Antofagasta hikes dividend after 78.7 pc profit increase

Ethereum surges past $30, up over 50% in less than a week.

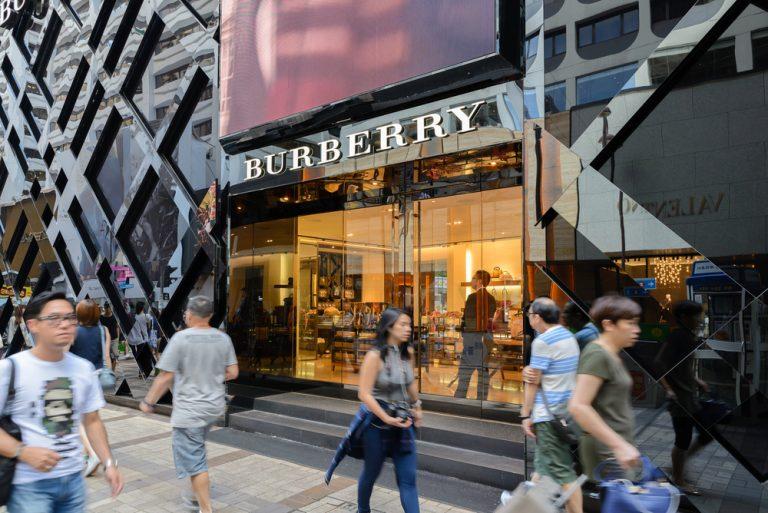

Economic uncertainty yet to have effect on consumer habits, says HSBC

12 Income Stocks for Q2 2017

As is evidenced by the income portfolio’s constituents, we continue to believe that the merits of holding a basket of high quality income stocks are compelling, particularly given the current low interest rate environment. As has been the case for a while now, the difference between the average market dividend yield and cash rate is now at a record level, with the dividend yield from the FTSE 100 around two times the highest current 12-month term deposit.

This, in combination with our belief that economic growth will remain sub-par until the risks and rewards of a Brexit become clearer, gives us confidence that investor demand for ‘income’ stocks will remain elevated despite the recent asset/sector rotations. While there remain a number of key risk factors for financial markets globally (i.e. destabilisation of the EU and rising tensions between the US and China), we think there is enough underlying momentum to absorb these challenges.

Download your copy of the income report now to discover the full list of constituents in the Income portfolio.

Download Income Report For Free

Copyright Fat Prophets® is a registered trade mark/trading name of Mint Financial (UK) Limited, which is authorised and regulated by the Financial Conduct Authority, Number 220591, registered in England and Wales, Number 04255908, with a registered office at 100 Fenchurch Street, London, EC3M 5JD. (www.fatprophets.co.uk)

DISCLAIMER The views and opinions expressed herein are for information purposes only. They are subject to change without notice, and do not take into account the specific investment objectives, financial situation or individual needs of any particular person. They should not be viewed as recommendations, independent research, or advice of any kind. The views accurately reflect the personal views of the author. They are not personal recommendations and should not be regarded as solicitations or offers to buy or sell any of the securities or instruments mentioned. The views are based on public information that we considers reliable but does not represent that the information contained herein is accurate or complete. With investment comes risk. The price and value of investments mentioned and income arising from them may fluctuate. Past performance is not an indicator of future results, and future returns are not guaranteed. We acknowledge an individual’s tax situation is unique and tax legislation may be subject to change in the future

China report first trade deficit in three years

Jawbone customer service ‘offline’, sparking complaints

Ibstock shares boosted by strong performance in the housing sector

“Crazy” discount rate changes to significantly hit young drivers

Harworth Group shares sink 5pc despite profit hike in 2016

06/03/2017