11/08/2016

Company reports: Old Mutual down, TUI up, Pagegroup mixed

Morning Round-Up: UK housing slows, Muslim women ‘disadvantaged’ by employers, Steinhoff ups Poundland bid

11/08/2016

BrewDog ‘Equity for Punks’ campaign launches new $50 Million bid in the US

BrewDog confident it will beat its’ own set crowdfunding world record

BrewDog, which produces the UK wide popular Punk IPA, currently holds the world record in equity crowdfunding. In four UK ‘Equity for Punks’ campaigns it raised over £26 million ($35 Million). Its latest campaign missed its target of £25 million but, with a total of £19 million raised in just one year, the campaign broke further records, becoming the first crowdfunding scheme to raise over £5m in under three weeks. The company is now attempting to break its own set records by raising $50 million (£38.29 million) from its US followers in only six months.Investors can purchase as little as two shares at $47.50 each

On offer are 1,052,632 shares of Common Stock at $47.50 per share, with investors having to purchase as little as two shares. All investors will also benefit from lifelong discounts on Brew Dog Products as well as an invitation to the annual general meeting. The US campaign will sell off a fifth of the new BrewDog USA Inc., which will be valued at $250 Million, to US investors. The rest remains owned by BrewDog and the 46,000 crowdfunding investors of previous UK campaigns meaning that UK backers will benefit greatly from the planned expansion into the vast US market.BrewDog said:

“No other business worldwide, let alone a brewery, has acquired so many investors and capital in this fashion. This American equity crowdfunding round marks an unprecedented move by any small business, with BrewDog set to further pioneer its audacious new approach to community-fuelled business in the USA.”Campaign is ambitious but founders are confident in success

The new campaign is of course very ambitious, especially considering that the Scottish brewery so far only has a very niche following in the United States. However, its first US brewery it already announced to open in Columbus Ohio late this year and first brews are expected by November. The 100,000 square foot space will feature a restaurant, taproom, retail space, visitor centre and beer garden for all beer lovers.Co-Founder James Watt stated that the companies approach is all about forming a community and connecting people who love beer:

“It is about taking beer lovers on this amazing journey with us. […] It is about working together to build something we can all be proud of. In 2010, we tore up convention, turned the traditional business model on its head and launched Equity for Punks, giving thousands of people a front row seat to the craft beer revolution in Europe. Now, we are coming to America. We are combining Europe’s leading brewer with the world’s biggest craft beer market. Expect fireworks.” The new US operations will be the first separately managed expansion of the business. UK operations so far manage 44 bars worldwide in ten countries including its’ home country Scotland, Brazil and Tokyo. So far BrewDog reported that the campaign has already gone beyond “more than $1 million in indication of interest in the first three days since going live on BankRoll”. More than 1200 individuals have registered their interest in investing in the US launch. While this is an encouraging start, the brewery has a long way to go to reach its target in only six months.Katharina Fleiner 10/08/2016

Top 10 best performing funds this year

No.10: BlackRock GF World Mining

The world’s biggest mining fund, aiming at investing at least 70% of its assets in shares of companies involved in mining and/or production of base and precious metals as well as minerals, has to date recorded 78.6% growth in total returns this year, in its ‘D2 USD’ share class. This comes after the fund saw 5 consecutive years of losses. Last year saw the fund fell by 37.5%. As of the end of May this year the fund manages US$4,063.2 Million (£3,125.3 million) in Assets. It’s top three holdings by weight currently are in BHP Billiton PLC, Randgold Resources Limited, Rio Tinto PLC (from top to bottom). Although the CIO of the Natural Resources Team at BlackRock and fund manager of BlackRock GF World Mining, Evy Hambro, warned that “2016 could be shaping to be another tough year for producers of natural resources”, the fund has managed to reach this year’s top ten ranking for best performing funds.No.9: HSBC Global Investment Funds Brazil Equity

