Kodak shares jump 110pc on cryptocurrency announcement

Photography firm Kodak (NYSE:KODK) has jumped on the cryptocurrency bandwagon, announcing the launch of its new ‘KodakCoin’ on Wednesday.

The currency will be “a photocentric cryptocurrency to empower photographers and agencies to take greater control in image rights management,” causing Kodak shares to almost double in price.

The move represents a move in a new direction for Kodak, who recovered from a bankruptcy in 2013 by selling off most of its patents to large American companies including Apple and Microsoft. It is now hoping to take a slice of the growing blockchain technology and cryptocurrency movement which, despite warnings from various senior figures in the finance industry, continues to gain traction.

KodakCoin will aim to help photographers find unlicensed use of their photographs online. Associated KodakOne software will trawl the web to find photographs used without permission, with the photographer then being paid in KodakCoin.

Kodak chief executive Jeff Clarke said:

“Kodak has always sought to democratise photography and make licensing fair to artists. These technologies give the photography community an innovative and easy way to do just that.”

Kodak shares rose over 110 percent on the news, and are currently trading up 117.6 percent at 6.80USD (1139GMT).

Ted Baker shares rise on strong Christmas performance

British clothing brand Ted Baker (LON:TED) saw shares rise over 8 percent on Wednesday, after a trading update confirmed the group’s “good performance over the Christmas period”.

Retail sales increased by 9 percent in the eight week period from 12th November 2017 to the 6th January 2018, compared to the same period last year, with e-commerce sales up by 35 percent. Online sales made up 30.1 percent of total retail sales, with gross margins finishing in line with expectations.

Commenting on trading, Ray Kelvin CBE, Founder and Chief Executive said:

“The Ted Baker brand has continued to perform in line with expectations over the Christmas period, delivering a good retail performance driven by particularly strong growth from e-commerce, which is an increasingly important part of our retail business. This pleasing result reflects the strength of the brand and the quality of our collections as well as the hard work, skill and commitment of our teams.

Whilst external trading conditions are expected to remain challenging in the year ahead, the strength of our brand and business model means that we remain well positioned to continue the long-term development of Ted Baker as a global lifestyle brand.”

Shares are currently trading up 7.83 percent at 3,058.00 (1045GMT).

Leading platform Crowd2Fund kicks off £30 million institutional fundraise

Crowdfunding platform Crowd2Fund have given its loyal platform investors the opportunity to get involved in its latest fundraising round, beginning with an exclusive offer to take part in an initial £1 million offering.

Demand from its platform investors was so high that the initial offering was overfunded to £1.5 million, and more shares were issued to avoid disappointment.The platform are aiming to raise another £30 million in total.

The equity offering was snapped up quickly and the firm believe it is a great way to stay true to their principles and build an investor team who will propagate the Crowd2Fund brand within their communities and networks.

The technology firm is now inviting investors to take part in a further £8.5 million equity tranche from a few carefully selected large investors who can bring skills and market knowledge. The aim is to close the next tranche before the end of this tax year, following the initial £1.5m which now takes the total investment to £4m since the business started in 2014.

The scale-up company believes there is little competition in the peer-to-business lending market, which is currently dominated by one major platform. There is also significant opportunity overseas which the company wants to harness. It is planned that the final £20 million of the £30 million raise will be completed in January 2019.

The UK peer-to-business market opportunity is tipped to be worth £8.3 billion per year by 2022. The current market size is approximately £1.8bn per year, or £150m per month in money lent. The platform believes it is achievable to seize at least 33% market share by offering a much stronger, more genuine customer proposition than anything currently available, thus targeting a minimum £1bn valuation within a short period of time.

