GSK to buy Novartis’ stake in Consumer Healthcare Business

GlaxoSmithKline (LON:GSK) announced the acquisition of Novartis’ 36.5 percent stake in their joint venture, the Consumer Healthcare Business.

GSK will pay £9.2 billion for the stake in the business, which manufactures Sensodyne toothpaste, Panadol headache tablets and Nicotinell patches. The Consumer Healthcare Business was formed in 2015 as part of the three-part transaction between GSK and Novartis, and lat year reported sales of £7.8 billion.

In order to finance the deal GSK said it was initiating a strategic review of Horlicks and may sell that and its other nutrition products. Previously the company was in the running for Pfizer’s consumer healthcare unit, but dropped its bid last week.

The company said in a statement that: “GSK is initiating a strategic review of Horlicks and its other consumer healthcare nutrition products to support funding of the transaction, and to drive increased focus on over-the-counter and oral health categories. Combined sales of these products were approximately £550 million in 2017.”

Emma Walmsley, Chief Executive Officer at GSK, commented: “The proposed transaction addresses one of our key capital allocation priorities and will allow GSK shareholders to capture the full value of one of the world’s leading Consumer Healthcare businesses. For the Group, the transaction is expected to benefit adjusted earnings and cash flows, helping us accelerate efforts to improve performance. Most importantly it also removes uncertainty and allows us to plan use of our capital for other priorities, especially pharmaceuticals R&D.”

Shares in GSK are currently up 5.11 percent at 1,354.00 (1008GMT).

H&M reports 61pc fall in profits

Fashion giant H&M (STO: HM-B) has reported a 61 percent fall in profits from this time last year, blaming the unusually cold winter.

The world’s second-biggest clothing chain said profits fell due to lower sales and steep markdowns.

The group posted profits of 1.3 billion Swedish krona (£112 million), which is compared to the 3.2 billion krona worth of profits for the same period last year.

“Weak sales in the fourth quarter, partly caused by imbalances in the assortment for the H&M brand, resulted in the need for substantial clearance sales in the first quarter,” said Karl-Johan Persson, chief executive of H&M.

“The high level of clearance sales combined with unusually cold winter weather had a negative impact on the sales of the spring garments. In the first quarter the H&M group’s sales were unchanged in local currencies.”

“Many of our ongoing initiatives are giving good indications and results, even though they have not yet been implemented at a large enough scale to have a decisive effect on the overall results. The weak sales development combined with substantial markdowns had a significant negative impact on results in the first quarter,” he added.

H&M currently has 4,700 stores in 69 countries, most of them are H&M stores but a growing number of mid-market chains, & Other Stories and Cos.

This year, the group plans to open 220 new stores – 90 of these & Other Stories and Cos. Following the fall in profits, shares in H&M fell five percent in early trading to their lowest point since 2008. The fashion retailer remains positive and expects to see increased sales and growth in profit over the year. “We take a long-term view that, together with our knowledge and experience enable us to navigate through times such as this… back to healthy growth in both sales and profitability,” said the group.Citigroup issued broker notes on William Hill and Rolls-Royce

Citigroup issued broker notes on Tuesday on both William Hill and Rolls-Royce, reaffirming previous ratings after a month of activity for both companies.

Citigroup brokers reaffirmed their buy investment rating on William Hill PLC [LON:WMH] and set its price target at 380p.

Shares in William Hill (LON:WMH) jumped earlier in March after the UK’s Gambling Commission recommended new restrictions on fixed-odds betting terminals (FOBT) that were lighter than expected. The Commission said the maximum stake FOBTs should be dropped from £100 to £30.

William Hill shares are currently trading up 1.08 percent at 327.40 (0916GMT).

Citigroup also reaffirmed its buy investment rating on Rolls-Royce Group (LON:RR) and set its price target at 1083p.

Earlier this month Rolls-Royce shares rocketed 11 after posting a 25 percent profit rise well ahead of their own expectations.

Pre-tax profit for the 2017 year rose to £1.07 billion, a huge jump from the £813 million posted in 2016, with revenue increasing by 6 percent to £15.09 billion. The company held its dividend steadydeclaring a figure 11.7p per share for the full year.

Chief executive Warren East said Rolls Royce had made “good progress” during the year.

Rolls-Royce shares are currently up 1.01 percent at 876.40 (0916GMT).

Stagecoach shares drop after severe weather hits bus services

Shares in travel company Stagecoach (LON:SGC) saw shares sink 2.5 percent on Tuesday, after a weak performance for its UK bus company and business in North America.

