AIM is set to outperform the All Share for remainder of CY2025

- The perfect storm that hit London’s AIM following peak-Pandemic in Q2 2021, has seen the index tumble by an extraordinary 60% relative to the FTSE All Share leaving it trading almost 40% below its 10-year average.

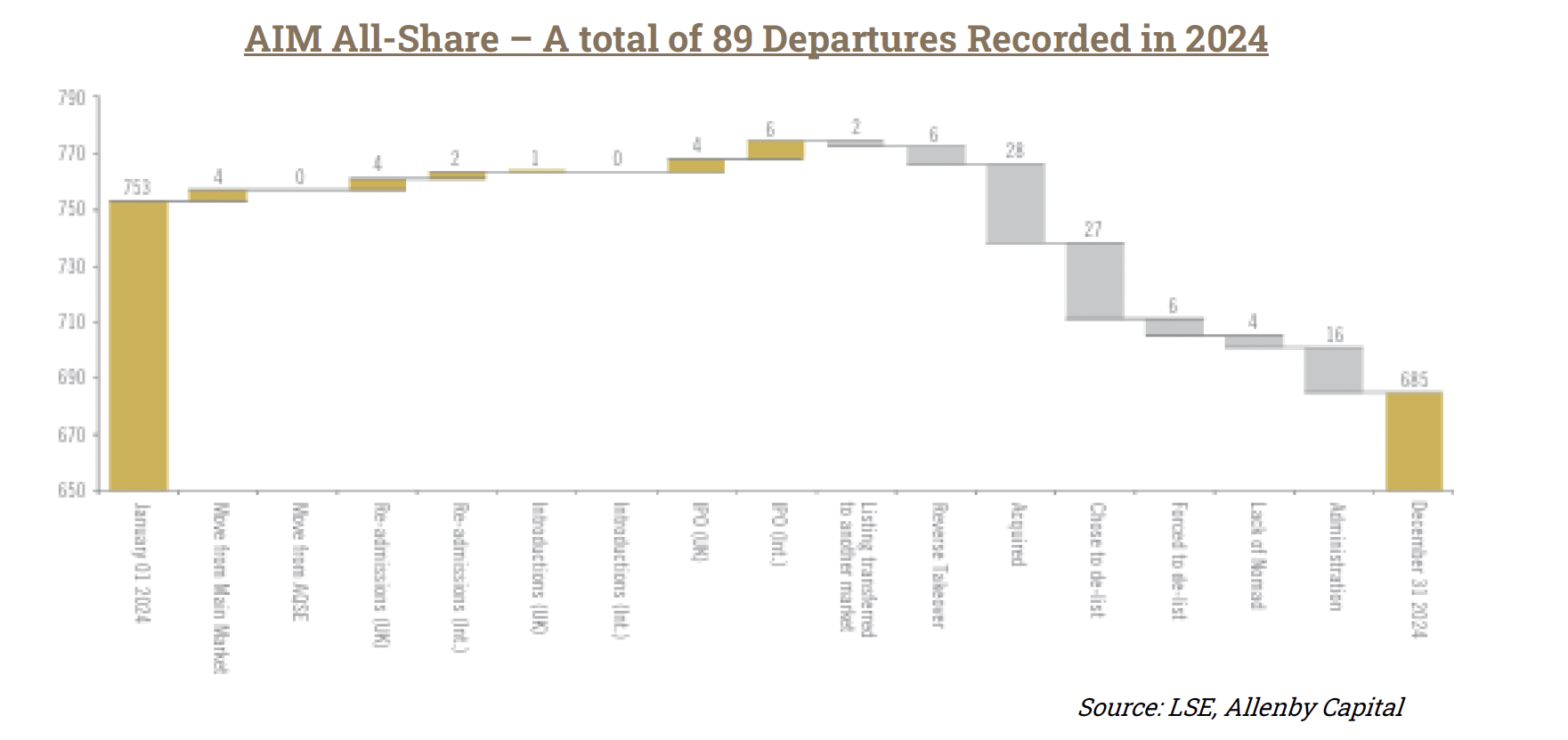

- Total listings have thinned down to just over one-third of the number that was achieved back in 2007, due primarily to the index’s highly innovative, but cash-hungry constituents routinely finding themselves unable to secure the funding necessary to create value through fulfilment of their business plans.

