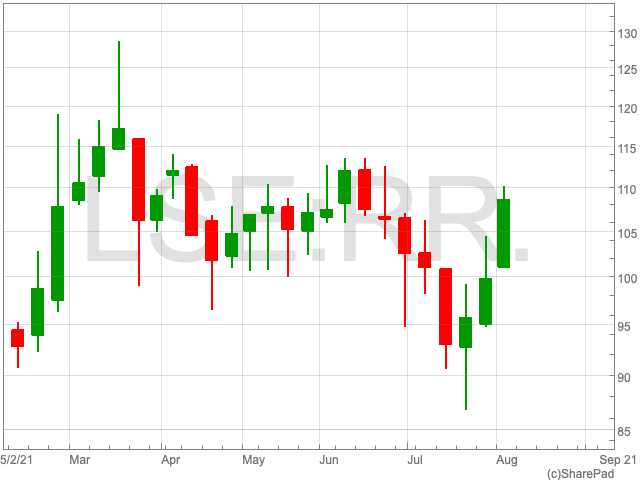

Rolls-Royce Share Price

The Rolls-Royce share price (LON:RR) is up by 3.46% on Thursday as the engineering company confirmed it returned to a profit. Unless there are some dramatically unforeseen circumstances, the Rolls-Royce share price will close out its third consecutive week in the black on Friday evening.

The Rolls-Royce share price has struggled throughout 2021 as the outlook for the aviation industry has remained cloudy. Since the beginning of the year, the Rolls-Royce share price is up by 4.90%. Investors will hoping the FTSE 100 company’s recent update, along with the continued easing of restrictions across the world, will bode well for the Rolls-Royce share price.

Return to Profit

Rolls-Royce made a profit for H1, confirming an underlying operating profit of £307m. This compares favourably to the same period a year ago when the engineering company made a £1.63bn loss.

In further positive news, Rolls said it is expecting to turn free cash flow positive during H2. However, its free cash flow target of £750m is not likely to happen until 2022, beyond the initially expected time period.

Warren East, chief executive, said: “We are making disciplined investments in the new opportunities to drive future growth, particularly in net zero power where we are leading the way with innovation and engineering excellence.”

James Andrews, senior personal finance expert at money.co.uk, said: “After 2020 saw an almost £4 billion year loss for Rolls-Royceamidst the COVID-19 pandemic, investors could be forgiven for cheering today’s profit of 114 million (before tax).”

“The company, which makes more money the more long-haul flights take place, is suffering a long Covid recovery as international air travel remains depressed.”

Actions taken early on in the pandemic, including shedding 9,000 staff and selling off part of the firm to free up cash, seemed to have positioned Rolls well to take off again as the travel sector recovers.

“And with share prices less than a third of their 2018, peak several experts rate the stock as a strong medium to long-term prospect,” Andrews said.