UK bus regional revenue fell by 0.1 percent on a like-for-like basis, after severe weather across the country impacted on results. In London, bus revenues fell by a hefty 4.3 percent.

In its North American business, year-to-date like-for-like revenue had fallen by 0.6 percent.

Its rail service in the UK fared better, however, seeing like-for-like revenue at its UK rail division (but excluding South West Trains) grow by 3.2 percent in the 44 weeks to 3 March. Revenue at its joint venture with Virgin Trains grew by 2.8 percent.

“Our expectation of the group’s adjusted earnings per share for the year ending 28 April 2018 has not changed from when we announced our interim results in December 2017,” Stagecoach said.

Shares in Stagecoach are currently trading down 2.52 percent at 127.90 on the news (0848GMT).

United Utilities profit “moderately” higher despite revenue slip

British water supply company United Utilities (LON:UU) said its revenues had slipped during the course of 2017, but would still manage to post underlying profit in line with expectations.

Expenditure increased at the company during the second half of the year, particularly on infrastructure renewals expenditure, but spending for the full year was likely to remain in line with targets.

Revenue was hit by regulatory revenue changes, but the drop was partly offset by a one-off accounting gain from its Water Plus retail joint venture. United Utilities also said it expected to increase the company’s regulatory capital value by around £400 million, due to the increase in retail price index inflation. Due to hedging, however, the company expects its underlying net finance expense to be around £40m higher than last year.

United Utilities said would be submitting its 2019 price review (PR19) business plan in September and it was “confident” of delivering against Ofwat’s themes.

Shares in United Utilities are currently trading up 0.34 percent at 658.20 (0826GMT).

Moss Bros shares rise as results come in better than expected

Moss Bros (LON:MOSB) reported a decline in profits over the course of 2017, after problems with stock shortages impacted on sales.

The group was expected to release results along these lines, after issuing a profit warning last week. The group saw a rise in revenue but it failed to have an effect due to an increased cost of sales, sending total pre-tax profit down 6.1 percent to £6.7 million. Retail like-for-like sales including e-commerce in the first eight weeks of the new financial year down 6.7 percent. as rising revenue was offset by an increased cost of sales.

However shares in the company moved up nearly 3 percent at market open, with the results coming in above expectations. Last week Moss Bros’ share price took a hit, plunging 25 percent as it cut its dividend and warned on the full year figures.

Chief executive Brian Brick commented: “Although this shows a slight improvement of the trend we reported in January, it is clear that the recovery we anticipated has been significantly hampered by the stock shortages.”

“We left ourselves with too little ‘running line’ stock to close out the year having bought cautiously for the second half of 2017. This has continued to hamper our performance into the start of the year.

“In spite of this issue, we have continued to progress the modernisation of the store portfolio, which is nearing completion and develop our omni-channel shopping proposition, including a better level of customer segmentation.”

Shares in Moss Bros are currently up 2.67 percent at 48.00 (0815GMT).

Tesla shareholders approve new “staggering” pay deal

The founder of Tesla (NASDAQ: TSLA) has had new approval for a new pay deal that could land him a bonus worth $55.8 billion (£40 billion).

Corporate governance experts have called the new pay deal “staggering” but it met approval from shareholders in California.

Elon Musk, who is the billionaire founder of the electric car company, must build the group into a $650 billion over the next decade. Tesla is currently worth $54.6 billion.

“Elon will receive no guaranteed compensation of any kind – no salary, no cash bonuses, and no equity that vests by the passage of time,” said Tesla.

“Instead, Elon’s only compensation will be a 100 percent at-risk performance award, which ensures that he will be compensated only if Tesla and all of our stockholders do extraordinarily well,” the group added.

Corporate governance group Institutional Shareholder Services did not agree with the shareholders’ approval of the deal and was strongly against the new plan, which will start in January.

Institutional Shareholder Services said that it will “lock in unprecedented high-pay opportunities for the next decade, and seemingly limits the board’s ability to meaningfully adjust future pay levels in the event of unforeseen events or changes in either performance or strategic focus.”

Shares in Tesla are down 18 percent from the year high the group reached in September.

Tesla has faced recent pressures including production delays and increasing competition.

Investors have also expressed concern that Musk is distracted by too many other projects including his SpaceX rocket launches – a reason shareholders may have voted in favour of the new pay plan.

Following Facebook’s data breach, Musk deleted the official Facebook pages for his Tesla and SpaceX companies.

Musk took to Twitter (NYSE: TWTR) to say he “didn’t realise” that his SpaceX brand had a Facebook page. “Literally never seen it even once,” he wrote. “Will be gone soon.”