Millions lent to hundreds of innovative growing businesses

Crowd2Fund was first launched in 2014, and quickly became one of the few crowdfunding platforms to be directly regulated by the FCA and to offer the new Innovative Finance ISA. Unlike a number of competitors within the peer-to-business lending space, Crowd2Fund allows investors to directly choose the businesses which they lend to, provides more information on investments, and investors can even get rewards from investing in interesting businesses. To date, the company has facilitated more than £15 million of investment to over 200 businesses, generating an average 8.7% APR return for investors before fees and bad debt. There have been no formal defaults after more than 3 years of trading. There are a handful of loans in arrears, however, the firm have 100% successfully recovered all funds so far from arrears. Crowd2Fund was the first provider in the UK to be approved by HMRC to roll out the Innovative Finance ISA (IFISA), and are still one of just a handful of platforms to be able to offer this highly efficient tax incentive to their investor base.Future Growth, internationalisation and exit plans

Crowd2Fund is now securing their next tranche of £8.5 million which will be used to grow the UK market. Furthermore, operations will also be set-up in the USA and South-East Asia, where the platform will be leveraging the new FinTech bridge which allows easy pass porting into these markets. Funds will also be used to continue to deliver a world class user experience and minimise operational cost by embracing automation and artificial intelligence. Founder and CEO Chris Hancock says: “The banking ecosystem is undergoing transformation and innovation like never before; what we have seen so far is only the beginning. We are planning to exit the company in 2022, with revenues of £34 million and a valuation of at least £1 billion. In order to reach this target Crowd2Fund would only need to capture 7.2% of the UK market, excluding international activity. “Theresa May, sterling and the FTSE 100

One would usually associate the strength of a nation’s government with the performance of the domestic stock market. A well organised government delivering on their promises and leading the country forward incites confidence in risk assets, such as equities.

Enter Theresa May. May did inherit one the most challenging leaderships of the past 100 years, but her leadership has been anything but ‘strong and stable’, and this has been reflected in the gyrations of sterling and UK equities.

After the sharp decline following the Brexit vote, the inverse relationship between sterling and the FTSE 100 has dominated the ebb and flow of the FTSE 100 as it trades in a tight sideways range.

Notwithstanding any external shocks, the outlook of the FTSE 100 is inextricably linked to sterling performance.

This in turn is more likely than not to be dictated by the markets perceptions of whether the UK is on course for a hard or soft Brexit.

May’s initial announcement of her intention to pursue hard Brexit, was greeted with a plunge in the value of the pound and a push higher in FTSE 100, providing her with some cover, as it seems the new US president deems it appropriate to gauge the success of one’s leadership by the performance of the stock market.

Not only did foreign exchange market’s turn their noses up at the prospect of May’s hard Brexit, so did her political peers. This culminated in an embarrassing defeat in the house of commons in late December.

The pound strengthened in the run up to the parliamentary vote, capping gains in the FTSE 100 and leading to its underperformance against other major equity markets.

It is therefore a sensible deduction that a soft Brexit is going to drive further underperformance in the FTSE 100 as sterling strengthens and fears of a hard Brexit induced economic downturn diminish, if of course, this inverse relationship continues.

Samsung shares fall despite being on track for highest ever annual profits

Electronics giant Samsung saw shares sink on Tuesday morning, despite news that the group is on track for its highest ever annual profits.

Shares sunk as Samsung’s figure for the quarterly profits missed analysts’ high expectations, disappointing investors. The group recorded profits of 15.1 million won for the previous quarter, below the 15.9 expected by analysts.

News that the group was on track for record annual profits apparently did little to boost the mood, with full-year profits expected to be 53.6 trillion won.

Outlook for 2018 also looks uncertain, with the group seeing shares fall over 10 percent from November. The group continues to operate in a competitive market, with its smartphones facing competition from cheaper companies in China, made yet more difficult by Samsung’s embarrassing recall of its Note 7 smartphone in 2016.

Samsung shares are currently trading 3.11 percent (1141GMT).

Morrisons shares rise on bumper Christmas figures

Sales at Britain’s fourth largest supermarket, Morrisons, continued to grow over the Christmas period, sending shares up 4 percent at market open on Tuesday.

Sales of its premium products rose by 25 percent over the 10 weeks to the 7th January, with overall group like-for-like sales up 2.8 percent.

The group, who had been going through a difficult period and have implement a plan to better compete in the challenging supermarket environment, attributed this Christmas’ success to more tills, shorter queues and improved stock availability.