The sub-fund of Luxembourg based HSBC Global Investment Funds has so far managed to increase total returns by 84.1% in its ‘AC NAV USD’ share class since the start of 2016, after this fund class declined 43.2% the previous year. The fund as of 30th June manages US$379.85 Million. It aims to invest in equity shares in Brazilian companies of all sizes. The largest share of its assets – around 30% – is currently invested in the financial industry. Consumer staples (13.72%) and industrials (12.52%) are the next favoured sectors. Its three top holdings by weight, top to bottom, are currently Ambev SA, Itausa-Investmentimentos ITAU-PR and 3 Petrobras – Petroleo BRAS-PR.No.8: SF Peterhouse Smaller Companies Gold

The small UK based fund manages £2.9 million as of the 9th of August 2016. This year it has so far been able to report on 113.2% growth in total returns. The fund, which started two years ago saw a change in management in January this year and under new managing director Amanda Van Dyke turned around 5 years of losses to reach a top-ten performance spot in its year to date performance. At least 80% of its core investment assets are invested in companies involved in the gold industry while a further 20% can be invested in shares of metal mining companies more broadly. Currently it is highly invested in Canadian equities (around 37% of total holdings) as well as UK equities (around 33% of total holdings). It also invests in American equities and the money market. Its top three holdings, top to bottom, are Rye Patch Gold CORP, Kinross Gold and Osisko Mining INC.No.7: CF Ruffer Gold

The fund, which managed to reach its first green figures in five years last year, has in the first 7 months of 2016 extended it’s growth, recording year to date total returns up 121.7%, compared to 12.1 at the end of 2015. After a performance high in mid-June, the fund, like many other investors in Gold, saw a four-year performance drop but has since then started to recover. By the end of June this month the fund managed £730.6 Million, which are principally invested in mining companies focusing on gold and other precious metals. The fund has invested heavily in the mining industry on Africa (33% of holdings). The two next biggest investment regions are Australia (20% of holdings) and North America (18% of total holding). Of a total of 105 holdings in 83 companies its biggest stock holdings, top to bottom, are Endeavour Mining, AngloGold Ashanti and Kinross Gold.No.6: Black Rock Gold and General

Another fund managed by Evy Hambro made it into the top ten listing. Black Rock Gold and General so far expanded total returns as much as 131.6 in their ‘D Accumulating’ shares class after recording an 18.1% reduction the previous year. Latest figures recorded yesterday, the fund manages £1,567.0 Million (US$2,037.3 Million). The fund primarily invests in companies which derive a significant proportion of income from either the gold mining industry or from other precious metals but is flexible to invest in outside opportunities when it sees fit. It is currently most highly invested in Randgold Resources Limited, Newcrest Mining LTD and Newmont Mining Corp.No.5: Old Mutual Blackrock Gold & General

Outperforming the considerably larger Black Rock Gold and General by 1.3% this year to date, the fund under same management reached the top 5 best performing funds since the start of 2016 with growth to date of 132.9%. Like many others in the top ten lists its current success comes from its predominant investment in the gold industry as well as other precious metals which are performing increasingly well this year after years of lower than hoped results on earnings per share. Moneyobserver rated the fund as the third best performing fund since Brexit at the end of June pointing towards gold as a save heaven in time of new economic uncertainty. The fund manages a total of £40.31 million, over half of which (56.16%) is invested in assets in Canada. Its top three holdings, top to bottom, are currently Newcrest Mining Ltd, Randgold Resources Limited ADR and Newmont Mining Corp.No.4: Smith & Williamson Global Gold & Resources

Another fund which recorded losses across the last five years, Smith & Williamson Global Gold & Resources jumped to a growth rate of 140.2% in the first 7 months of 2016. Like other top five success stories the fund invests in gold. The largest share of its assets invested in gold mining companies as well as precious metal related companies and resource based companies. However, the fund also invests in gold bullion shares and other transferrable securities, money market instruments, deposits, collective investment schemes and warrants. As of the 9th August the fund manages £67.0 Million (US$87.1 Million). Agnico-Eagle Mines, Newmont Mining and Asanko Gold are its top holdings, top to bottom.No.3: Investec Global Gold

