Aquis weekly movers: Valereum returns from suspension

Oscillate (LON: MUSH) says all directors will receive their salaries in shares from the beginning of 2024. They will be issued at the mid-price on the day before the payment. Executive director Steven Xerri bought 6.29 million shares at 0.42p each, taking his stake to 7.8%. The share price jumped by two-thirds to 0.5p, which is the highest it has been since August.

Valereum (LON: VLRM) shares resumed trading on 27 November. The Gibraltar Stock Exchange acquisition is not going ahead. The convertible loan note funding facility has been terminated. Warrants will be cancelled, and the company will seek to ensure that the shareholder register is accurate. Accounting records will be audited. Karl Moss has been appointed finance director. The share price recovered 21.3% to 4.5p.

Aquis Exchange (LON: AQX) says that the Aquis Stock Exchange has become the first recognised investment exchange to run on a cloud-based engine, which determines trades. The share price is 5.8% higher at 365p.

KR1 (LON: KR1) had an NAV of 56.14p/share at the end of the November 2023. The digital assets generated income of £395,437. The share price rose 5.26% to 70p.

FALLERS

Vulcan Industries (LON: VULC) has finally published its accounts for the year to March 2023. The loss was £1.02m, although there was also an extraordinary profit of £1.59m on discontinued activities. The loss-making businesses have been sold. The company is moving into renewables. The share price has fallen 64% to an all-time low of 0.135p.

Guanajuato Silver (LON: GSVR) is withdrawing from the Aquis Stock Exchange at the end of 2023. It does not believe it can justify the cost of this quotation, which was gained on 25 October 2022, and the TSX Venture Exchange listing. The share price fell 13.5% to 16p. A deal has been signed to terminate the obligation to make contingency payments of $2m to Great Panther in return for offsetting a working capital adjustment owed to the company. The share price slumped 13.5% to 16p.

Marula Mining (LON: MARU) has commenced phase one exploration at the Nyorinyori and NyoriGreen graphite projects in Tanzania. The focus is the high-grade and jumbo flake graphite mineralisation, which is thought into extend in the NyoriGreen licence. The initial findings should be reported in January. Ore commissioning at the new ore sorter at the Blesberg lithium and tantalum project in South Africa should be completed at the end of January. The expanded processing plant should be commissioned in the first quarter of 2024. The share price is 10% lower at 11.25p.

Coffee shop owner Cooks Coffee Company (LON: COOK) reported flat continuing revenues of NZ$2.04m and it has gone from a pre-tax profit of NZ$125,000 to NZ$319,000. There was a NZ$5.27m loss on discontinued operations. In October, there were record sales per store. A regional developer has been appointed to increase the number of stores in southwest England. By March, Cooks Coffee expects to have up to 80 Esquires outlets in the UK and Ireland by March. Oberon Capital has been appointed corporate adviser. The share price declined 6.25% to 3.75p.

Tesla shares drop after new Cybertruck pricing reveal

On Friday, Tesla’s CEO, Elon Musk, revealed that the long-awaited futuristic ‘Cybertruck’ is going to cost 50% more than his initial estimates.

New prices will start at $60,990, but many still worry about the car’s potential usefulness.

Tesla’s shares have been falling all week and are down 3% at the time of writing on Friday. That said, Tesla shares are up a bumper 117% year-to-date, paying testament to Musk’s pricing strategy across the Tesla fleet.

The truck was inspired by a car-turned-submarine from the 1977 James Bond movie “The Spy Who Loved Me,” said Musk.

Musk himself never hid his excitement about the car’s futuristic look and speed range.

The Cybertruck, he said, “can not only beat a Porsche 911 on the track, but it can also tow a 911 faster than the 911 can drive itself”.

When the design was first revealed by Tesla four years ago, many voiced their concerns about the car’s everyday usefulness and, therefore, its popularity on the market. Some refer to it as a comic-book car due to its futuristic design.

After that, responding to a major critique of the Cybertruck’s design—its practicality—Tesla presented a video demonstrating the truck’s superior towing capacity compared to a Ford F-350 diesel truck, as well as similar models from Chevrolet, Ram, and Rivian.

Following Musk’s 2019 projection of a $40,000 price for the Cybertruck, the vehicle garnered over a million reservations with $100 deposits.

Despite escalating raw material expenses for electric vehicles (EVs), Musk had not revised the price until Monday, announcing new deposits at $250. Analyst Paul Waatti from consultancy AutoPacific noted that the pricing was expected, anticipating the Cybertruck to resonate well with a more niche audience.

FTSE 100 gains as miners steam ahead

The FTSE 100 ticked higher on Friday as strong miners buoyed the index and took it briefly to the highest levels since mid-October.