According to CEO David Potts, the group has “become more competitive, and despite the rising cost of many commodities the price of a basket of key Christmas items was the same as the previous year”.

“More and more customers found more things they wanted to buy at competitive prices at Morrisons this Christmas,” he concluded.

The latest figures from Kantar Worldpanel suggest all supermarkets had a better-than-expected Christmas period, with figures published on Tuesday showing that British shoppers spent £1 billion more in supermarkets over the last 12 weeks of last year than the year before.

Morrisons shares rose on the news at market open, before calming slightly to trade up 1.5 percent at 230.30 (1104GMT).

Coinsilium shares jump 12 percent on Indorse acquisition

Blockchain venture builder Coinsilium Group saw shares rise over 12 percent on Monday, after the group announced the acquisition of a further 3.5 percent of the share capital of Indorse Pte.

The company bought Indorse, an “ethereum-based decentralised network for professionals” through its wholly-owned subsidiary Seedcoin for an agreed price of 175,000 Singapore Dollars, approximately £97,000.

Coinsilium Chairman Malcolm Palle will become a Board Director of Indorse, as Seedcoin’s representative. Indorse Co-founder Gaurang Torvekar become Seedcoin’s CEO and the company’s Co-founder David Moskowitz will move to the position of Director.

Malcolm Palle said: “Indorse’s successful public beta launch with more than 2,600 sign ups on the platform since the July ‘proof-of-concept’ launch, has confirmed our trust in the capabilities of their development team led by Gaurang Torvekar.

“Indorse is proving to be a perfect match for our strategy of building value for our shareholders through identifying compelling early stage investment propositions lead by highly talented teams. I look forward to joining the Board of Indorse and to working closely with the team at this exciting stage in their journey.”

Coinsilium shares are currently trading up 12.45 percent at 0.28 USD.

US stocks hit refresh highs after Non-Farm Payrolls

US shares hit fresh highs on Friday driven by a jobs report that signalled pressure in the retail sector but expansion in construction.

The US created 148,000 jobs in December, missing estimates of 190,000.

While the number of jobs created missed estimates, average wages came inline with economists prediction at at annualised growth rate of 2.5%.

“A little bit of a disappointment when you only get 2,000 jobs out of the government and get retail at the absolute busiest time of the year losing 20,000 jobs. It just goes to show the true struggle that traditional brick and mortar is having now…Outside of that I actually thought it was a good report.” said JJ Kinahan, of TD Ameritrade.

US stocks took the release as enough reason to break to new highs with the S&P 500 trading above 2731 in early trade.

Shares in the US have had a solid start to the year as investors price in the potential benefits of Trump’s much anticipated tax reforms.

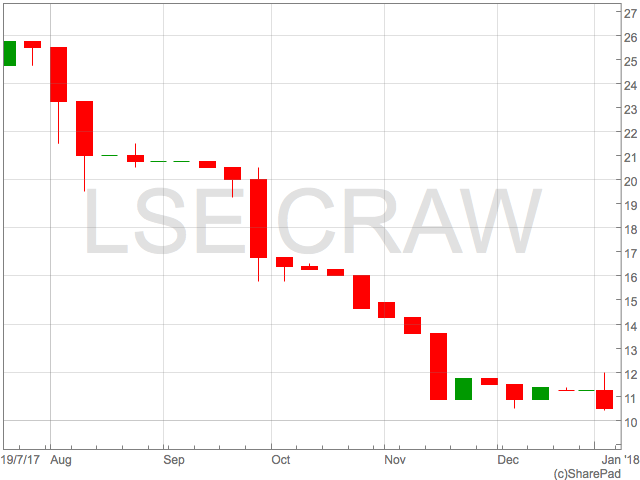

Crawshaw shares slump after slow festive sales

Crawshaw, the UK’s leading value butcher, suffered meaty fall in it’s share price after annoucing its Christmas trading figures.

Shares in the group were down over 7% on Friday after the group revealed like-for-like sales were down 6.1% in the 15 week period to 24th December.

The group blamed lower footfall and weak consumer sentiment for the drop in sales.