Starting into the top three, the bronze spot for best performing funds is taken by another fund investing in gold mining primarily. The UK based fund recorded growth in total returns as high as 145.8% after five years of losses. In its worst year, 2013, the fund lost as much as 44.2%. It is now managing a total of £144.1 million (US$187.3 million). Like other well-performing funds, it is most highly invested in Newmont Mining Corp, Newcrest Mining Ltd and Barrick Gold Corp.No.2: WAY Charteris Gold & Precious Metals

Taking the second place, WAY Charteris Gold & Precious Metals managed to increase total returns by 205% since the start of the year. It is also the fund which currently is rated highest in the FE Risk Rating with a score of 291. This rating is relative to the FTSE100 rating, which is always kept at 100. The ranking further exposes the idea that precious metals is the path to success this year. The fund invests in a range of instruments which feature gold or other precious metals exposure as direct underlying assets and has holdings of transferable securities in companies whose core business lies in the gold and wider precious metal industry. About 90% of all assets are invested in Canada and it’s top holdings at the moment lie in the Silver industry with Endeavour Silver, First Majestic Silver and Fortuna Silver Mines Inc representing the largest weight in holdings.No1.: MFM Junior Gold

At the top of all best performing funds stands currently MFM Junior Gold, a fund which manages as of the end of June only £18.3 million (US$23.8 million). The fund recorded some of the greatest losses in the past years, reaching -65.8% at their lowest in 2013. It has now managed one of the biggest recoveries on the table over the course of the last 7 months, to take the top spot in performance just over half way through 2016, recording 226.3% in return growth. The fund, which invests mainly in small and medium sized companies in the industry of identifying, developing and extracting gold, targets investments in the mining industry of other precious metals as well and has in light of adverse market conditions also turned to cash holdings, bonds and government securities. Its top holdings are currently in Aureus Mining Inc., Taranga Gold Corp and Endeavour Mining Corp.10/08/2016

Pay-out ratio exceeds net profits in FTSE 100 companies

| Name | Num shares (m) | Total Profit (m) | Dividend | Dividend Payout £m | Payout Ratio |