- The recent dearth of IPOs now leaves a surviving rump of much better positioned, higher quality businesses led by experienced management that have continued to progress their unique opportunities which are often supported by key assets and/or global IP.

- The extent of the market’s perceived undervaluation has been highlighted by one key market player suggesting that as many as one-third of <£250m value AIM companies are now vulnerable to hostile bids.

- The 41 consecutive months of UK-focused equity fund outflows that followed Brexit have been one of the principal drivers of AIM delistings. This now appears to be slowing sharply and, with the recent halving of the inheritance tax exemption also having been priced in, focus is likely to return to the index’s cost of capital, which is widely expected to track a series of UK base rate cuts downward between now and the year end.

- As part of its ‘Plan for Growth’, the Labour party is also said to be considering UK pension and ISA reform as a route to unlocking significant new investment in domestic growth businesses. The suggestion a set proportion of this will be directed specifically to unlisted securities offers scope to significantly reinvigorate the AIM index.

- Contrasting with the FTSE100, AIM has almost negligible direct exposure to Trump Tariffs. Yet it and the wider UK market will clearly benefit from more competitive pricing from China as production originally destined for the US gets redirected, along with potential to exploit trans-shipment trade opportunities resulting from the country’s relatively low 10% imposition and its position amongst the most advanced nations in terms negotiating a US free trade deal.

