AIM-quoted Fulcrum Metals (LON: FMET) was on of the top 20 stock picks for 2025. Strong progress has been made, but the share price has slipped over the first quarter. The latest announcement brings the signing of a master licence for technology developed by Extrakt much nearer.

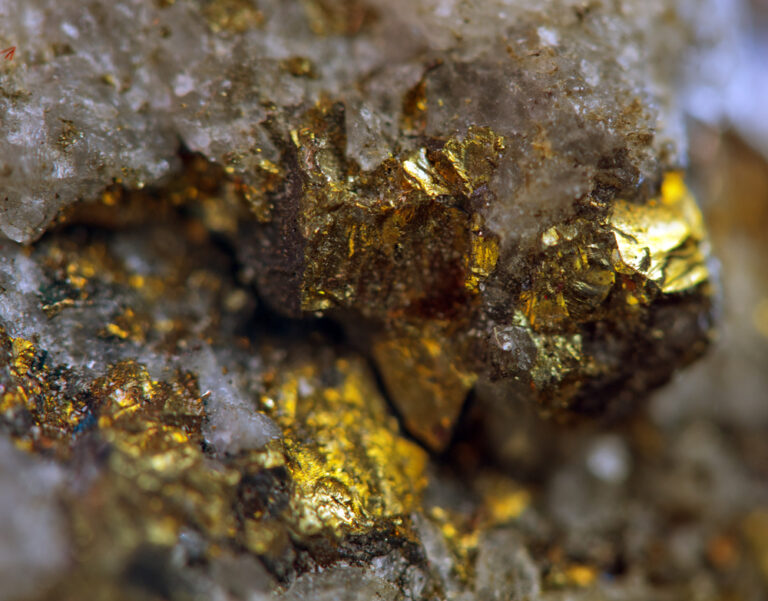

There are plenty of sites in Canada where the technology can be used to process the tailings and improve the environment. On a non-optimised basis, gold recoveries from the Teck-Hughes tailings were 59.4%. Management believes that this figure can go above 70% when the operations are optimised.

The proof of concept NPV7.5% was $33m based on a nine year operational life. Optimisation could raise this to $75.5m. That is before any licence royalties.

There are also ways that the costs of the processing can be reduced. There is also potential to extract other minerals.

Specialist mining technology developer Extrakt uses separation technology to extract metals from tailings without the use of cyanide. Fulcrum Metals is on the verge of negotiating a master licence for exclusive use of the technology for historic gold waste.

The authorities are keen on reducing environmental problems and permits could be fast-tracked.

Fulcrum Metals has limited financial resources, but once it has the exclusive licence it can exploit the technology in a number of ways. For example, it can do deals with miners in the region who want to avoid environmental liabilities. There could be joint ventures or deals to process waste through a hub operation.

The share price has fallen from 7.75p to 6.5p so far this year. Last autumn, £863,000 was raised at 8p/share. This means that there is enough cash to carry out the additional testing.

Once optimisation is achieved there will be a pre-feasibility study assessment.

Once the master licence is signed this should provide positive impetus for the share price, as will further optimisation news.