| 3i Group PLC | 972.73 | 824 | 20 | 194.55 | 23.61% |

| Admiral Group PLC | 281.97 | 300 | 58.7 | 165.52 | 55.17% |

| Anglo American PLC | 1,402.23 | -3,662.20 | 20.933 | 293.53 | -8.02% |

| Antofagasta PLC | 985.86 | 410.53 | 1.971 | 19.43 | 4.73% |

| ARM Holdings PLC | 1,407.44 | 339.7 | 10.54 | 148.34 | 43.67% |

| Ashtead Group PLC | 501.52 | 407.6 | 22.5 | 112.84 | 27.68% |

| Associated British Foods PLC | 791.67 | 532 | 35 | 277.08 | 52.08% |

| AstraZeneca PLC | 1,264.57 | 1,839.57 | 188.5 | 2383.71 | 129.58% |

| Aviva PLC | 4,058.19 | 918 | 20.8 | 844.10 | 91.95% |

| Babcock International Group PLC | 505.6 | 286.6 | 25.8 | 130.44 | 45.51% |

| BAE Systems PLC | 3,174.10 | 918 | 20.9 | 663.39 | 72.26% |

| Barclays PLC | 16,911.02 | -394 | 6.5 | 1099.22 | -278.99% |

| Barratt Developments PLC | 1,002.30 | 449.4 | 15.1 | 151.35 | 33.68% |

| Berkeley Group Holdings (The) PLC | 137.37 | 404.1 | 200 | 274.74 | 67.99% |

| BHP Billiton PLC | 2,112.07 | 1,214.52 | 82.275 | 1737.71 | 143.08% |

| BP PLC | 18,783.82 | -4,220.91 | 26.726 | 5020.16 | -118.94% |

| British American Tobacco PLC | 1,864.31 | 4,290.00 | 154 | 2871.04 | 66.92% |

| British Land Co PLC | 1,029.60 | 1,345.00 | 28.36 | 291.99 | 21.71% |

| BT Group PLC | 9,927.60 | 2,588.00 | 14 | 1389.86 | 53.70% |

| Bunzl PLC | 335.51 | 232.7 | 38 | 127.49 | 54.79% |

| Burberry Group PLC | 444.43 | 309.5 | 37 | 164.44 | 53.13% |

| Capita PLC | 667.04 | 52.7 | 31.7 | 211.45 | 401.24% |

| Carnival PLC | 190.44 | 1,147.02 | 72.108 | 137.32 | 11.97% |

| Centrica PLC | 5,467.08 | -747 | 12 | 656.05 | -87.82% |

| Coca-Cola HBC AG | 361.7 | 203.94 | 30.764 | 111.27 | 54.56% |

| Compass Group PLC | 1,642.96 | 869 | 29.4 | 483.03 | 55.58% |

| CRH PLC | 829.73 | 526.77 | 45.669 | 378.93 | 71.93% |

| DCC PLC | 88.76 | 178.03 | 97.22 | 86.29 | 48.47% |

| Diageo PLC | 2,517.12 | 2,244.00 | 59.2 | 1490.14 | 66.41% |

| Direct Line Insurance Group PLC | 1,375.00 | 580.4 | 13.8 | 189.75 | 32.69% |

| Dixons Carphone PLC | 1,151.46 | 161 | 9.75 | 112.27 | 69.73% |

| easyJet PLC | 397.21 | 548 | 55.2 | 219.26 | 40.01% |

| Experian PLC | 957.54 | 500.25 | 29.333 | 280.88 | 56.15% |

| Fresnillo PLC | 736.89 | 47.6 | 3.656 | 26.94 | 56.60% |

| GKN PLC | 1,714.15 | 197 | 8.7 | 149.13 | 75.70% |

| GlaxoSmithKline PLC | 4,871.83 | 8,422.00 | 80 | 3897.46 | 46.28% |

| Glencore PLC | 14,394.74 | -3,232.43 | 3.816 | 549.30 | -16.99% |

| Hammerson PLC | 791.88 | 726.8 | 22.3 | 176.59 | 24.30% |

| Hargreaves Lansdown PLC | 474.32 | 156.66 | 21.6 | 102.45 | 65.40% |

| Hikma Pharmaceuticals PLC | 239.92 | 170.1 | 21.609 | 51.84 | 30.48% |

| HSBC Holdings PLC | 19,922.11 | 8,805.17 | 34.59 | 6891.06 | 78.26% |

| Imperial Brands PLC | 958.71 | 1,691.00 | 141 | 1351.78 | 79.94% |

| Informa PLC | 648.94 | 171.4 | 20.1 | 130.44 | 76.10% |

| InterContinental Hotels Group PLC | 197.52 | 795.73 | 69.6 | 137.47 | 17.28% |

| International Consolidated Airlines Group SA | 2,120.47 | 1,087.73 | 14.513 | 307.74 | 28.29% |

