Greggs shares jump as viral Mac and Cheese helps boost sales

Greggs shares jumped on Tuesday after the sausage roll specialist reported improved trading performance in the first 20 weeks of 2025, with total sales increasing by 7.4% to £784 million compared to £730 million in the same period last year.

The high street baker saw like-for-like sales in company-managed shops grow by 2.9%, with performance strengthening during the latter part of the period. The company noted that “better trading conditions” had supported this improved trend.

A stabilisation in costs will be welcomed by investors. Greggs was built on its affordable sausage rolls and steak bakes, and high inflation has threatened its ability to maintain low prices. The company said it sees no change in cost inflation after many periods of rising prices.

In recent years, Greggs has been focused on product innovation, and the results were evident in today’s update.

The firm’s over-ice drinks range, now available in 1,300 shops, is performing well following the introduction of two new flavours: Peach Iced Tea and Mint Lemonade. Pizza boxes continue to see strong demand, whilst the newly launched Mac and Cheese has gained viral popularity on TikTok.

The company’s made-to-order range, which includes chicken burgers, wraps and fish finger sandwiches, has now been rolled out to over 300 shops nationwide after an initial trial last year.

Shop Estate Expansion

Greggs remains active in expanding its retail footprint, opening 66 new shops during the period, including 15 with franchise partners and four new Drive-Thrus – one of which marks the company’s first in Northern Ireland, located in Craigavon.

The firm closed 46 shops in the same period, including 21 relocations, bringing its total estate to 2,638 shops as of 17 May. This comprises 2,077 company-managed shops and 561 franchised units.

Shop closures have been first-half weighted in 2025, but with a strong pipeline, Greggs maintains confidence in achieving its target of 140 to 150 net openings for the full year.

Supply Chain Development

Construction of Greggs’ new frozen product manufacturing and logistics facility in Derby, along with its National Distribution Centre in Kettering, is progressing “at pace”. The sites are expected to become operational in 2026 and 2027 respectively, in line with planned timescales and budget.

Outlook Unchanged

Despite delivering improved like-for-like sales in what it describes as “a challenging market context”, Greggs has maintained its full-year guidance. The company expects cost inflation to remain around 6% on a like-for-like basis.

The Board’s expectations for full-year outcomes remain unchanged, with the company noting that its plans for managing inflationary headwinds are “progressing well”.

Greggs shares were down 28% on the year before trading got underway today. The 6% jump in Greggs shares in early trade reflects price stabilisation and a softening in concerns that the price of a sausage roll and other baked goods were becoming too expensive for Greggs’ core customer base.

Cerillion optimistic about second half

AIM-quoted telecoms enterprise software provider Cerillion (LON:CER) had flagged a weaker first half and management remains positive about growth in full year revenues with a new contract helping to meet the target. The share price has still declined 7.6% to £16.95.

In the six months to March 2025, revenues dipped from £22.5m to £20.9m. The mix of revenues was different with lower software income due to fewer renewals and higher services revenues.

Pre-tax profit fell from £10.5m to £9.3m. R&D spending was increased. Net cash still improved from £26.6m to £31.2m over the 12-month period. The dividend has been raised by one-fifth to 4.8p/share.

The back order book was £50.2m at the end of March 2025 and that has already risen to £56.5m. That follows a £8m implementation services agreement, that will lead to a licence agreement. This follows an acquisition by an existing customer.

Panmure Liberum still forecasts growth in full year revenues from £43.8m to £49m, which would enable pre-tax profit from £19.8m to £20.4m. The shares are trading on 33 times prospective earnings. That reflects the strong track record and confidence that forecasts can be achieved.

FTSE 100 falls as US credit rating downgraded

The FTSE 100 fell with global equities on Monday after Moody’s cut the US credit rating to Aaa to Aa1, hitting investor sentiment and stopping a rip-roaring rally in global equities in its tracks.

Despite the downgrade having little real-world impact, with most other credit rating agencies already stripping the US of its ‘triple A’ ratings, the move has served as a reminder of the risks facing the global economy from Trump’s trade policies.