London’s leading index was 0.6% to the good in mid-afternoon trade on Friday.

Miners soared as investors digested better-than-expected Chinese manufacturing data which raised hopes of improving activity in the world’s second-largest economy.

“Miners led the charge after Chinese manufacturing data beat expectations, raising hopes that the Asian superpower will require more commodities from the big natural resources companies on the stock market. The Caixin China General Manufacturing PMI index rose to 50.7 in November from 49.5 in October – a figure above 50 implies expansion and a figure below 50 is contraction,” said Russ Mould, investment director at AJ Bell.

On Friday, Anglo America, Glencore, Rio Tinto and Antofagasta were among the top risers. Anglo American stormed ahead with a 5% gain, and Antofagasta jumped 3.5%.

Housebuilders were in focus after Nationwide said UK house prices had increased for the third consecutive month amid a lack of supply.

However, early gains for Taylor Wimpey, Barrat Developments and Berkeley Group Holdings had subsided by the afternoon as investors considered the dynamics behind rising prices.

“This looks like a welcome bump for the market, but it’s not quite as positive as it seems. A dearth of homes for sale has put a floor under prices, which rose slightly during November. But life remains tough for sellers,” said Sarah Coles, head of personal finance at Hargreaves Lansdown.

“Prices are on the up for the third successive month, which feels like good news. However, in order to get these higher prices, you have to actually sell your home – which is easier said than done. Sales have slowed to a crawl. October figures out this week from HMRC showed property sales were down a fifth in a year.”

Tesco was among the fallers after JP Morgan downgraded their price target to 230p from 240p. Tesco shares were down 1.8% to 280p at the time of writing.

AIM movers: Siemens sells Sondrel stake and Cap-XX gets grant

Good news for Cap-XX (LON: CPX), which will receive a net A$1m R&D development grant from the Australian Taxation Office. The supercapacitors developer has signed a joint venture agreement with Ionic Industries for the exclusive commercialisation of the latter’s graphene oxide technology. This will help to increase electrode density in supercapacitors. Purchases are anticipated from new distributors and more distributors are being signed up. The share price improved 12% to 1.4p.

Chaarat Gold (LON: CGH) has reached a deal with the Kyrgyz Republic government regarding the Tulkubash and Kyzltash projects. The government is confirming its commitment to help Chaarat develop the projects. They will promote international investment. The share price rose 10.7% to 7.25p.

T42 IoT Tracking Solutions (LON: TRAC) is collaborating with Sateliot IOT Services on satellite-based maritime tracking. Clients will be connected to the Sateliot satellites to improve coverage in the oceans. The share price increased 8.33% to 3.25p.

Mind Gym (LON: MIND) shares recovered 5.19% to 40.5p following the interims. A trading statement had already warned that revenues would be much lower than anticipated and the share price took a large hit. Clients are delaying hires and related spending. The interim revenues fell from £26.8m to £20.9m and the human resources training and education company fell into loss. Annualised costs have been cut by £8m, with £3m showing through in the second half. A full year pre-tax loss of £2.5m is forecast and Mind Gym may have a small net debt position at the year end in March 2024. The company should return to profit next year as revenues recover and the cost savings kick-in.

FALLERS

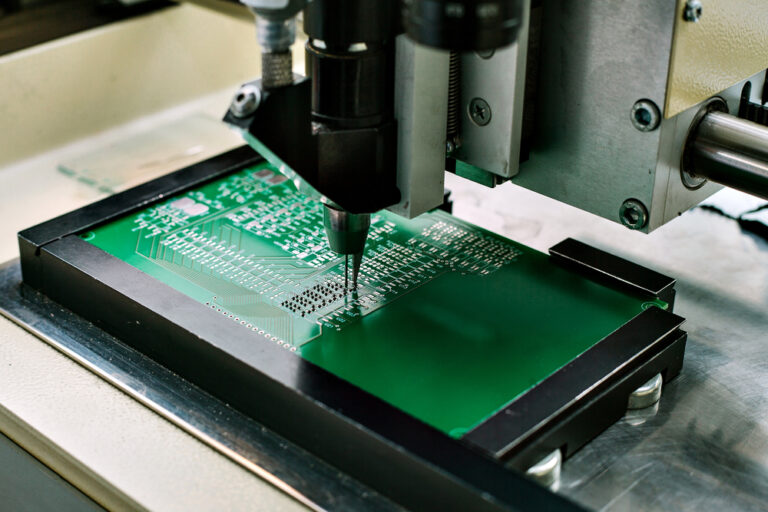

Siemens has sold its entire 11.2% stake in Sondrel (LON: SND) for £589,000. The placing price was 6p and the share price slumped 46.4% to 7.1p. The semiconductors designer raised £17.5m at 55p/share when it joined AIM in October 2022. Project delays have hit revenues. Siemens previously had a share purchase agreement with the company and the chief executive but that was terminated. Siemens was granted the status of preferred supplier of electronic design automation software for a 36-month period at the time of the flotation.