| Intertek Group PLC | 161.39 | -360.5 | 52.3 | 84.41 | -23.41% |

| Intu Properties PLC | 1,344.71 | 518.4 | 13.7 | 184.23 | 35.54% |

| ITV PLC | 4,025.41 | 495 | 6 | 241.52 | 48.79% |

| Johnson Matthey PLC | 193.53 | 333.1 | 71.5 | 138.37 | 41.54% |

| Kingfisher PLC | 2,256.86 | 412 | 10.1 | 227.94 | 55.33% |

| Land Securities Group PLC | 790.68 | 1,338.00 | 35 | 276.74 | 20.68% |

| Legal & General Group PLC | 5,949.12 | 1,075.00 | 13.4 | 797.18 | 74.16% |

| Lloyds Banking Group PLC | 71,373.73 | 860 | 2.25 | 1605.91 | 186.73% |

| London Stock Exchange Group PLC | 350.3 | 328.3 | 36 | 126.11 | 38.41% |

| Marks & Spencer Group PLC | 1,624.68 | 112 | 18.7 | 303.82 | 271.26% |

| Mediclinic International PLC | 737.24 | 177 | 5.24 | 38.63 | 21.83% |

| Merlin Entertainments PLC | 1,013.91 | 170 | 6.5 | 65.90 | 38.77% |

| Mondi PLC | 485.55 | 665.74 | 40.195 | 195.17 | 29.32% |

| Morrison (Wm) Supermarkets PLC | 2,335.26 | 222 | 5 | 116.76 | 52.60% |

| National Grid PLC | 3,746.87 | 2,591.00 | 43.34 | 1623.89 | 62.67% |

| Next PLC | 147.31 | 666.8 | 158 | 232.75 | 34.91% |

| Old Mutual PLC | 4,929.47 | 614 | 8.9 | 438.72 | 71.45% |

| Paddy Power Betfair PLC | 83.71 | 108.71 | 180 | 150.68 | 138.61% |

| Pearson PLC | 821.64 | 823 | 52 | 427.25 | 51.91% |

| Persimmon PLC | 308.29 | 521.9 | 110 | 339.12 | 64.98% |

| Provident Financial PLC | 147.64 | 218.2 | 120.1 | 177.32 | 81.26% |

| Prudential PLC | 2,575.68 | 2,579.00 | 38.78 | 998.85 | 38.73% |

| Randgold Resources Ltd | 93.63 | 127.36 | 44.975 | 42.11 | 33.06% |

| Reckitt Benckiser Group PLC | 703.78 | 1,743.00 | 139 | 978.25 | 56.12% |

| RELX PLC | 1,091.20 | 1,008.00 | 29.7 | 324.09 | 32.15% |

| Rio Tinto PLC | 1,374.56 | -563.92 | 143.13 | 1967.41 | -348.88% |

| Rolls-Royce Group PLC | 1,838.74 | 83 | 16.37 | 301.00 | 362.65% |

| Royal Bank of Scotland Group (The) PLC | 11,755.50 | -1,594.00 | 0.00 | 0.00% | |