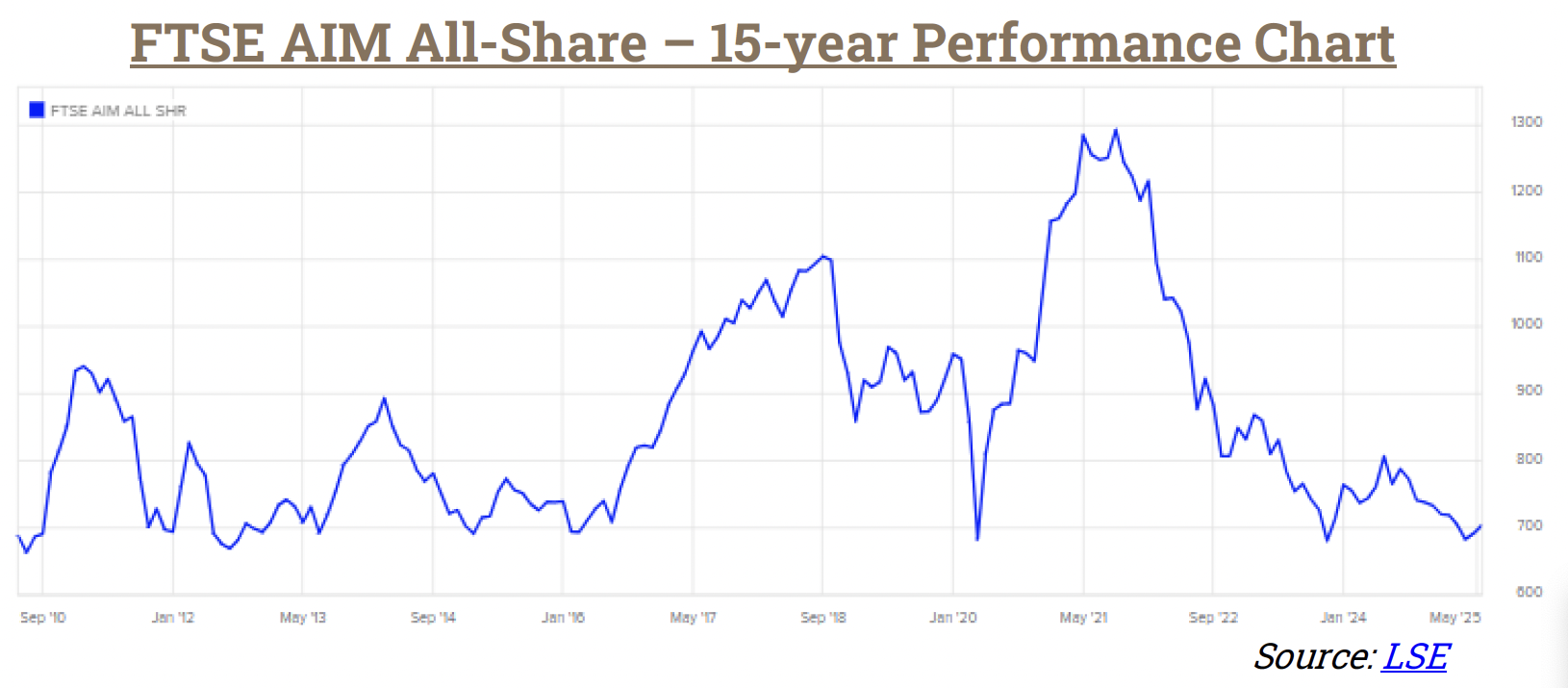

- Chartists will also be interested in the fact that the AIM All-Share has rebounded decisively no less than nine times from its current level (±3.0%) over the past 15 years, as can be seen in the long-term chart below:

FTSE AIM All-Share Data

Index Level: 709.22

Net Market Cap: £41,301m

No of Constituents: 586

52 week high/low: 810.02/624.42

1-year Return: -7.13%

Constituent Sizes and Yield

Ave. Market Cap: £70.48m

Largest Mk Cap: £3,587.50m

Smallest Mk Cap: <£1m

Index Yield: 1.21%

Trump’s perspective for his second 100 days – Respite for global equity and bond markets

- The current 90-day tariff pause may well be extended beyond 8 July as intense negotiations continue

- Adoption of a flexible, country-by-county approach offers possible route to limit net economic damage

- US’s softening stance on China is key and could result in major concessions/agreements from both sides

- Trump’s team looks to strike as many as 90 trade deals during the present 90-day pause with more to follow

- Notwithstanding the above, anyone brave enough to tackle their country’s economic woes head-on in such an unorthodox manner will of course face significant risk from their political rivals – just ask Liz Truss!

The jury is still out in terms of what exactly President Trump truly expected his ‘Liberation Day’ to ultimately deliver. Face on he was blatantly forcing the US’s trading partners to his door as part of a ‘shock horror’ tactic to put himself firmly in the driving seat, kick off a reset in the way the global economy is run and provide a credible route to regain control of his nation’s spiralling deficit. The reasoning is simple enough. Decades of ineffectual tinkering by past presidents have seen the US’s national debt rise unsustainably (now >US$36 trillion) and the call was clearly out there for someone with ‘big enough shoulders’ to take the situation in hand.