RUA Life Sciences (LON: RUA) took advantage of last week’s share price surge to raise £4m at 11p/share. There is also a retail offer that closes on 7 December. That could raise up to £750,000. The share price dived 41.1% to 12.25p. The cash will finance the vascular graft and heart valve development programmes while partners are sought. Cavendish expects the company to be profitable in 2025-26 before any contributions from the developing products. The share price is lower than before its recent rise and is not far off its all-time low.

Velocys (LON: VLS) shares continue to decline as investors await developments in the potential bid at 0.25p/share from a consortium including Lightrock and Carbon Direct Capital Management. The sustainable fuels developer is running out of cash and needs strong financial backing to finance projects. The share price slipped 27.4% to 0.2395p.

Share buying by directors of healthcare services provider Totally (LON: TLY) has not stopped the decline in the share price which is down a further 12.4% to 4.6p. New chair Simon Stilwell bought one million shares at 6.1p each, while non-exec Michael Rogers acquired 40,000 shares at 5.333p each.

UK house prices rise for third month – Nationwide

UK house prices rose for a third consecutive month, according to data released by Nationwide on Friday. The average UK price was up 0.2% in November month-on-month, but house prices were down 2% year-on-year.

“Nationwide’s house price index recorded the third successive monthly increase, implying some resilience to the UK property market. While the annual change is still in negative territory, the level narrowed from -3.3% in October to -2% in November,” said Russ Mould, investment director at AJ Bell.

A lack of supply was providing support for house prices as the number of transactions fell. Mortgage rates have fallen, but not to the extent of bringing buyers back into the market in large numbers.

“This looks like a welcome bump for the market, but it’s not quite as positive as it seems. A dearth of homes for sale has put a floor under prices, which rose slightly during November. But life remains tough for sellers,” said Sarah Coles, head of personal finance at Hargreaves Lansdown.

“Prices are on the up for the third successive month, which feels like good news. However, in order to get these higher prices, you have to actually sell your home – which is easier said than done. Sales have slowed to a crawl. October figures out this week from HMRC showed property sales were down a fifth in a year.”

Tesco shares fall as JP Morgan slashes price target

Tesco shares fell on Friday after the supermarket’s price target was slashed by equity analysts at JP Morgan.

JP Morgan cut its price target to 230p from 240p sending Tesco shares to the bottom of the FTSE 100. Tesco shares were trading at 281p on Friday morning.

Tesco sales, excluding fuel, grew 8.9% on a constant currency basis in the first half of 2024FY, and adjusted operating profit rose 14%.

Pressure from the discounters is making the grocery market an increasingly competitive space, which risks a race to the bottom in terms of sacrificing margins to maintain market shares.

“Tesco was the top faller on the FTSE 100 after JPMorgan cut its target price to 230p from 240p. That knocked the supermarket’s share price by 1.8% to 280.6p and ended a rally in the stock which has been in motion since August. The company has gained market share this year but still faces intense competition,” said Russ Mould, investment director at AJ Bell.

Tekcapital and Cadence Minerals have multibagger potential in 2024

It’s always darkest before the dawn. This is particularly relevant for two AIM-listed investment companies, Tekcapital and Cadence Minerals.

The interest rate tightening cycle has done AIM companies no favours, and some have been hit harder than others. Companies structured as investment companies, including Tekcapital and Cadence Minerals, are among the hardest hit.

Rising risk-free rates have dented the market pricing of investment vehicles holding privately held assets. This includes not only AIM-listed investment companies but also some of London’s largest investment trusts. Even constituents of the FTSE 350.

Many private equity investment trusts with a market capitalisation of over £1bn trade at a discount in excess of 35%.

These discounts are more pronounced in AIM-listed investment companies, and here lies the opportunity.

The disconnect between Tekcapital and Cadence Minerals shares and their respective underlying valuations, combined with the prospect of interest rate cuts in 2024, provide investors with potential multi-bagging returns over the next year.

The opportunity in these two companies sits nearly as much with the external macro environment and cyclicality of early-stage companies as it does with Tekcapital’s and Cadence Minerals’ business models. The macro environment is also a risk consideration for these companies over the next year.