| Royal Dutch Shell PLC | 3,745.49 | 1,262.63 | 124.465 | 4661.82 | 369.22% |

| Royal Mail Group PLC | 1,000.00 | 241 | 22.1 | 221.00 | 91.70% |

| RSA Insurance Group PLC | 1,018.99 | 235 | 10.5 | 106.99 | 45.53% |

| SABMiller PLC | 1,623.87 | 1,792.65 | 89.821 | 1458.58 | 81.36% |

| Sage Group (The) PLC | 1,079.50 | 194.3 | 13.1 | 141.41 | 72.78% |

| Sainsbury (J) PLC | 1,925.57 | 471 | 12.1 | 232.99 | 49.47% |

| Schroders PLC | 226 | 467.4 | 87 | 196.62 | 42.07% |

| Severn Trent PLC | 235.67 | 330 | 80.66 | 190.09 | 57.60% |

| Shire PLC | 898.57 | 879.78 | 18.01 | 161.83 | 18.39% |

| Sky PLC | 1,719.00 | 666 | 33.5 | 575.87 | 86.47% |

| Smith & Nephew PLC | 895.74 | 266.98 | 20.68 | 185.24 | 69.38% |

| Smiths Group PLC | 395.15 | 246 | 41 | 162.01 | 65.86% |

| SSE PLC | 1,007.63 | 460.6 | 89.4 | 900.82 | 195.58% |

| St James’s Place PLC | 526.97 | 202.2 | 27.96 | 147.34 | 72.87% |

| Standard Chartered PLC | 3,283.07 | -1,428.68 | 9.398 | 308.54 | -21.60% |

| Standard Life PLC | 1,975.37 | 1,423.00 | 18.36 | 362.68 | 25.49% |

| Taylor Wimpey PLC | 3,264.96 | 490.1 | 1.67 | 54.52 | 11.13% |

| Tesco PLC | 8,174.18 | 138 | 0.00 | 0.00% | |

| Travis Perkins PLC | 250 | 167.6 | 44 | 110.00 | 65.63% |

| TUI AG | 586.78 | 254.97 | 41.586 | 244.02 | 95.70% |

| Unilever PLC | 1,283.46 | 3,571.68 | 88.49 | 1135.73 | 31.80% |

| United Utilities Group PLC | 681.9 | 397.5 | 38.45 | 262.19 | 65.96% |

| Vodafone Group PLC | 26,561.45 | -4,024.00 | 11.45 | 3041.29 | -75.58% |

| Whitbread PLC | 182.67 | 391.2 | 90.35 | 165.04 | 42.19% |

| Wolseley PLC | 252.38 | 213 | 90.75 | 229.03 | 107.53% |

| Worldpay Group PLC | 2,000.00 | -29.8 | 0.00 | 0.00% | |

| WPP Group PLC | 1,284.60 | 1,160.20 | 44.69 | 574.09 | 49.48% |

Miranda Wadham on 10/08/2016

Top 10 cheapest FTSE 100 stocks you can buy right now

10/08/2016

Prudential Insurance and G4S shares up on strong results

Prudential Insurance released impressive half year results on Wednesday, with a 6 percent increase in operating profits causing shares to jump.

Earnings came in above analysts’ expectations at £2.06 billion for the half year period. The company had strong success in its Asian arm, where profits rose 15 per cent, posting an operating profit of £743 million.

Prudential plc (LON:PRU) is currently up 1.90 percent at 1,419.00 (1041GMT).

G4S shares fly on half year results

G4S shares are trading up nearly 20 percent this morning after a strong set of half year results.

Revenue rose to £3.53 billion, with profits before tax rising to £115 million – up from just £80 million last year. The company has shrugged off various scandals over the past few years, including the recent revelation that the Orlando nightclub killer was an employee. Despite this the company insisted that demand has “remained positive”, with CEO Ashley Almanza saying the company has “delivered tangible results”.

G4S (LON:GFS) shares are currently up 18.30 percent at 231.20 (1048GMT).

10/08/2016

Morning Round-Up: Bank of England new plan struggles, Entertainment One/ITV deal, Asian shares up

10/08/2016

Are rising property prices in Germany evidence of next housing bubble?

Worries about the German housing market persisted since late 2015

Worries about the growing volume of demand and rising property prices in Germany already came up late last year when economists warned that the ECB’s monetary expansion program could cause bubbles in the housing market of the UK, Germany and Norway. Germany has historically been a country less prone to volatile cyclical developments in the housing market due to having a more prevalent renting culture than other European countries. According to Eurostat only 52.5% of German households owned their own home in 2014, compared to 64.8% in the UK and 70.1% in the European Union collectively. However, in the last three months of 2015, construction expanded to become one of the country’s biggest contributor to growth fuelled by higher demand for individual home ownership. New mortgages jumped 22% over the course of 2015 after years of 3% growth or below.Data on 2016 developments in the housing demand and property prices reinforced concerns

Fears persisted after Destatit published data which showed that in January this year building permits for flats rose by 34.5% compared to the same month the previous year. Numbers of new building permits therefore reached record highs last seen a decade ago. Economists also observed that house prices have risen by over 5% year on year in the first half of 2016, levels similar to the housing boom the country experienced in the late 1980s and early 1990s corresponding with the fall of the Berlin Wall and subsequent unification of West and East Germany. Bloomberg in May published figures suggesting that housing prices in major cities such as Berlin, Hamburg and Munich grew as much as 30% over a 5-year period.