Car sales set to plunge in 2018

Car sales in the UK are predicted to slide this year, adding to worries over a slowdown in consumer spending.

New car registrations may fall by up to 5.5 percent during the course of 2018, according to ratings agency Moody’s. The falling value of the pound since the EU referendum has had a negative effect on the market, making imported cars more expensive for UK consumers. It also said Brexit-related uncertainty was “weighing on consumer spending decisions”.

The figures are in stark contrast to those of Germany, Spain, France and Italy, which are all expected to see gains. According to Moody’s, the UK market is likely to be the “worst performing” market of any big European economy.

The industry has seen impressive growth of late, with a record 2.7 million new car registrations in the UK in 2016 according to SMMT figures. However the figures took a plunge last year, falling 5.7 percent as consumers began to spend less and avoid big diesel vehicles.

Facebook value plummets $58bn following drop in shares

Following the company’s data breach scandal, Facebook (NASDAQ: FB) saw the end of the week with a $58 billion drop in value.

After founder Mark Zuckerberg apologised for the data breach, which affected 50 million users, shares in the group fell from $176.80 on Monday to $159.30 on Friday.

Laith Khalaf, a senior analyst at Hargreaves Lansdown, has said that the controversy has been a “damaging episode” for the tech giant.

“One of the secrets of Facebook’s success has been that the more people who use Facebook, the more integral it becomes to its customers. Unfortunately for Facebook, the same dynamic cuts in the opposite direction if it loses a meaningful number of users as a result of this scandal,” he added.

The backlash for the tech giant has been widespread, with Elon Musk deleting the Facebook pages for his companies Telsa (NASDAQ: TSLA) and Space X in the spread of the #deletefacebook movement.

Since the data breach came to light, Zuckerberg has taken out full-page adverts in UK and US Sunday newspapers to apologise.

In the US, the ads appeared in The New York Times (NYSE: NYT), The Washington Post, and The Wall Street Journal (OTCMKTS: WSCO).

In the UK, the apology appeared in the Sunday Telegraph, Sunday Times, Mail on Sunday, Observer, Sunday Mirror and Sunday Express.

“This was a breach of trust, and I am sorry,” it read.

“I’m sorry we didn’t do more at the time. We’re now taking steps to make sure this doesn’t happen again.”

“We’re also investigating every single app that had access to large amounts of data before we fixed this. We expect there are others,” the social media giant’s chief added.

Shares in Facebook were initially priced at $38 each in 2012, which steadily climbed to $190 by February this year.

Auto Trader runs on autopilot

Auto Trader is the largest car listing website in the UK and is one of the most profitable businesses in the FTSE All-Share index. The company listed in March 2015 at 235p and has made solid financial progress since then.

A business earning a high return on capital employed (ROCE) will inevitably attract new competitors. The only way, therefore, that a company can sustain a high return on capital is if it possesses competitive “moats.”

Auto Trader generated a return on capital employed (ROCE) of 59% in the year to March 2017. This means that every pound invested in the group – debt and equity – earned 59p of profit before interest and tax.

Most companies can only dream of generating a ROCE at this level with 15% considered attractive. Auto Trader has sustained a high ROCE on the back of two competitive moats: networks effects and a strong brand.

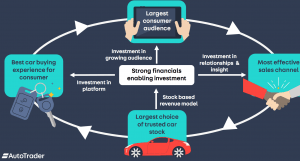

Auto Trader model & moats: network effects and a trusted brand

Source: Auto Trader investor presentation

Listing platforms generate Network effects because additional listings attract more users and additional users attract more listings. People gravitate to the leading listing platform and have little incentive to switch to move elsewhere.

Gumtree Motors is the nearest competitor to Auto Trader and is owned by US group eBay. In January 2018, UK car buyers spent 678 million minutes on Auto Trader’s platform versus 138 million minutes on Gumtree Motors.

Auto Trader also benefits from having a trusted brand, which is particularly important in the used car sector. According to research, only 7% of car buyers trust car dealers and 23% find visiting a car dealership “daunting.”

There is a risk that Amazon or Facebook could use their brands to make an aggressive move into the UK car listing market. Network effects, though, suggest that it would be hard to usurp Auto Trader’s market leading position.

The end market for Auto Trader is, however, mature with UK used car sales expected to decline 1-3% in 2018 to 7.9 million vehicles. This compares to 7.5 million in 2007, before the financial crisis, and 6.9 million used vehicles in 2009.