CEO, Noel Collett, said of the results:

“On balance, this was a solid core Christmas trading performance against what remains a very tough high street environment. Our biggest ever Christmas week and the record number of meat hampers sold clearly demonstrates the trust our customers place in us for their most important meat spend of the year. This gives us a solid platform to improve trading momentum going into 2018.

CEO, Noel Collett, said of the results:

“On balance, this was a solid core Christmas trading performance against what remains a very tough high street environment. Our biggest ever Christmas week and the record number of meat hampers sold clearly demonstrates the trust our customers place in us for their most important meat spend of the year. This gives us a solid platform to improve trading momentum going into 2018.

CEO, Noel Collett, said of the results:

“On balance, this was a solid core Christmas trading performance against what remains a very tough high street environment. Our biggest ever Christmas week and the record number of meat hampers sold clearly demonstrates the trust our customers place in us for their most important meat spend of the year. This gives us a solid platform to improve trading momentum going into 2018.

CEO, Noel Collett, said of the results:

“On balance, this was a solid core Christmas trading performance against what remains a very tough high street environment. Our biggest ever Christmas week and the record number of meat hampers sold clearly demonstrates the trust our customers place in us for their most important meat spend of the year. This gives us a solid platform to improve trading momentum going into 2018.

“We continue to focus on strengthening Crawshaws’ position as the country’s best value butcher. We are excited by the performance of our factory shops and by the progress of our 2Sisters supply agreement and, while there is much to do, we remain confident that this combination will be transformational for the long-term growth of the company.”

Crawshaw results add to the mixed picture of consumer health during the Christmas period following the release of results from Next and Debenhams.

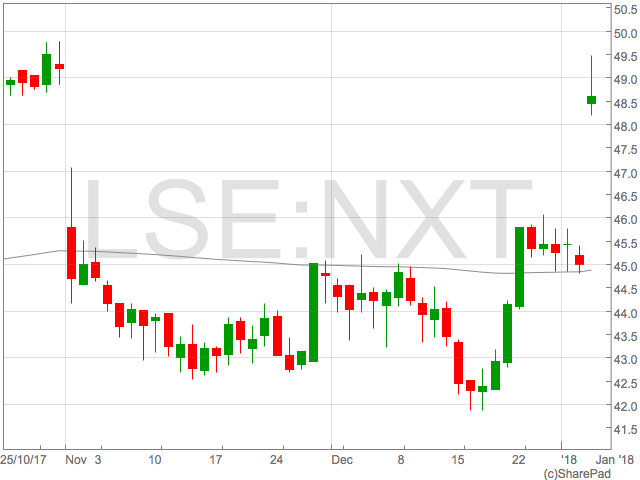

Next shares jump on positive Christmas update

Shares in UK retailing group Next soared on Wednesday morning following their Christmas trading statement.

Next sales figures for the 54 day period to 24th December revealed the company had successfully offset weaker retail sales with a bumper online sales increase.

Online sales rose 13.6% offsetting a disappointing 6.1% drop on sales in the retail unit.

Investors cheered the results sending Next shares as much as 9% higher in early trade on Wednesday.

Next predicted that profit would slow slightly in the coming year to £705m as operating cost rose at a faster pace than sales which were expected to rise 1%.

The results were not only good news for Next, but the wider retail space; shares in Marks & Spencer and Sainsbury’s rose 1% and 1.2% respectively.

Next predicted that profit would slow slightly in the coming year to £705m as operating cost rose at a faster pace than sales which were expected to rise 1%.

The results were not only good news for Next, but the wider retail space; shares in Marks & Spencer and Sainsbury’s rose 1% and 1.2% respectively.

Next predicted that profit would slow slightly in the coming year to £705m as operating cost rose at a faster pace than sales which were expected to rise 1%.

The results were not only good news for Next, but the wider retail space; shares in Marks & Spencer and Sainsbury’s rose 1% and 1.2% respectively.

Next predicted that profit would slow slightly in the coming year to £705m as operating cost rose at a faster pace than sales which were expected to rise 1%.

The results were not only good news for Next, but the wider retail space; shares in Marks & Spencer and Sainsbury’s rose 1% and 1.2% respectively.