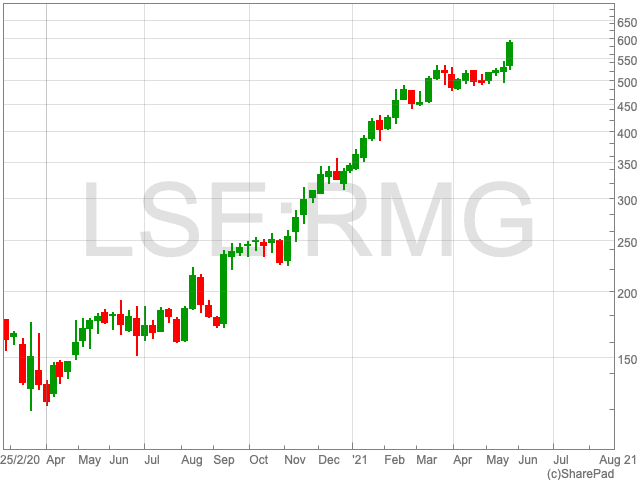

The Royal Mail share price (LON:RMG) has performed so well over the past 12 months that it is being heavily tipped to re-enter the FTSE 100. After gaining 6.8% on Tuesday, the postal service company is now valued at 587.39p per share. Since the beginning of the year, the Royal Mail share price is up by 74.1%. The question now is: can the group sustain the same levels of growth as the pandemic comes to an end. One major analyst seems to think so.

Royal Mail Results

The Royal Mail share price boomed as its profits quadrupled during its latest financial year. This was down to the pandemic giving rise to an online shopping boom. The online spree was reflected in soaring demand for parcel deliveries to the benefit of the FTSE 250 company’s balance sheet.

Its revenues were up to £12.6bn, an increase of 16.6%, thanks to a 39% rise in parcels revenue. Royal Mail’s market value tripled to £5.2bn over the same period, and as such paid out a one-time dividend payment of 10p. The company also confirmed it will begin a new dividend policy at 20p per share, beginning this financial year.

While Royal Mail performed spectacularly over the pandemic, a question mark remains over its ability to sustain its levels, especially without lockdowns. Analysts at JP Morgan believe it has the capacity to do so.

JP Morgan

Analysts at JP Morgan are bullish on the prospects of the Royal Mail share price, as they appear unsure why there wasn’t more of a reaction to the post service’s results.

“We struggle to understand why the share price has not reacted more positively to the full-year results, given the sharply better price-mix and confirmation of material year-on-year cost savings,” Sam Bland, an analyst at JP Morgan, said.

They increased their price target for Royal Mail to 801p, up from 685p, sticking to their ‘overweight’ rating. The analysts added that their stance would remain bullish even if UK profits dipped during the second half of the 2022 financial year, as it would be offset by a sharp rise during H1.

FTSE 100

Following its outstanding performance over the past year, Royal Mail is tipped to make a return to the FTSE 100 in June’s quarterly reshuffle. “

“The latest FTSE 100 reshuffle, the results of which are due to be announced after the close on Wednesday 2 June, could be relatively quiet this time around, with just one demotion and one promotion.”

“Royal Mail and Renishaw are the two firms that look most likely to swap places, although cybersecurity specialist Avast, engineer Weir and even Real Estate Investment Trust British Land are currently within 5% to 8% of the market cap cut-off for relegation to the FTSE 250,” says Russ Mould, AJ Bell Investment Director.