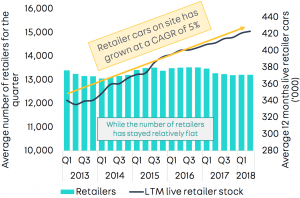

Retailers and last 12 months live cars on Auto Trader’s website

Source: Auto Trader investor presentation

Listing platforms generate Network effects because additional listings attract more users and additional users attract more listings. People gravitate to the leading listing platform and have little incentive to switch to move elsewhere.

Gumtree Motors is the nearest competitor to Auto Trader and is owned by US group eBay. In January 2018, UK car buyers spent 678 million minutes on Auto Trader’s platform versus 138 million minutes on Gumtree Motors.

Auto Trader also benefits from having a trusted brand, which is particularly important in the used car sector. According to research, only 7% of car buyers trust car dealers and 23% find visiting a car dealership “daunting.”

There is a risk that Amazon or Facebook could use their brands to make an aggressive move into the UK car listing market. Network effects, though, suggest that it would be hard to usurp Auto Trader’s market leading position.

The end market for Auto Trader is, however, mature with UK used car sales expected to decline 1-3% in 2018 to 7.9 million vehicles. This compares to 7.5 million in 2007, before the financial crisis, and 6.9 million used vehicles in 2009.

Retailers and last 12 months live cars on Auto Trader’s website

Source: Auto Trader

Physical stock on Auto Trader’s platform has grown 5% a year from 2013 with each car retailer listing more cars. In the six months to September 2017 there was a 3% year-on-year increase in vehicles on the platform to 451,000.

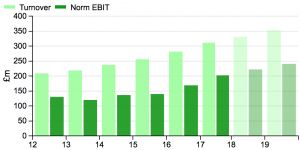

Auto Trader’s has seen solid top-line momentum recently with revenue up 8% in fiscal 2015, 10% in fiscal 2016 and by 9% in fiscal 2017. The operating profit margin has also improved from 57% in fiscal 2014 to 67% in fiscal 2017.

Turning to the balance sheet and the leverage ratio (net debt to EBITDA) declined to 1.55X at September 2017 versus 2.7X at September 2015. The company has been buying back shares since the IPO and looks set to continue doing so.

Auto Trader has delivered growth in a mature sector

Source: Auto Trader

Physical stock on Auto Trader’s platform has grown 5% a year from 2013 with each car retailer listing more cars. In the six months to September 2017 there was a 3% year-on-year increase in vehicles on the platform to 451,000.

Auto Trader’s has seen solid top-line momentum recently with revenue up 8% in fiscal 2015, 10% in fiscal 2016 and by 9% in fiscal 2017. The operating profit margin has also improved from 57% in fiscal 2014 to 67% in fiscal 2017.

Turning to the balance sheet and the leverage ratio (net debt to EBITDA) declined to 1.55X at September 2017 versus 2.7X at September 2015. The company has been buying back shares since the IPO and looks set to continue doing so.

Auto Trader has delivered growth in a mature sector

Source: SharePad

When Auto Trader listed in March 2015 at 235p its forward P/E ratio stood at 18.3X. The forecast P/E ratio is currently 17.2X for the year to March 2019 and 15.5X for the year to March 2020 (using a share price of 340p).

Auto Trader is clearly a high quality business but the UK used car market is mature and cyclical. Revenue growth has been delivered on the back of increased listings per car retailer, new product offerings and price increases.

Disruption is a long-term risk with taxi apps like Uber, on-street car rental and autonomous vehicles reducing the need for car ownership. The independence that car ownership delivers, though, means that it is unlikely to disappear.

Disclosure: The writer does not currently hold shares in Auto Trader.

Source: SharePad

When Auto Trader listed in March 2015 at 235p its forward P/E ratio stood at 18.3X. The forecast P/E ratio is currently 17.2X for the year to March 2019 and 15.5X for the year to March 2020 (using a share price of 340p).

Auto Trader is clearly a high quality business but the UK used car market is mature and cyclical. Revenue growth has been delivered on the back of increased listings per car retailer, new product offerings and price increases.

Disruption is a long-term risk with taxi apps like Uber, on-street car rental and autonomous vehicles reducing the need for car ownership. The independence that car ownership delivers, though, means that it is unlikely to disappear.

Disclosure: The writer does not currently hold shares in Auto Trader.

Source: Auto Trader investor presentation

Listing platforms generate Network effects because additional listings attract more users and additional users attract more listings. People gravitate to the leading listing platform and have little incentive to switch to move elsewhere.

Gumtree Motors is the nearest competitor to Auto Trader and is owned by US group eBay. In January 2018, UK car buyers spent 678 million minutes on Auto Trader’s platform versus 138 million minutes on Gumtree Motors.