But having promised Americans a “boom like no other” if he was elected president for a second time, Trump was certainly not handed a mandate to upend the US economy, become a world pariah and threaten domestic standards of living. On one hand, it might be possible to believe Trump was simply bamboozled by the White House’s sums pointedly failing to recognise the true price (in terms of faltering domestic growth, spiralling inflation, an exodus of international investment, reduced consumer choice etc.) that would need to be paid by the US electorate. On the other, numerous retreats/concessions/olive branches effected or offered rapidly after declaring his hand (incl. the 90-day tariff pause, numerous exemptions such as smartphones, pharma etc. and a 2-year tariff offset on auto parts, while reaching out for discussions with China etc.) along with a declared ambition to strike as many as 90 trade deals (with India, Japan and South Korea looking likely to be the first) during the current 90-day tariff pause, suggests the true gameplan may always have been to adopt widespread negotiated policy flexibility. Trump possibly never expected to actually receive what his team’s apparent tariff algorithm originally set out, but at the very least believe it will enable him to eventually conclude a long list of country-by-country agreements predicated on formal, longer-term understandings regarding their future investment in and prospective trade balances with the US.

While Liberation Day will undoubtedly leave the global economy with some residual damage, the successful conclusion of such negotiations could potentially limit the net domestic/international impact, while placing the US on a more sustainable long-term footing and endorsing its role as the world’s sole superpower. His stance is most definitely courageous and will take some years to play out. So, the question could instead be, does he really have that long? There are very few brave enough to challenge him head-on over his running of his economy, but his team are already said to be preparing for an impeachment fight in case the Democrats take control of the House in 2026. Liz Truss, who very briefly assumed the UK’s premiership in 2022, would of course be the first to testify that those taking such giant economic steps (or gambles?) on anything but a highly measured and carefully negotiated basis involving all stakeholders along the way, can find themselves on a very short fuse.