London’s leading index fell in early trade and was down 0.6%. US futures were pointing to a lower open, while most major European indices traded in negative territory.

News of an agreement between the UK and the EU to reduce trade frictions did little to boost interest in stocks on Monday.

“While largely a symbolic move, the US credit downgrade from Moody’s, as well as the progress of a bill in Washington promising major tax cuts, cast a pall over the markets at the start of the week,” says AJ Bell investment director Russ Mould.

“Having been floored by the announcement of Liberation Day tariffs last month, stocks got back on their feet remarkably quickly, but there is still enough to suggest some lasting grogginess.

“US-related stocks and investment trusts dominated the list of losers on Monday morning in London, while precious metals miners were higher as gold and silver prices moved up and the dollar weakened.”

Pershing Square Holdings, the US equity-focused FTSE 100 closed-ended fund, was the top faller following the US downgrade. Pershing Square’s top holdings include Alphabet, Chipotle, Nike and Uber.

The Scottish Mortgage Investment Trust, a vehicle heavily weighted towards US tech, was not far behind Pershing Square at the bottom of the leaderboard.

Fresnillo was the FTSE 100 top riser with a 1.7% gain. Gold miner Endeavour Mining only added 0.3%.

Diageo shares slipped despite sales increasing in its fiscal third quarter as the group announced the impact of tariffs on the business.

“The current tariff regime is expected to cost around $150mn annually,” said Aarin Chiekrie, equity analyst, Hargreaves Lansdown.

“Diageo expects to be able to offset around half of this through streamlining operations and will likely lean on price hikes to help offset the rest. But this will take a bit of time to enact. Alongside a soft first-half performance, full-year organic operating profits are expected to decline slightly.”

AIM movers: Bad drilling news from Pantheon Resources and third partnership for Arecor Therapeutics

Tanfield Group (LON: TAN) says the US courts have granted a motion for partial summary judgement in the dispute over Snorkel International, where Tanfield has a 49% stake that is the subject of a call option by the other shareholder. This summary judgement says that the 49% stake cannot be acquired for nil as the partner wanted to. The trial will begin in October. The share price jumped 19.1% to 4.24p.

Staff provider Staffline (LON: STAF) is continuing its rise following last week’s announcement that it has won a new contract with food and drink logistics provider Culina that could be worth £300m over three years. This is set to start generating revenues in the summer. There will be initial implementation costs in 2025. Panmure Liberum raised its 2025 pre-tax profit forecast from £5.3m to £6m. The 2026 estimate was increased from £5.7m to £8.3m. The share price is 12.6% higher at 36.6p, which is seven times prospective 2026 earnings.

Arecor Therapeutics (LON: AREC) is collaborating with obesity-focused Skye Bioscience on a formulation development. This involves the use of the Arestat platform will assess formulations of Skye’s CB1 inhibitor nimacimab. This will be funded by Skye, which has the option to licence the rights to the new formulation. This is the third partnership this year. The share price is 12.2% ahead at 46p.

Oriole Resources (LON: ORR) says results from drilling at the 90%-owned Mbe gold project in Cameroon have increased the total mineralised sections to 137, using a cut-off of 0.2g/tonne. There are some results with high grades from the latest hole. The fourteenth hole is being drilled, and the programme should complete in the third quarter. An independent consultant can then produce a JORC exploration target estimate. The share price rose to 0.231p, but it is currently up 1.9% to 0.214p.

FALLERS

Pantheon Resources (LON: PANR) says an initial unstimulated flow test from Megrez-1 in Alaska showed production dominated by water, which was consistent with the previous test in the area. Management will assess the data, but it currently says no recoverable oil resource should be associated with the Lower Prince Creek interval. The next test is on the Lower Sagavanirktok 3 horizon perforation, which is the best remaining candidate reservoir. Planning continues for early-stage development at Ahpun West. The share price dived 34.1% to 27.95p.

