Commenting, Peter Mann, Chairman, said:

“Harwood has reported another strong year of progress, driven by both organic growth and the contributions of acquisitions, underpinning the strategy of strong financial services advice revenues, good quality investment performance and increasing assets, and completing further acquisitions.

“The Group is highly cash generative and I am pleased to announce that we are recommending the payment of a final dividend of 2.24 pence per share subject to shareholder approval at the Company Annual General meeting on the 18 April 2018. The final dividend will be paid on 11 May 2018 to shareholders on the register at the close of business on 27 April 2018.

“Overall, the progress made since the Company’s IPO in March 2016 indicates a strong outlook for the next financial year.”

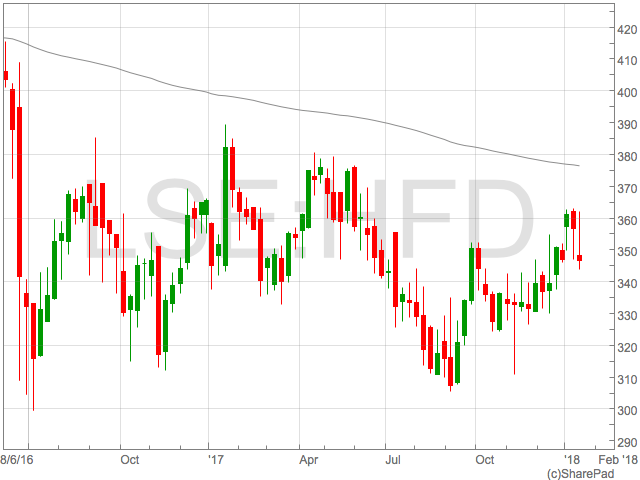

Shares in Harwood rose 1.59 percent in early trading to 160.00 (0834GMT).