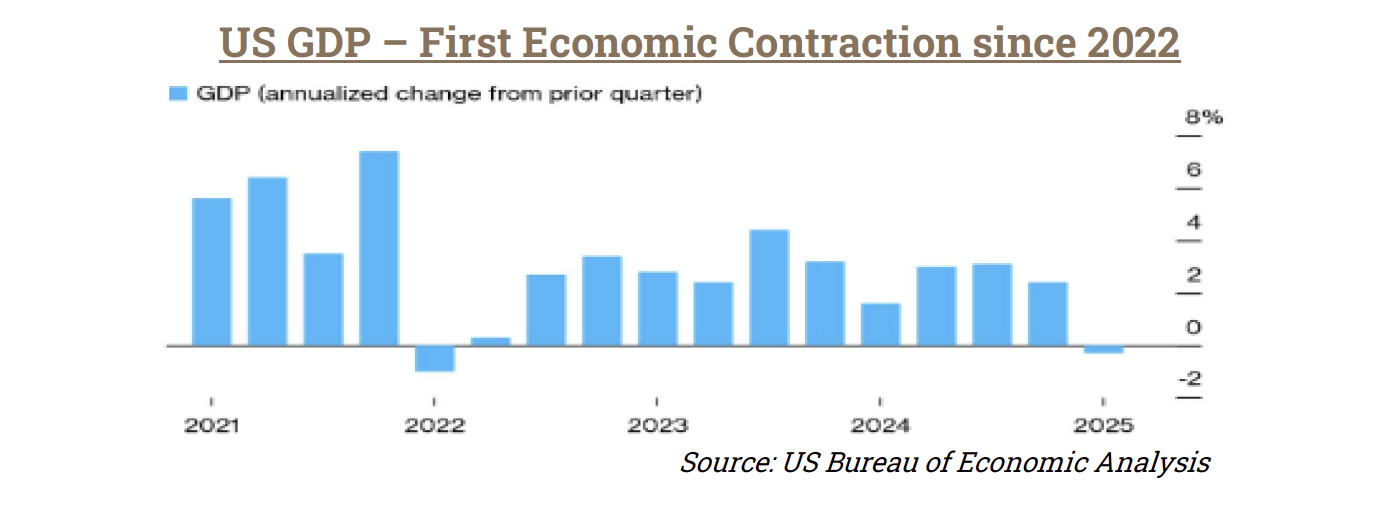

Marking his 100th day in office at a rally in Michigan on 29th April, Trump declared he had “… delivered the most profound change in Washington in 100 years” and that he had “just gotten started.” But having promised Americans a “boom like no other” if they elected him president, the 78-year-old Republican’s performance for consumers, companies, the economy and workers, is now clearly much less celebratory. For someone who feeds foremost on public adoration, the flipping of his approval rating from positive to negative since his inauguration must be leaving its mark. The majority of Americans are voicing concern about a recession and how a trade war will affect the economy/employment, the value of their savings after the S&P500 briefly entered ‘bear market’ territory earlier last month and the rising price of goods amid a tumbling US$. Driving this home the same day, Conference Board data confirmed that April’s consumer confidence had fallen to an almost five-year low, followed one day later by the Commerce Department estimating US economy (GDP) had suffered its worst quarter since Covid, contracting 0.3%in the first three months of 2025 (Q4 2024: +2.4%). While this may reflect a surge of imports from US firms seeking to front-run the tariff impositions, the fact that initially defiant trade responses were registered all around the world (particularly from the main battleground, China) and the fact that trade resolutions are likely to take much longer to negotiate than Trump wishes, means that the situation should be expected to get quite a lot worse (including an inflationary spike) before things start to stabilise.

The relative resilience of global market indices following an initial shock reaction, however, reflects foremost a growing belief among traders that the worst may be over following the chaotic rollout on 2 April. Recognising that he is standing on a cliff-edge, Trump’s second hundred days will almost certainly see him move from the offensive to the accommodative when dealing with international trading partners. For the most part they are already forming a long orderly queue outside his door, ready to show willing with packages of carefully crafted proposals. The wild card of course is China and many, particularly amongst other Asian economies, will choose to follow its lead in any discussions. The fact that China has signalled willingness to talk so soon after the US’s outreach through multiple channels, suggests comprehensive exchanges will get underway shortly. International markets will heave a huge sigh of relief once this becomes apparent. The risk for anything else is simply too big; both are aware of the prospective damage a long-term standoff between the world’s two largest economies would have to their future prosperity and that the wounds would be largely self-inflicted.