Cybersecurity software company Acuity RM (LON: ACRM) has raised £410,000 at 1p/share. This will finance sales and marketing, plus further product development. The share price declined 24.1% to 1.1p.

Digital advertising services provider Dianomi (LON: DNM) continues to be hit by the volatile advertising market going into 2025. Four-fifths of revenues come from the US. In 2024, revenues fell from £30.2m to £28m and there was a pre-tax profit of £300,000. Panmure Gordon expects revenues to continue to deteriorate in the second half. The 2025 revenues forecast has been cut from £31.1m to £27.5m and the 2026 figure has been reduced by a similar figure. This means that there are expected to be losses in 2025 and 2026. The share price slipped 11.8% to 30p.

Drug developer Immupharma (LON: IMM) reduced its loss from £2.9m to £2.5m after cutting R&D spending by two-fifths to £1.2m. The outflow from operating activities was £1.77m, which was partly covered by the sale of shares in Aquis-quoted Incanthera (LON: INC). There was £237,000 in cash at the end of 2024 and since then £2.91m was raised at 3.75p/share. The share price decreased 11.6% to 2.965p.

Why rules-based stock picking works (and how to build smarter rules)

In the first article of this series, we tackled the problems many investors face – story-driven speculation, tip chasing, and the trap of seeking more and more information which often brings overconfidence rather than better results.

One answer is using a rules-based approach, based around the characteristics of shares proven to identify winners. When you know that there’s a persistent payoff to buying the highest quality, value and momentum shares there can be a real mindset shift.

But for many, that’s where the journey stalls.

Because once you realise that rules matter, the next step is to create your first set.

Price to Earnings Ratio of less than 12? Tick. Return on Capital above 15%? Tick. Debt under control? Tick. You build a rational set of logic, and it feels good.

Until you hit a wall.

(NB – If you’re curious how to go from “first rules” to full portfolio strategy, join me for a live webinar on Thursday 22nd May at 5pm (BST) – details at the end of the article).

