The Shell share price rally has been derailed by a poor Q3 update and the recent dip could be looked upon as an opportunity for investors seeking a buying opportunity in Shell shares.

Recent news around Shell has focused on their decision to change their share structure and fighting off activist investor plans to break the company up, but the value we see in Shell shares stems from their transition to clean energy and the strength of their current energy business.

While Shell is under pressure to become cleaner and greener faster than they currently are, investors will do well to remember Shell is a huge business and although this process is underway, it will take many years for Shell to earn significant revenues from green energy.

However, Shell are growing their operations in clean energy in a big way. We previously wrote Shell’s future prosperity, and shareholder returns, was inextricably linked to how fast they pivot to clean energy and low carbon solutions.

With COP26 driving home the need to drastically change our energy consumption mix, the spotlight is on Shell is now more than ever.

investors will be pleased that Shell has significantly ramped up their activities in clean energy in an effort to meet Net Zero targets.

Shell acquired Linejump earlier this year which operates a platform connecting renewable energy providers to businesses demanding clean, green energy.

Another example of Shells shift to be cleaner is a recent partnership to build a 58-megawatt solar farm in Alberta.

“We are transforming Scotford into a world-class site that will provide our customers with lower-carbon fuels and the products they desire,” said Mark Pattenden, Shell Canada Senior Vice President, Chemicals and Products.

“Partnerships like this will enable Scotford to contribute to Shell’s overall plan to become a net-zero emissions energy business by 2050, in step with society.”

While these projects highlight Shell’s intention to become greener, the fact still remains the company earns almost all of its money from the production and distribution of fossil fuels, and for now, will be the focus of investors determining the value of Shell’s business.

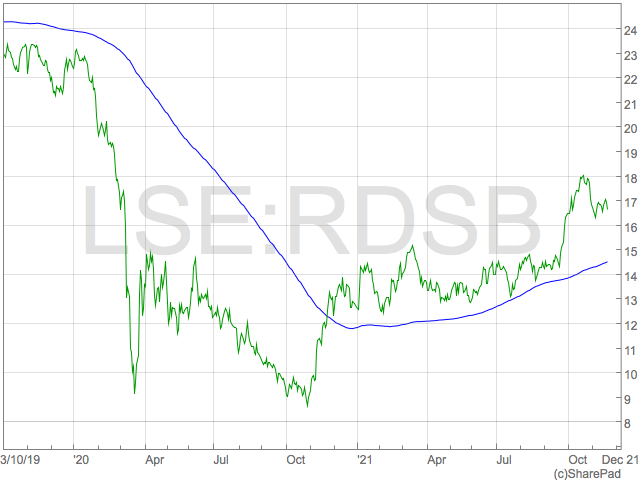

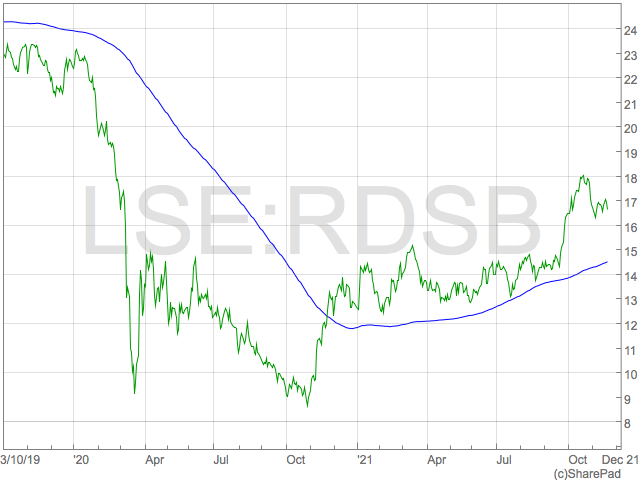

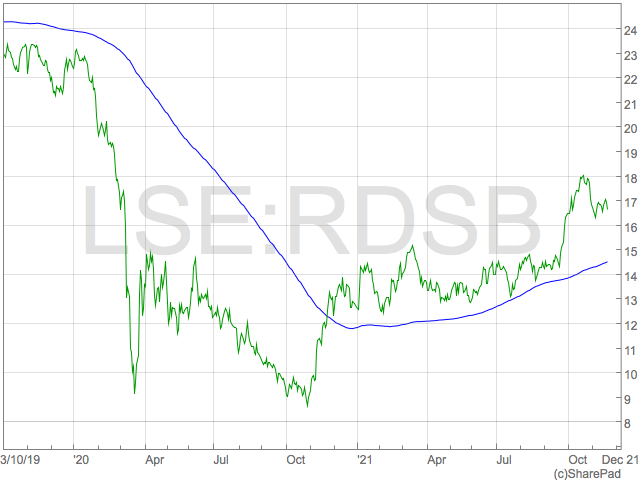

Shell share price

Investors who held throughout the pandemic will now be feeling slightly better about their holdings, however Shell shares are yet to get anywhere near the 2,300p pre-pandemic highs.

Despite Shell enjoying higher energy prices, their Q3 results were a major disappointment for investors and derailed a steady rally in shares.

“Normally one shouldn’t get too hung up over a mere three months’ trading, but this was meant to be Shell’s big quarter, given the surge in oil and gas prices in the past few months. Sadly, it has missed earnings forecasts and left investors feeling frustrated,” said Russ Mould, investment director at AJ Bell after Shell’s Q3 results.

This frustration caused a near 10% decline in the Shell share price over the following days.

we would argue this dip presents an opportunity for buyers looking for a long term holding in Shell.

The attractiveness stems from the dividend and the low forward PE ratio.

Shell has as a forward PE ratio just 9 based on analyst expectations of earning for next year. Of course, this is highly dependant on the price of oil and gas over the next 12 months and it is highly unlikely Shell disappoint on the earnings front in Q4 as much as in Q3.

In addition, the Shell dividend is creeping back up to what it was and strong cash flow generation in Q3 will support further increases in the regular dividend in the future.

Investors also have a $7 billion distribution from the sale of their Permian assets to look forward to.