So, the second 100 days is look set to be the President’s most dangerous period. Warning signals are coming from all corners. The near-term economic impact his policies on the US’s domestic economy and national well-being is likely to painted large for all to see. Trump’s ongoing feud with Jerome Powell suggests the Fed is unlikely to run to his rescue, first seeking to gauge the effects the existing base and proposed tariffs will have on consumer prices and the US$ before responding to the slowing economy. Tumbling popularity in the opinion polls will compound issues still further, with potential to culminate in a second major sell-off of equity and bond markets. This leaves the President pedalling furiously uphill as he looks for agreement across multiple counties/territories, that reduce or eliminate the tariffs altogether (his team have already indicated their aim to strike 90 trade deals during the present 90-day pause), in exchange for negotiated future direct US investment, job creation and prospective trade balance reductions on a sliding scale. There appears to be a few already willing to comply with such demands and their early delivery will likely be highly trumpeted as a successful new framework for dealing with the US. The problem of course is that the list is very long and individual negotiations are likely to become extended, particularly with China. 8 July is the date on which the 90-day tariff pause is due to end. It seems a reasonable guess that it will need to be extended several times in order to get a reasonable quorum onboard. In the meantime of course, the baseline 10% tariff remains in place.

AIM – Now quite dramatically oversold with liquidity gradually improving

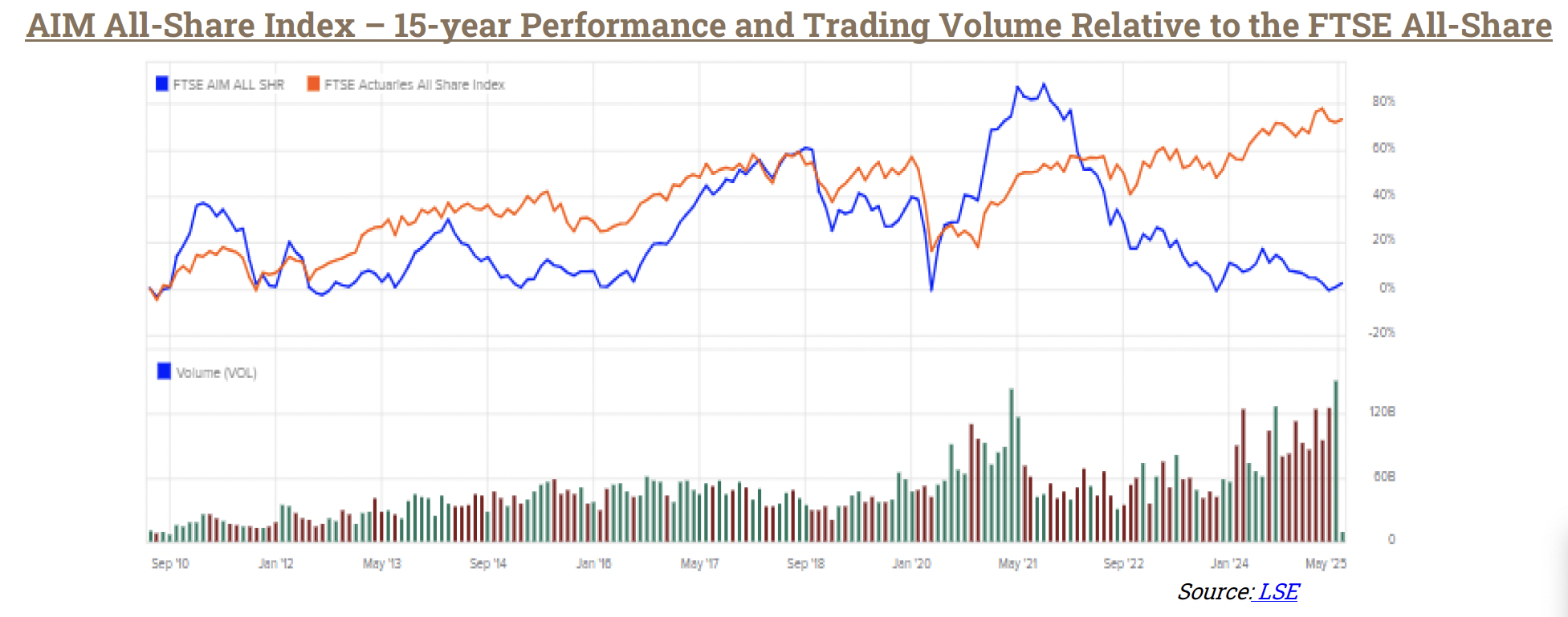

In terms of relative valuations, a chart highlighting AIM’s 15-year performance against the FTSE All-Share paints a stark recent picture:

The perfect storm that hit the index after the Pandemic peaked in Q2 2021 has seen it tumble by an extraordinary 60% relative to the FTSE All Share, leaving it trading almost 40% below its 10-year average. Significantly, however, liquidity has gradually started to improve as weaker participants have been forced out and the average market cap/free float rises.

Since 2010, the index has passed through five phases of quite dramatic relative outperformance as value in its constituent’s ability to create significant value through innovation has been recognised. The Pandemic is one such example. AIM is home to a number of highly specialised life science companies that are developing unique solutions for global problems; they demonstrated capability to rapidly refocus their expertise in the search for therapeutics and related products (including vaccines, anti-virals, diagnostics etc.) as part of the international fight against the coronavirus disease (COVID-19). From the global condition first being formally recognised in March 2020, to UK peak mortality (Delta variant) in April 2021, the sector was one of the principal drivers behind the index’s c.90% rerating.

Subsequently, however, the index has been hit with a perfect storm. As the public health emergency began to pass in Q3 2021, AIM experienced a generalised sell-off of companies that had been significantly chased up during the crisis. Almost coincident with this Brexit spurred a medium-term sell-off of UK-focussed equity funds, resulting in 42 consecutive months of outflows which were, of course, often focussed on the markets’ less liquid participants. This particularly drained AIM investment, resulting in an extended run of delistings amongst its weaker, cash-starved constituents which continues today.