The problem with strict rules

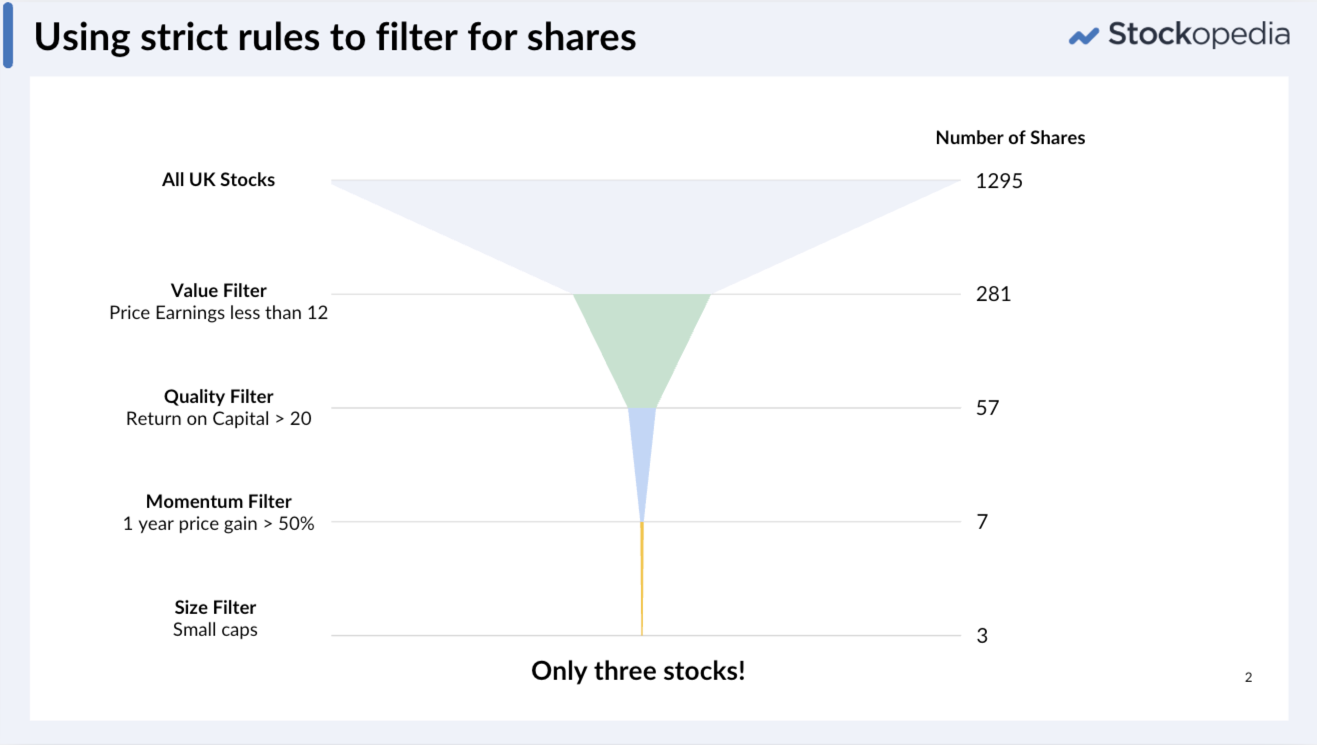

I still remember the buzz of creating my first stock screen. Stock screens are essentially checklists of rules that can narrow a universe of thousands of stocks down to a manageable list.

My first was based on Jim Slater’s criteria from his excellent Zulu Principle book. I had a whole list of “must have” criteria which would find me reasonably priced, quality growth shares. But how many candidates did the screen produce?

Just three. Two were rather small and illiquid and the third was some obscure foreign-listed firm. It was quite disappointing. And it certainly wasn’t an investable portfolio.

Checklists can be powerful – don’t underestimate them. They add discipline to your investing and help filter out the noise. But they be extremely restrictive.

If a stock has a P/E of 12.4 but you’ve screened for less than 12, should it really be cut out? Of course not. But a strict set of rules won’t catch it.

So what do you do?

You start raising all your cutoffs – you find a broader set – but something feels amiss. You know your cutoffs are keeping out some of the best candidates in the market.

From strict criteria to solid scoring

The breakthrough for me came when I stopped thinking so binary – in pass/fail terms – and came across the idea of scoring. It was Joel Greenblatt, in his excellent “The Little Book that Beats the Market”, that sowed the seed.

What if, instead of demanding that a company have a P/E of less than 12, you scored every stock in the market for how low the price earnings ratio was? And another for how profitable it was – using its “return on capital”.

Rather than just having a hard cutoff for “cheap” or “good” shares, you could create a gradient – with “cheap, highly profitable” stocks at one end, and “expensive, unprofitable” shares at the other.

It’s a fundamentally different approach. You’re no longer left with just a few stocks, you have a score for every stock in the market. And what’s even better, you can then compare any stock against any other.

Building your own DIY scores

You can do this even if you are a stock picker, looking at stocks on a case by case basis. You can build a set of solid rules, which can even include qualitative assessments like “how experienced and trustworthy is the management”, and grade stocks between zero and ten for each rule.

I know some of the best investors in the UK that do this. It does require judgement, but it removes a lot of bias from your investing process, and helps you avoid getting too sucked into a story.

But a more data-first approach allows you to compare all the stocks in the market.

If you like doing your own work, you can do this yourself – you will need access to a financial database to export some data. Some are free on the web, though you do have to be careful with data quality. But it’s really worth it.

Choose some key metrics across a few of the quality, value and momentum dimensions. For example as I’ve described you might choose the P/E ratio and the return on capital (a key profitability measure). Score each one as a percentage from zero to 100, where 100 is “best”.

Total the scores and rank again. You can then use this score to check your own stock ideas against. It’s not hard. And it works.

Check out the illustration in this spreadsheet.

It uses institutional quality data from Stockopedia’s database (correct at the time of publishing).

