UK manufacturing faces worst month in five years

April saw worst month for UK manufacturing in over five years, with a 1.4 percent fall in factory production.

According to the Office for National Statistics (ONS), April was the steepest fall since October 2012 and marked the third consecutive fall.

“Manufacturing fell in the three months to April with electrical machinery and steel for infrastructure projects seeing reduced production,” said Rob Kent-Smith, the ONS’ head of national accounts.

“International demand continued to slow and the domestic market remained subdued. However, oil and gas production grew strongly in the aftermath of the Forties pipeline closure at the end of last year.”

The poor results led to the fall in the pound, which slipped 0.35 percent against the dollar to $1.3368.

Construction was also weaker than expected for April and grew just 2.3 percent in May.

Suren Thiru of the British Chambers of Commerce said: “It is possible that the UK is now moving past the recent sweet spot for exporters, with growth in key markets moderating and the impact of the post-EU referendum slump in sterling, which has helped some exporters, subsiding. The possibility of an escalating trade war has added to the downside risks for exporters.”

GDP growth in the first quarter of the year slumped to 0.1 percent. The Bank of England held off from increasing interest rates in May and remains optimistic for positive results.

“The very poor set of April industrial production, construction output and trade data can only fuel Bank of England concerns and uncertainties over the economy and there can be no doubt that the [Bank’s Monetary Policy Committee] will leave interest rates unchanged at their June meeting next week,” said Howard Archer of the EY Item Club.

“The data also make an August interest rate hike by the Bank of England look a lot more questionable,” he added.

The UK trade deficit was also seen to increase to £5.3 billion in April. This is the largest amount since September 2016.

Amazon commits to post-Brexit Britain with plans to create 2,500 jobs

Amazon (NASDAQ: AMZN) has committed to UK expansion, despite uncertainty surrounding Brexit.

The retail giant has said it will create over 2,500 jobs in the UK this year including 650 head office roles.

Doug Gurr, the company’s UK and Ireland boss, said: “The UK is a fantastic place to do business.”

“We are trying to make sure all the businesses that work with us can continue to operate effectively … We don’t yet know exactly what the rules [on trading after Brexit] are going to be. We will wait and see what happens and adapt as necessary,” he added.

The group employed about 24,000 at the end of last year but hopes to increase this number to 27,500 by the end of 2018.

Building several new warehouses in the UK, the group hopes to employ experts in speech science and machine learning in order to develop its smart speakers and the Alexa personal assistant.

Amazon has invested £9.3 billion in the UK since 2010 and has created thousands of jobs. This is unlike retailers including Tesco (LON: TSCO) and Sainsbury’s (LON: SBRY), which have both cut thousands of jobs this year amid the Brexit uncertainty.

CEO Jamie Dimon of JP Morgan (LON: JMC) said that the group may cut over 4,000 jobs in the UK if a suitable Brexit deal isn’t reached.

Amazon is currently facing legal dispute over employment rights of delivery drivers. The group has also been criticised over the conditions for workers in warehouses.

Gurr has said he is “proud of working conditions across all parts of our business” and said the group runs public tours of warehouses and the public are able to see the facilities for themselves.

The Amazon boss has not commented on whether the group plan to buy Waitrose (LON: JLH) in order to expand the business.

LSE confirms rule change to allow Aramco listing

The London Stock Exchange has been accused of bending corporate governance rules in order to attract the huge Saudi Aramco listing, allowing the group to float 5 percent of the company instead of the 25 percent usually asked for.

Both London and New York have been competing to nab the listing, which could bu the largest in history. For London, it would underscore its reputation as a centre of global finance despite the uncertainty of Brexit.

In order to do so, the LSE has relaxed its requirements for admittance onto the stock exchange, with the FCA confirming that a new category will allow a smaller float for sovereign-controlled companies. Saudi Aramco is Saudi Arabia’s state-owned oil company.

However, the Institute of Directors criticised the decision, saying it would put the “UK’s global reputation as a leader in good governance” at risk. It added that it was “deeply disappointed”, and would lead to “a reduction in standards”.

Aramco has still not confirmed where it will float its shares, or even if it will do so at all.

Distil shares up 13pc as taste for premium gin continues

Drinks brand owner Distil (LON:DIS) saw shares rise over 13 percent on Friday morning, after reporting a jump in both profits and turnover.