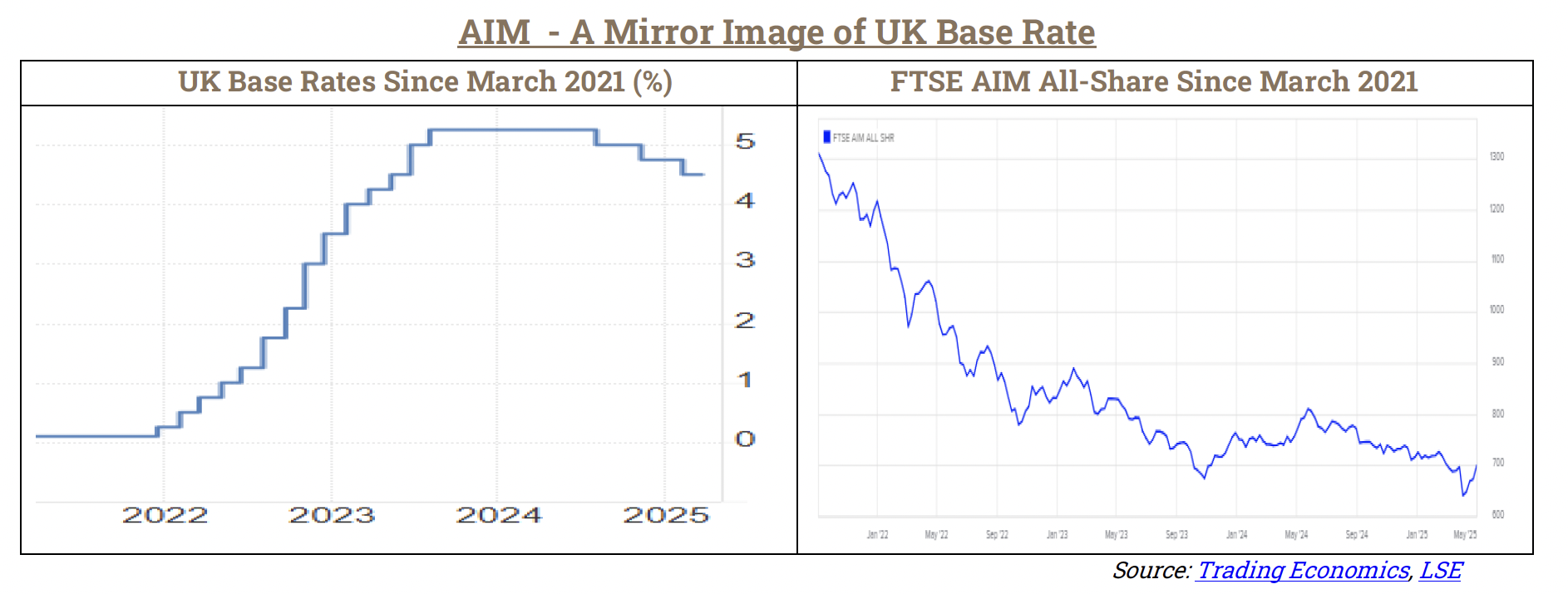

As the charts below demonstrate, the cost of capital required to fund growth amongst these young, often pre-revenue, cash-consuming enterprises is also key to their continuing prosperity. Having enjoyed more than five years of exceptionally low base rates (range 0.1% to 0.75%), the post-COVID inflationary spiral that saw UK annualised CPI spike from just 0.7% in March 2021 to a 41-year high of 11.1% by October 2022, resulted in no less than 14 base rate hikes between December 2021 and August 2023. To make things worse, the index’s dilemma was then capped in the Chancellor’s Autumn Budget 2024, with a halving of the effective inheritance tax relief on AIM shares (effective from April 2026) despite the longer-term investment support that it was known to provided. This in turn contributed to a number of its traditional investors and dedicated small/microcap funds being forced to exit, with their sell-down helping to produce a quite extraordinary valuation gap in the process.

The situation, however, appears to have passed its worst and AIM now offers potential for a sharp rebound relative to the UK’s principal indices over the remainder of 2025.

Firstly, it’s important to note that the pace of UK fund redemptions slowed towards the end of 2024, with December recording the lowest level of outflows in several years. UK equity funds specifically experienced just a £1.4 billion outflow in February 2025, easing from £1.7 billion in January, according to The Investment Association. This change appears to be partly due to the FTSE 100’s obvious valuation discount relative to Europe and the US (price-to-earnings ratios of 11x vs. 13x and 21x resp.) and partly due to the Brexit-inspired sell-off finally starting to tail off. Indeed, the recent fund outflow from the US that immediately following last month’s Liberation Day announcement is seen generating net UK inflows in the coming months, as international investors look to park their cash in relatively safer, undervalued, more traditional income generating investments and away from premium-priced growth/tech stocks that will remain vulnerable until the global situation can be clarified.

UK Base rates are also headed downward. Back in January Morgan Stanley, for example, forecasts no fewer than five cuts (of 25bp each and one of which has already been delivered) in 2025. Clearly this could accelerate faster still if Trump tariff’s result in the sharp near-term contraction across the major western economies that is now widely projected.

Having already seen the index price in next year’s reduction in inheritance tax relief, there now appears to be

more positive signals coming from HM Government. It appears to recognise that further weakening or sidelining of AIM would be an effective admission that Britain is not interested in supporting entrepreneurs, start-ups and growth businesses. While vague threats to Enterprise Investment Scheme (‘EIS’), Venture Capital Trusts (‘VCTs’), Entrepreneurs’ Relief etc., appear to have dissipated, different means for more direct for incentivisation are being sought. Various routes to drive willingness to take risk are being considered, including UK pension and ISA reforms that could potentially unlock billions of liquidity for such assets. Talks of replicating the so-called ‘Canadian’ model of pension ‘mega-funds’, which would merge the UK’s 86 local authority pension schemes, is one idea. The so-called Mansion House Compact, which was signed by 11 of the country’s large pension providers in 2023, also commits them to a target of investing 5% of their pension fund assets into unlisted equities by 2030. The eventual timing of such any such moves of course remains uncertain and care has to be taken not to overwhelm a junior market that has shrunk quite dramatically in recent years. Nevertheless, early indication of moves in this direction could significantly reinvigorate AIM, creating a rush of new IPOs in the process.