Take a look and see if you can find any of your shares within it – their scores might surprise you

While this is just a simple example, the benefit of this kind of gradient-based thinking is huge. It can add so much rigour to your process, but more than this – it really gets results.

Taking it further

Scoring the market for a couple of financial ratios isn’t really that robust.

Just scoring for “value” based on the P/E ratio can leave opportunities on the table – what about companies that are cheap relative to their company sales, but are just turning profitable? When their sales grow, they can see huge profit expansion.

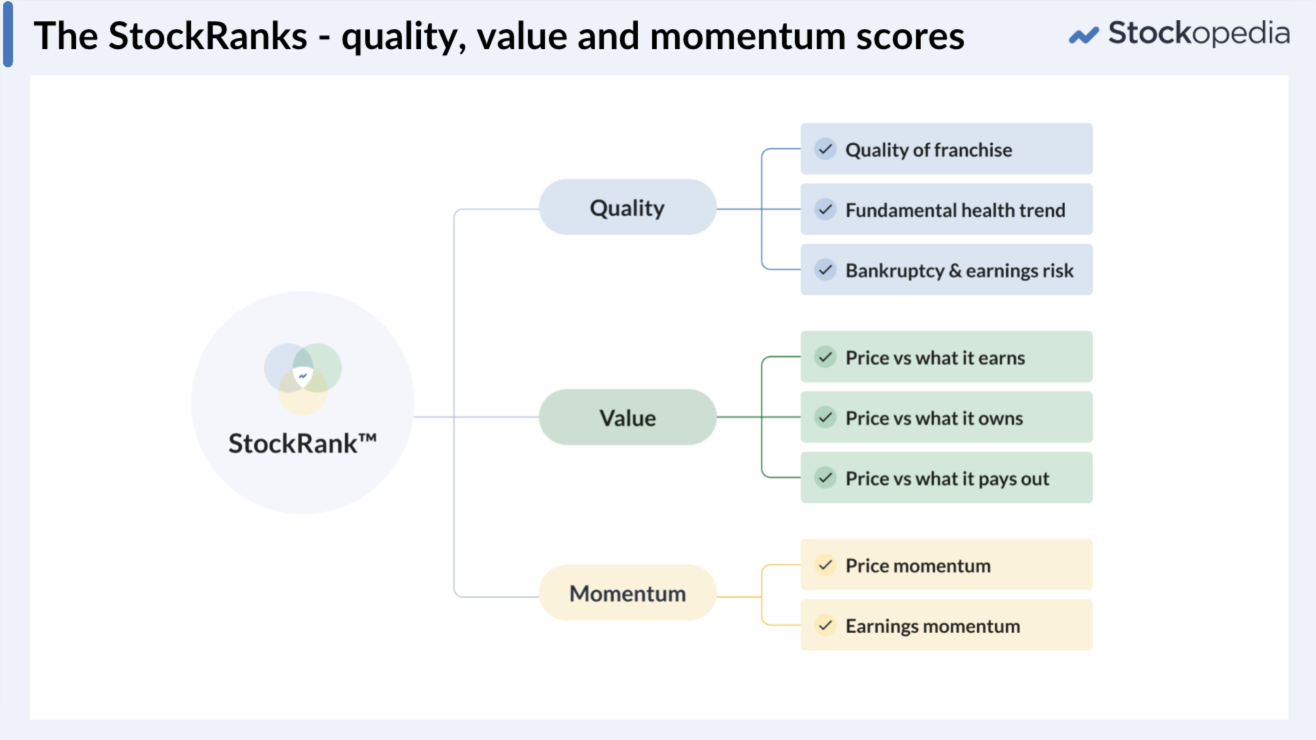

So at Stockopedia, we built a system that takes this further. Every stock gets a daily score – out of 100 – based on its Quality, Value, and Momentum profile – but each of these scores is built from a range of financial ratios, to give a more robust and rounded guide to their relative merit.

We call these measures the StockRanks and they have a terrific track record of finding stocks that perform.

