Unique multi-cap approach offers a 3.2% yield with downside protection

The £423m Diverse Income Trust (LON: DIVI) is an unusual vehicle that provides exposure to both large and small cap UK stocks including those listed on AIM. It benefits from a highly regarded management team led by Gervais Williams and has built up an impressive track record.

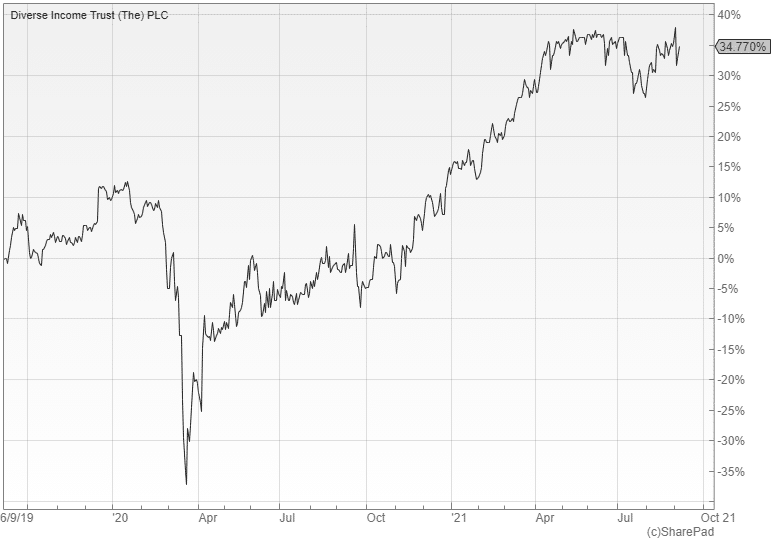

Since the launch in 2011 the trust has generated a NAV total return of 249.5%, which is well ahead of the 89.8% achieved by its FTSE All-Share benchmark over the same period and the 130.9% average return produced by the UK Equity Income sector as a whole.

The strong absolute and relative returns have been possible because of the tilt towards smaller companies where greater market inefficiencies create a fertile environment for talented stock pickers to add value.

Williams concentrates on businesses that can compound cash dividends over the long-term. These sorts of dividend-paying stocks have been out-of-favour for much of the last decade with the low interest rate environment benefitting their growth counterparts, but with inflation picking up and bond yields starting to rise the portfolio could now be entering a more supportive macro environment.

DIVI offers a well-diversified exposure consisting of128 different holdings, of which 35% by value are listed on AIM with a further 14% in FTSE SmallCap stocks. It has a significant investment in financials that would benefit from a higher interest rate environment with notable positions in CMC Markets, K3 Capital and L&G.

Another key differentiator is the willingness to use options to protect the portfolio against a market crash. Williams and his team have used this approach for years and sold the last one at the height of the sell-off in March 2020 before re-investing the proceeds at distressed prices.

The FTSE 100 put option has recently been reinstated to guard against the impact of another sharp fall in the market. This covers 38% of the current portfolio value and provides decent downside protection following the recent strong gains.