With the total count of AIM All-Share constituents now down to just 586, a little over one-third of the 1694 achieved at the index’s peak, the recent dearth of IPOs leaves the ‘surviving’ constituents with far more experienced management who continue to progress opportunities that are often backed by key assets and unique, global IP. The value this has to potentially introduce for larger, cash-rich acquisitive enterprises was highlighted by UK investment bank, Peel Hunt, at the end of last year when its head of M&A anticipated a ‘wave of demand’ from private equity and foreign buyers looking to take-out small and mid-cap UK stocks. It considered up to one-third of sub-£250m market cap firms quoted on of London’s junior stock market to be vulnerable to a takeover in 2025 in a “major and sustained” deluge. Of the 28 takeovers concluded in 2024 (vs. 22 in 2023), the average bid premium when compared to the prior day’s close was +66% (median +50%) with a range of -63% to +252%.

THIS DOCUMENT IS NOT FOR PUBLICATION, DISTRIBUTION OR TRANSMISSION INTO THE UNITED STATES OF AMERICA, JAPAN, CANADA OR AUSTRALIA.

Conflicts

This is a non-independent marketing communication under the rules of the Financial Conduct Authority (“FCA”). The analyst who has prepared this report is aware that Turner Pope Investments (TPI) Limited (“TPI”) has a relationship with the company covered in this report. Accordingly, the report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing by TPI or its clients ahead of the dissemination of investment research.

TPI manages its conflicts in accordance with its conflict management policy. For example, TPI may provide services (including corporate finance advice) where the flow of information is restricted by a Chinese wall. Accordingly, information may be available to TPI that is not reflected in this document. TPI may have acted upon or used research recommendations before they have been published.

Risk Warnings

Retail clients (as defined by the rules of the FCA) must not rely on this document.

Any opinions expressed in this document are those of TPIs research analyst. Any forecast or valuation given in this document is the theoretical result of a study of a range of possible outcomes and is not a forecast of a likely outcome or share price.

The value of securities, particularly those of smaller companies, can fall as well as rise and may be subject to large and sudden swings. In addition, the level of marketability of smaller company securities may result in significant trading spreads and sometimes may lead to difficulties in opening and/or closing positions. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results.

AIM is a market designed primarily for emerging or smaller companies and the rules of this market are less demanding than those of the Official List of the UK Listing Authority; consequently, AIM investments may not be suitable for some investors. Liquidity may be lower and hence some investments may be harder to realise.

Specific disclaimers

This document has been produced by TPI independently. Opinions and estimates in this document are entirely those of TPI as part of its internal research activity. TPI has no authority whatsoever to make any representation or warranty on behalf of any of the markets or indices mentioned in this report

General disclaimers

This document, which presents the views of TPIs research analyst, cannot be regarded as “investment research” in accordance with the FCA definition. The contents are based upon sources of information believed to be reliable but no warranty or representation, express or implied, is given as to their accuracy or completeness. Any opinion reflects TPIs judgement at the date of publication and neither TPI nor any of its directors or employees accepts any responsibility in respect of the information or recommendations contained herein which, moreover, are subject to change without notice. Any forecast or valuation given in this document is the theoretical result of a study of a range of possible outcomes and is not a forecast of a likely outcome or share price. TPI does not undertake to provide updates to any opinions or views expressed in this document. TPI accepts no liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document (except in respect of wilful default and to the extent that any such liability cannot be excluded by applicable law).

The information in this document is published solely for information purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. The material contained in the document is general information intended for recipients who understand the risks associated with equity investment in smaller companies. It does not constitute a personal recommendation as defined by the FCA or take into account the particular investment objectives, financial situation or needs of individual investors nor provide any indication as to whether an investment, a course of action or the associated risks are suitable for the recipient.

This document is approved and issued by TPI for publication only to UK persons who are authorised persons under the Financial Services and Markets Act 2000 and to professional clients, as defined by Directive 2004/39/EC as set out in the rules of the Financial Conduct Authority. This document may not be published, distributed or transmitted to persons in the United States of America, Japan, Canada or Australia. This document may not be copied or reproduced or re-distributed to any other person or organisation, in whole or in part, without TPIs prior written consent.

Copyright © 2025 Turner Pope Investments (TPI) Limited, all rights reserved.