Top ranked stocks through time have included many of the very best multibaggers in the UK market – stocks like Rolls Royce, Games Workshop, Jet2 and more – before they took off.

The top 10% of ranked shares – those in the 90+ range – have on average returned 11.9% annualised. And the lowest ranked 10%? Well more than 75% of them end up losers – with an average annualised return of -17%.

Now, this doesn’t mean every 90+ ranked stock is going to be a winner. Of course not. A good score is not a buy recommendation. Individual stocks do their own thing, profit warnings happen and markets go down as well as up. But across groups of stocks, over the longer term, the odds weigh in your favour. That’s what matters.

Learn to build a portfolio that captures the 90+ effect

Having a great scoring system helps you track down high potential stocks with a lot more ease and less emotional attachment. And because there’s no hard cutoff, you can always build a portfolio. But just taking the top 20 stocks is not a complete investment process.

Join us for a free, live webinar to dive deep into this subject on Thursday 22nd May at 5pm (BST):

“The Smarter Way to Build a Market Beating Share Portfolio”.

Registration is free, and if you can’t make the date you can catch the replay by registering here.

I’ll be covering a complete process. Not only to pick high potential stocks, but to construct a portfolio with both the diversification required to manage risk, and the discipline to consistently capture the returns. We’ll show how this process has delivered a portfolio that beat every fund manager in the UK over the last decade – which we’ll continue to discuss in our next article.

Diageo sales rise and guidance left unchanged despite tariff impact

Diageo shares rose in early trade on Monday before falling back after the drinks giant announced promising fiscal Q3 results that provided a welcome reprieve from warnings on slowing sales that dominated trading updates in recent periods.

Diageo’s organic net sales climbed 5.9% to $4.4 billion, driven by volume growth of 2.8% and positive price/mix of 3.1%, although reported net sales increased by just 2.9% due to unfavourable foreign exchange movements and recent disposals.

Management noted that favourable phasing contributed approximately 4% to the quarter’s organic net sales growth, primarily in North America. This timing advantage is expected to reverse in the fourth quarter.

All regions delivered positive price/mix except Asia Pacific, where continued consumer downtrading and adverse market mix negatively impacted performance.

Diageo has reiterated its full-year fiscal 2025 guidance for both organic net sales and operating profit. The company expects improvement in organic net sales growth in the second half compared to the first half of fiscal 2025, but it still sees operating profits falling as tariffs impact trading.

The company said the impact of tariffs is estimated at approximately $150 million on an annualised basis, assuming there are no increases from the current rates. Management expects to mitigate around half of this impact on operating profit, citing their “long track record of managing international tariffs”.

Investors will welcome Diageo’s assessment of the impact of tariffs, given that alcohol has been one of the main tariff battlegrounds in Donald Trump’s trade war.

Diageo’s launch of the first phase of its “Accelerate” programme to create a more agile operating model will also encourage investors. The group expects the programme to help deliver approximately $3 billion in free cash flow annually from fiscal 2026.

Diageo shares were 0.6% lower at the time of writing.

“Diageo managed to serve up solid growth in the first quarter, with sales benefiting from a good mix of both price and volume growth. Diageo has a world-class cocktail of brands, including Guinness, Smirnoff, Johnny Walker, and Tanqueray,” said Aarin Chiekrie, equity analyst, Hargreaves Lansdown.

“These powerhouse brands have helped all regions manage to squeeze through price hikes except Asia Pacific, which continued to see consumers downtrading to cheaper brands, which weighed on sales.”

The current tariff regime is expected to cost around $150mn annually. Diageo expects to be able to offset around half of this through streamlining operations and will likely lean on price hikes to help offset the rest. But this will take a bit of time to enact. Alongside a soft first-half performance, full-year organic operating profits are expected to decline slightly. Zooming out, the picture is starting to look a touch better than it has for some time. Sales to China are largely unaffected by tariffs, Latin America and the Caribbean are lapping some weak comparable figures, and there are early signs that the industry is recovering from its cyclical hangover.”