New Commerzbank report discusses the extend of the issue

Commerzbank now published its own assessment of the likelihood that growing property prices in Germany will turn the property market into a volatile time bomb and its views are mixed. Commerzbank first warned of worrying developments in the country’s housing market at the beginning of the year when its Real Estate Monitor started to indicate imbalances in the German housing market. The research department of the bank has now stated that such indicators have since worsened further.The report argues:

“The housing boom in Germany is looking increasingly like a bubble as house prices steadily decouple from the fundamental factors. – Since 2010, prices have risen faster than rents, consumer prices and private household income.” The imbalance between the rise in property prices to rents, inflation and income may be the first sign that Germany’s housing market is well on its way to balloon.ECB expansionary monetary policy is to blame

Driving the growing housing demand in Germany is the ECB’s expansionary monetary policy that Mario Draghi committed himself to in order to recover the Euro Zone economy from the Euro Crisis. Quantitative easing and low interest rates have encouraged lower mortgage rates and enabled German households to afford their own homes. But, as it could be observed in the US in the years before the US housing crisis, the probability that rates can drop much further is now extremely low, which could start to grind demand to a halt when rising housing prices are no longer rebalanced by lower interest rates. In the US this development ultimately led to a sharp correction in demand and pricing, followed by growing default rates on mortgages which ignited the start of one of the worst financial crisis to shake the global economy. In Germany, growing house prices were outweighed by lower interest rates and rising income, making the financing of housing easier, until the beginning of 2015. However, since then rises in house prices have started to exceed both growth in income and decreases in the interest rate and housing is becoming less affordable.Commerzbank said:

“According to our own index – which is not comparable 1:1 with the US index – the costs of financing an average house relative to average private household incomes are still much lower than [in the US] in 2009. However, as a further sharp fall in interest rates is now unlikely, the unfavourable trend in housing affordability should continue if the recent trend in prices continues as it has done recently.” “The tensions on the housing market are generally rising, albeit from quite a low level.”German ten-year yields and construction boom now eyed as future indicators

One important indicator to keep an eye on now is the German ten-year bond yield. If they should rise – and mortgage rates follow – the tensions in the housing market are likely to increase. The risk could also increase if we were to observe a further construction boom in Germany which would resolve current housing shortages in some regions, reducing upwards pressure on property prices. However, so far there is little evidence of such developments as Commerzbank reports. Although building investment has outpaced GDP in growth since 2010, its’ share in GDP only rose to 6%, well below the benchmark of 7.5% which was reached during the 1990s housing boom. While construction orders have increased realty in volume, production has largely failed to respond to the increase in demand. This is attributed to a lack in capacity to deliver on a higher volume overturn. Therefore, the deciding factor will be whether companies increase their capacity to cater to the higher demand on new constructions.Low private debt ratio eases concerns

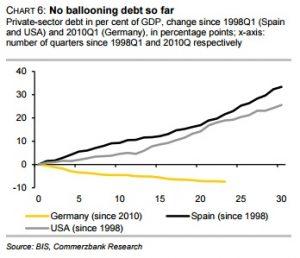

On a positive note, Commerzbank and other analysts acknowledged that there is so far no sign of ballooning private debt, such as was observed in the US and Spain before the latest crisis. The private debt ratio has in fact decreased in the first seven months of 2015. This suggests that the German private debtors are in a considerably better position than mortgage holders were in the US and Spain around a decade ago. Therefore, although it is worth keeping an eye on the developments in the German housing market, as well as debt levels, it is unlikely that the current rise in demand for private property in Germany will develop into housing boom and consequential bust as in the USA and Spain.

Therefore, although it is worth keeping an eye on the developments in the German housing market, as well as debt levels, it is unlikely that the current rise in demand for private property in Germany will develop into housing boom and consequential bust as in the USA and Spain.

Katharina Fleiner 09/08/2016

UK industrial output grows at fastest rate since 1999

British industrial output grew in the second quarter of year, according to new figures from the Office for National Statistics, becoming the latest in a string of positive economic figures since the EU referendum.

Second quarter industrial output in Britain grew 2.1 percent on the first quarter, the fastest growth rate since 1999. However, the data does highlight a slowing in industrial output throughout the quarter, with the rate in April at over 2 percent slowing to 0.1 percent in June.

In a separate report also released today the ONS showed a widening in the trade deficit over the same quarter, growing to £5.1 billion in June from £4.2 billion the month before. Imports are also set to reach a record high of nearly £49 billion.

09/08/2016