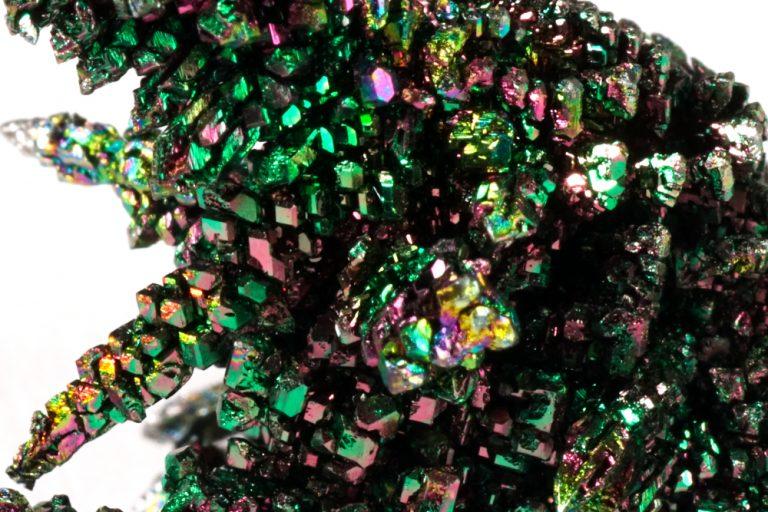

Ferro-Alloy Resources (LON: FAR) is the worst performing full listed company today after it warned that problems with the delivery of concentrate material to its secondary processing facility will hit third quarter results. This follows record second quarter vanadium, molybdenum and nickel production. The share price is 16.3% lower at 9p. That is the lowest since 2021.

Second quarter production was 141.4mt V2O5 equivalent following investment in increasing capacity. A further improvement had been expected in the third quarter.

Shore Capital has put its forecasts under review, although it believes that the processing plant could reach full capacity in the fourth quarter. Supply contracts are in place to prevent the problems happening again.

Liberum has reduced its second half production forecast from 500t V2O5 equivalent to 313t V2O5 equivalent. Even so, full year production and results are likely to be better than for 2022.

Ferro-Alloy Resources is generating cash from the processing to invest in the development of the Balasausqandiq project in Kazakhstan. The feasibility study is expected in the fourth quarter of 2023, although it could be delayed to the first quarter of 2024. The updated mineral resource estimate is 32.9mt grading 0.62% V2O5 for the first ore body.

Vanadium prices have fallen from a high of $10.2bn/lb to $7.4/lb, which is more in line with long-term expectations. Demand for batteries will underpin demand.