While we have highlighted the disparities in the valuation of privately held assets and current market pricing, Tekcapital and Cadence Minerals hold both private companies and public companies listed to major global exchanges with clear and transparent pricing, this further strengthens the case for a rerate.

Tekcapital

Tekcapital has a portfolio of four technology companies with the market opportunity to improve the lives of millions of people.

Two companies, Innovative Eyewear and Belluscura, are listed on the NASDAQ and AIM, respectively.

MicroSalt is preparing for an AIM listing, and Tekcapital is likely waiting for more favourable market conditions to pull the trigger.

Autonomous vehicle safety company Guident is privately held, and there are no signs from Tekcapital that a listing is planned in the near term.

Tekcapital’s market cap is currently £13m compared to the portfolio’s net asset value of $53.1m as of 30th June. Equity analysts separately valued the portfolio at a similar level shortly after the release of the half-year results.

If the NAV were calculated today, it would almost certainly be lower due to declines in the underlying share prices of portfolio companies. That said, it wouldn’t be dramatically lower.

The case for Tekcapital sits in the rerating of underlying portfolio companies and the listing of MicroSalt, which will crystalise the value created in the low-sodium salt technology business. Tekcapital recently said MicroSalt had secured deals with top-tier customers, including one of the world’s biggest snack food producers.

There will be arguments for and against individual portfolio companies’ future potential.

To demonstrate the Tekcapital team’s ability to identify technologies with substantial commercial opportunity, we would highlight Belluscura’s multimillion-dollar orders and commitments, representing a step change in revenue generation.

This will likely filter through to Belluscura’s share price once their recent funding package is completed.

Indeed, Tekcapital recently said they saw multimillion-dollar revenue for each of their portfolio companies in the next year as they move away from being early-stage intellectual property-heavy technology companies to gaining significant market traction.

Should this be achieved, the $53.1m net asset value as of 30th June would be a distant memory.

Trading at 8p, Tekcapital has the potential to rally to many multiples of the current share price to move back in line with the current NAV, let alone the potential future NAV of their portfolio companies as they factor in further commercial success.

Cadence Minerals

Cadence Minerals is a mining investment company with holdings providing exposure to iron ore, lithium, and rare earths.

Like Tekcapital, it trades at a significant discount to its holdings’ NAV. However, Cadence Mineral’s potential to multibag in the coming year rests with one individual portfolio holding, the flagship Amapa iron ore project.

Equity analysts at Edison Research recently attributed a 23.9p valuation to the Amapa iron ore project by itself. This compares to the 6p share price Cadence Minerals currently changes hands for.

The Amapa iron ore project located in Brazil was once valued at over $600m by Anglo American. Cadence Minerals has a 32% stake in the asset and has an option to increase its holding.

Cadence is currently working towards bringing the mine back into production and pursuing the necessary permits and licenses to do so. The company was given a boost earlier this year after announcing the acceleration of an operational license, which shortened the issuing time from 36 months to around 12 months.

As is typical of mining projects, investors will likely become increasingly interested in Cadence as production at Amapa nears.

The project benefits from an existing railway line and port, meaning the capex required to start producing iron ore is significantly lower than it otherwise would be.

Cadence has recently entered into an MoU with a party to explore the financing of the Definitive Feasibility Study and eventual mine construction.

In addition to Amapa, Cadence has notable investments in lithium companies Evergreen and European Metals Holdings. Cadence also has a stake in ASX-listed Hastings Technology Metals. The sum of these investments totals very roughly £5m.

With a market cap of £11.3m, this would mean the market is attributing a value of circa £6m to Amapa. The Pre-Feasibility Study released by Cadence Minerals in January 2023 gave the Amapa project a $949 million Net Present Value and $2.96 billion profit before tax over the life of the mines.

Sentiment around junior mining assets soured during the interest rate hiking cycle, hence the low valuation of Cadence Minerals. This can turn on a dime.

Ceres Power slips out revenues warning

Fuel cells developer Ceres Power (LON: CWR) slipped out a profit warning at 6pm on Thursday. More delays with licence agreements mean that 2023 revenues will be much lower than expected.

Management says that 2023 revenues are likely to fall from £22m to £20m-£21m. Consensus revenues were previously £31m. Back in January 2023 revenues of £50m were anticipated by Peel Hunt.

The expectations were reduced at the time of the interims when Ceres Power admitted that China joint ventures with Bosch and Weichai would not be concluded this year because of the requirement for regulatory clearance. Management warned that the outcome depended on securing new licences.

The share price has already halved this year. At the close the share price was 187.8p and it is likely to be much lower when trading begins on Friday.

On 29 June, Ceres Power switched from AIM to the Main Market. The closing share price on AIM was 304.6p.