Auto Trader also benefits from having a trusted brand, which is particularly important in the used car sector. According to research, only 7% of car buyers trust car dealers and 23% find visiting a car dealership “daunting.”

There is a risk that Amazon or Facebook could use their brands to make an aggressive move into the UK car listing market. Network effects, though, suggest that it would be hard to usurp Auto Trader’s market leading position.

The end market for Auto Trader is, however, mature with UK used car sales expected to decline 1-3% in 2018 to 7.9 million vehicles. This compares to 7.5 million in 2007, before the financial crisis, and 6.9 million used vehicles in 2009.

Retailers and last 12 months live cars on Auto Trader’s website

Source: Auto Trader investor presentation

Listing platforms generate Network effects because additional listings attract more users and additional users attract more listings. People gravitate to the leading listing platform and have little incentive to switch to move elsewhere.

Gumtree Motors is the nearest competitor to Auto Trader and is owned by US group eBay. In January 2018, UK car buyers spent 678 million minutes on Auto Trader’s platform versus 138 million minutes on Gumtree Motors.

Auto Trader also benefits from having a trusted brand, which is particularly important in the used car sector. According to research, only 7% of car buyers trust car dealers and 23% find visiting a car dealership “daunting.”

There is a risk that Amazon or Facebook could use their brands to make an aggressive move into the UK car listing market. Network effects, though, suggest that it would be hard to usurp Auto Trader’s market leading position.

The end market for Auto Trader is, however, mature with UK used car sales expected to decline 1-3% in 2018 to 7.9 million vehicles. This compares to 7.5 million in 2007, before the financial crisis, and 6.9 million used vehicles in 2009.

Retailers and last 12 months live cars on Auto Trader’s website

Source: Auto Trader

Physical stock on Auto Trader’s platform has grown 5% a year from 2013 with each car retailer listing more cars. In the six months to September 2017 there was a 3% year-on-year increase in vehicles on the platform to 451,000.

Auto Trader’s has seen solid top-line momentum recently with revenue up 8% in fiscal 2015, 10% in fiscal 2016 and by 9% in fiscal 2017. The operating profit margin has also improved from 57% in fiscal 2014 to 67% in fiscal 2017.

Turning to the balance sheet and the leverage ratio (net debt to EBITDA) declined to 1.55X at September 2017 versus 2.7X at September 2015. The company has been buying back shares since the IPO and looks set to continue doing so.

Auto Trader has delivered growth in a mature sector

Source: Auto Trader

Physical stock on Auto Trader’s platform has grown 5% a year from 2013 with each car retailer listing more cars. In the six months to September 2017 there was a 3% year-on-year increase in vehicles on the platform to 451,000.

Auto Trader’s has seen solid top-line momentum recently with revenue up 8% in fiscal 2015, 10% in fiscal 2016 and by 9% in fiscal 2017. The operating profit margin has also improved from 57% in fiscal 2014 to 67% in fiscal 2017.

Turning to the balance sheet and the leverage ratio (net debt to EBITDA) declined to 1.55X at September 2017 versus 2.7X at September 2015. The company has been buying back shares since the IPO and looks set to continue doing so.

Auto Trader has delivered growth in a mature sector

Source: SharePad

When Auto Trader listed in March 2015 at 235p its forward P/E ratio stood at 18.3X. The forecast P/E ratio is currently 17.2X for the year to March 2019 and 15.5X for the year to March 2020 (using a share price of 340p).

Auto Trader is clearly a high quality business but the UK used car market is mature and cyclical. Revenue growth has been delivered on the back of increased listings per car retailer, new product offerings and price increases.

Disruption is a long-term risk with taxi apps like Uber, on-street car rental and autonomous vehicles reducing the need for car ownership. The independence that car ownership delivers, though, means that it is unlikely to disappear.

Disclosure: The writer does not currently hold shares in Auto Trader.

Source: SharePad

When Auto Trader listed in March 2015 at 235p its forward P/E ratio stood at 18.3X. The forecast P/E ratio is currently 17.2X for the year to March 2019 and 15.5X for the year to March 2020 (using a share price of 340p).

Auto Trader is clearly a high quality business but the UK used car market is mature and cyclical. Revenue growth has been delivered on the back of increased listings per car retailer, new product offerings and price increases.

Disruption is a long-term risk with taxi apps like Uber, on-street car rental and autonomous vehicles reducing the need for car ownership. The independence that car ownership delivers, though, means that it is unlikely to disappear.

Disclosure: The writer does not currently hold shares in Auto Trader.