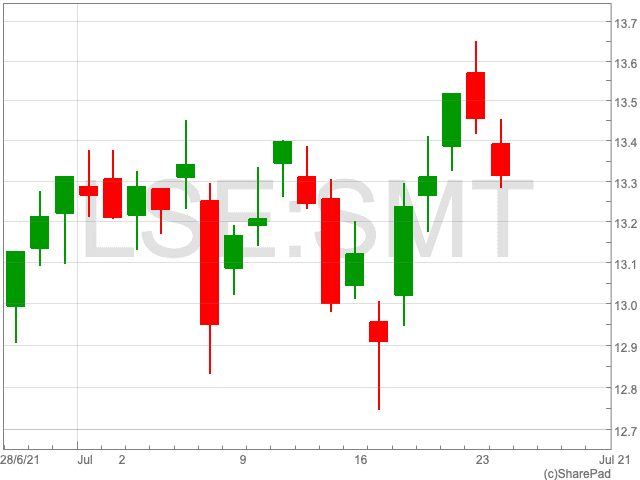

Scottish Mortgage Investment Trust Share Price

The Scottish Mortgage share price is down by 0.87% following a further crackdown by China on its technology sector which caused a drop in the share price of Tencent, one of the fund’s prominent holdings. The set back comes as Scottish Mortgage was beginning to establish some momentum following a sharp fall towards the beginning of the year.

Over the past month the Scottish Mortgage share price is up by 1.65%, while since the beginning of the year the FTSE 100 company has added 9.36%. With 18.68% of the fund – 5.83% being Tencent – consisting of Chinese companies, investors may be concerned over the measures taken by the government, and what it means for the Scottish Mortgage share price.

Tencent

Over the weekend, the State Administration of Market Regulation (SAMR), China’s market regulator, announced that it was blocking Tencent from acquiring copyright agreements with labels, as well as fining the company £56,000 with regard to its previous acquisition of China Music Corporation in 2016.

The regulator said Tencent would have received an unfair competitive advantage.

As a result of the ruling, Tencent will lose exclusive music deals with major labels including Universal Music Group, Sony Music and Warner Music.

Another of Scottish Mortgage Investment Trust’s major holdings, Alibaba, also came under pressure, receiving a $2.8bn for abusing its market power.

The Tencent share price closed 7.72% on 26 July, while the Alibaba share price has fallen by 4.14%.

The Scottish Mortgage share price, along with other China and emerging markets-focused investment firms, have taken hits as the Chinese government comes down on big tech. It could cause investors to consider the pros and cons of investing in the region moving forward.