The brand, who own Blavod Black Vodka, Blackwoods Vintage Gin and RedLeg Spiced Rum, saw operating profit jump to £0.16 million in the year to end of March, up from £0.01m the previous year. Turnover jumped 23 percent to £1.2 million, with margins unchanged at 58 percent.

“We are pleased to have delivered a strong set of results with significant growth in volumes, revenue and profits, supported by investment in our brands,” said Executive Chairman Don Goulding.

“We look forward to building on this success though further investment in our key brands in the coming year.”

Net operating cash inflow rose to £1.03 million, from £0.91 million the previous the year. Growth was driven largely by strong performances from Distil’s RedLeg spiced rum and Blackwoods Vintage gin, after launching new packaging for the Blackwoods 2017 Vintage gin in the final quarter of the year.

Shares in Distil are currently trading up 13.64 percent at 2.50 (1107GMT).

TSB board gives Paul Pester full support, despite calls for resignation

MPs have pushed for TSB chief executive Paul Pester to quit over his handling of the bank’s recent IT meltdown.

Earlier this week the Treasury select committee advised the bank’s board to give“serious consideration as to whether his position was sustainable”, adding that his comments at the time had been “complacent and misleading”.

The comments were made in a letter from Nicky Morgan, the committee’s chair, to TSB chair Richard Meddings. However, the bank’s board said Pester had their complete support, despite consistent calls for him to step down.

TSB suffered a major IT meltdown six weeks ago, with some customers still facing disruption. Fraudsters also took advantage of the problems, stealing money from teh accounts of 1300 customers.

In her letter, Nicky Morgan said: “This tone has been set from the top – by Paul Pester – and whether intentionally or not he has not been straight with the committee and TSB customers. Dr Pester’s statements that “everything is running smoothly for the vast majority of our … customers” and that “there will be no barriers” to customers switching accounts, and his denial that there were problems on TSB’s fraud reporting line, are all examples of this.

“The Treasury committee, therefore, has lost confidence in Dr Pester’s position as chief executive of TSB, and considers that the TSB board should give serious consideration as to whether his position is sustainable.”

The bank’s response underlined their confidence in Pester’s leadership, saying that the improvements had been made “under the leadership of Paul Pester, who continues to have the full support of the TSB board.”

Patagonia Gold shares edge up on output figures

Patagonia Gold (LON:PGD) shares moved up in early trading on Friday, after releasing output figures for its Cap Oeste operation in Argentina.

Cap Oeste is Patagonia Gold’s only producing asset and the group released no comparative figures. In the first quarter the mine produced 10,662 ounces of gold equivalent, with the average cash cost of production coming in at $693 per ounce, or $756 per ounce including depreciation and amortisation.

“The team at Cap Oeste continue with efforts to optimise the production process, while the installation of the new crushing circuit to reprocess the material already stacked on the leach pad is completed,” the company said.

“The production guidance for the year is currently being reviewed and the market will be updated once this exercise is complete”.

Patagonia Gold said it was using the proceeds from gold sales from Cap Oeste to complete the payment of the new crushing circuit, as well as reducing its net debt position.

Shares in Patagonia Gold are currently up 0.86 percent at 117.50 (0946GMT).

Fuller Smith & Turner shares drop on weak beer sales

Fuller Smith & Turner (LON:FSTA) saw shares sink nearly 3 percent in early trading on Friday, after flat sales in beer and cider pointed to uncertainty in the future.

The group reported a strong set of results despite the flat sales, with profit before tax increasing by 9 percent in the year to the end of March to £43.6 million. Revenue grew 5 percent to £403.6 million, despite the “challenging” market.

“While we are still in a time of national and global uncertainty – and we do not underestimate the related wider market and economic issues that we will have to navigate over the months ahead – we believe we are in a strong position,” said Chief Executive Simon Emeny.

Like-for-like sales in the the managed pubs & hotels division performed better, up 2.9 percent for the period, while like-for-like profit in the Tenanted Inns division rose 3 percent. Adjusted profit before tax rose 3 percent to £43.2 million, from £42.1 million.

Shares in Fuller, Smith & Turner are currently trading down 2.89 percent at 942.00 (0930GMT).

European markets down ahead of G7 meeting

The FTSE 100 opened down on Friday morning, with nearly every share trading down an hour after market open.

The FTSE is currently down 0.74 percent at 7,647.73, with the DAX also down 1.27 percent. Other European markets have followed suit, seeing the CAC40 fall 0.23 percent and the IBEX35 down 0.73 percent.

The impending G7 meeting has spooked investors globally, with Canada set to host the world meeting starting today. America is likely to face criticism over its trade policies from the UK, Germany, France, Japan, Italy and Canada, causing uncertainty.

The economic calendar is fairly quiet at this time of year, meaning G7 speculation is likely to have a bigger effect.

Jasper Lawler ofLondon Capital Group told The Guardian that investors were starting to show “unease” over the potential climate at the G7 Summit, culminating in a softer session for Asia and the weaker start in Europe.

BT shares rise as CEO steps down

BT shares soared on Friday morning, after the group’s CEO Gavin Patterson announced his departure from the company.

Investors cheered the news of Patterson’s decision, which came about after shareholders made it clear they had little confidence in his ability to implement BT’s turnaround plan.

The new plan was unveiled just four weeks ago, designed to breathe new life into the company after it missed both profit and revenue guidance in March. The strategy includes 13,000 job cuts and a move out of BT’s central London headquarters, in order to cut costs amid growing competition.

BT’s chairman, Jan Du Plessis, said:

“The board is fully supportive of the strategy recently set out by Gavin and his team. The broader reaction to our recent results announcement has, though, demonstrated to Gavin and me that there is a need for a change of leadership to deliver this strategy.”

Patterson, who has been the group’s CEO since 2013, said it had “been an honour to lead BT since 2013 and serve as a member of the board for the last 10 years”.

Shares in BT rose by around 2 percent following the announcement.

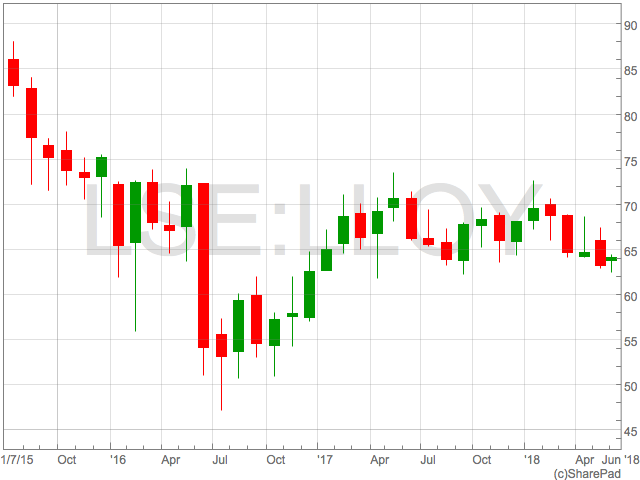

Lloyds share price bounces off strong support

Lloyds share price has remained in a tight range since the beginning of 2017, finding strong support in the 62p – 62.50p and resistance at 73p-74p.

The 200 day moving at 66.7p represents a potential magnet for the price in the short term, sitting neatly in the middle of the 2018 trading range. Technical traders will also be aware 14-day RSI has recently touched 30, signalling oversold, and has rebounded.

Strong results

The group boosted investor sentiment by raising its 2017 dividend by 20 percent at the start of the year, and announcing a £1 billion share buyback. In February the group reported relatively strong results, with statutory profit before tax up significantly to £5.3 billion, an increase of 24 percent on the year before. Underlying profit also increased by 8 percent to £8.5 billion, leading the group to boost its ordinary dividend per share by 20 percent. The banking group may also be set to benefit from a rising UK interest rate over the next couple of years. Despite it being expected to rise to just 2 percent by 2020, this would be an improvement on its current level and offer a boost to Lloyds.Contract tender

Lloyds has also gained the interest of several of the big investment management groups, after putting an investment contract up for tender. Goldman Sachs Asset Management joined rivals in the battle to win the £109 billion investment contract earlier this week, with BlackRock, JPMorgan Asset Management and Schroders all having already been selected to take part in a second round of bids in April. The contract is one of the largest ever to be put up for tender in Europe and has been managed by Standard Life Aberdeen since 2014.