This morning’s Trading Update from this AIM-listed industrials company has seen its Broker up its ‘fair value’ for the group’s shares some 17% from 21.6p to 25.2p, 50% higher than last night's close.

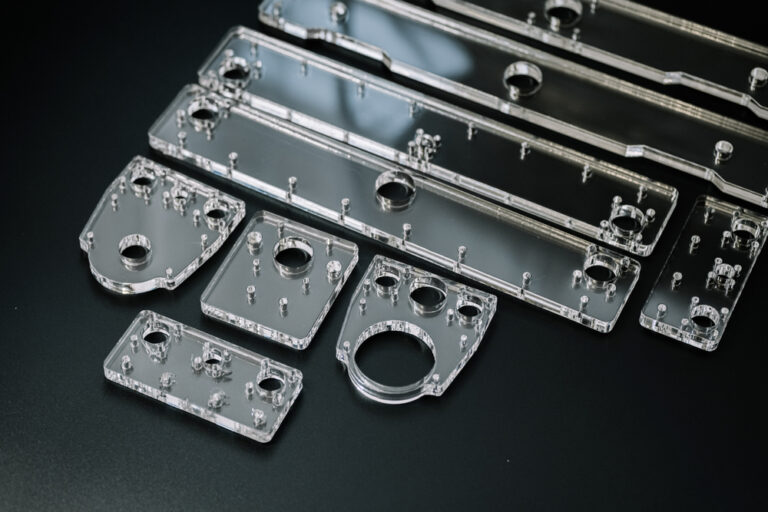

The Wythenshawe, Manchester-based group is a specialist in the design, manufacture and supply of plastic products and has guided that the results for the year to end April 2023 will be slightly better than market expectations.

The group should see its robust balance sheet bolstered by a healthy cash and cash equivalents balance of £5m, compared to its £15.4m capitalisation.

Despite some challengin...

Tekcapital’s Guident to co-host US National Autonomous Vehicle Day

Tekcapital’s Guident will co-host the National Autonomous Vehicle Day event on May 31 at the Jacksonville Transportation Authority’s Test & Learn Facility.

The event will bring together investors, officials and industry leaders to discuss, debate and showcase the latest in autonomous vehicle technology.

Key themes for the event will be increased safety, reduced traffic congestion and improved accessibility.

“Guident takes great pride in co-sponsoring this year’s National Autonomous Vehicle Day alongside JTA in Jacksonville,” saidHarald J. Braun, Guident’s Executive Chairman.

“The convergence of industry leaders at this event holds immense significance as we collaborate to forge an ecosystem that revolutionizes public transportation for the better. Together, we are spearheading the creation of a transformative industry, paving the way for an enhanced future of autonomous urban mobility.”

Guident will soon deploy its Remote Monitoring and Control Center solution with the Jacksonville Transportation Authority for a closed route shuttle service. Guident is developing a similar solution for the Boca Raton Innovation Campus in Florida.

AIM movers: Enwell Energy dividend boost

Enwell Energy (LON: ENW) announced a 15p a share dividend. That sparked a 34.9% rise in the share price to 20.95p, which values the company at £67.2m. There was $88.7m in the bank at the end of 2022, including $6.9m in Ukrainian currency. This is the first good news for a while the Ukraine-focused oil and gas company is trying to find a UK auditor and two production licences were suspended earlier this month – they contribute 12% of production.

Bonhill (LON: BONH) has found a buyer for its loss-making US financial publishing business. KM Business Information US is paying $4.1m. A previous buyer tried to reduce the $6.5m original offer for the business. The share price jumped 21.1% to 5.75p.

Active Energy Group (LON: AEG) says that permission for the construction and operation of a CoalSwitch biomass fuel manufacturing facility at Player Design Inc’s site in Maine. This is conditional on certain data being provided within six months. Production of CoalSwitch pellets could start in the third quarter of 2023. There is further interest in licences from other potential US partners. The share price improved 15.7% to 5.15p.

SIMEC Atlantis Energy Ltd (LON: SAE) says Quinbrook Infrastructure Partners has requested to leas land at the company’s Uskmouth energy park in Wales for use for a battery storage project. That is expected to commence commercial operations in 2024. The share price rose 11.9% to 1.175p.

Maritime data company Windward (LON: WNWD) has launched Ocean Freight Visibility, which is a shipments analysis dashboard. Even so, the share price fell 8.89% to 41p.

Industrial lasers manufacturer 600 Group (LON: SIXH) made an operating loss of $2.4m in the year to March 2023. That is the result of several unprofitable contracts because the effect of inflation had not been taken into account. The order book is worth $7.8m. Tangible net assets are $11m. The share price is 7.25% lower at 8p.

SDX Energy (LON: SDX) says a suspended employee has raised concerns about financial and tax operations. SDX Energy says that they are “substantially without merit”. The oil and gas company has appointed former investment banker Daniel Gould as managing director and he will help with potential acquisitions. The share price declined 6.86% to 4.75p.

Last night Pantheon Resources (LON: PANR) said that 95.4 million shares issued in the recent fundraising are being admitted to AIM today. The other 8.78 million shares have not been issued because the subscription money has not been received, although it is expected in the next few days. The share price slipped 7% to 19.05p. The recent fundraising was at 17p.

Housebuilders, US Tech, and UK Equity Tactics with Marc Kimsey

The UK Investor Magazine was thrilled to be joined by Marc Kimsey, Head of Equities at Frederick and Oliver, for a comprehensive look at tactical positioning in global stocks.

Marc takes a tactical approach to markets and individual equities and we discuss how positioning has evolved since our last Podcast.

We discuss the main macro drivers of stocks currently before moving onto sectors and individual stocks.

Marc explains his views on UK housebuilders and why the end of this year may bring opportunities.

Advert:

Voted “Most Popular Broker” by TradingView in 2022, 2021, and 2020.

Trade with OANDA and get access to one year’s subscription to TradingView Pro.*

*Get TradingView Pro for 1 year when you start trading with OANDA and meet the minimum volume requirements.

Disclaimer:

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

SSE to slash dividend to invest in growth

SSE reaped the rewards of changes to household energy price caps as underlying operating profits soared 65% to £2.5bn in the year to 2023.

Changes to the price cap due to surging energy prices meant energy suppliers were given the opportunity to hike prices during the last year.

Clearly conscious of the optics of benefitting at the expense of UK consumers, SSE said they had invested more in CAPEX to help energy security than they made in profits.

Carefully positioned on the first line of the report, SSE confirmed they had allocated £2.8bn to CAPEX and investment during the period – more than the £2.5bn operating profits generated.

SSE’s existing investors will be pleased that even after the significant levels of investment, there was still cash left over to increase the dividend for the 2023FY. However, income-seeking investors may be perturbed that the company is rebasing the dividend to 60p next year to allocate further funds to investment.

The slashing of the dividend signals SSE may soon be viewed as a growth proposition instead of an income play.

SSE shares were 1.2% higher at the time of writing.

“SSE’s networks deliver electricity across Scotland and Southern England. This is classic utility territory – with revenues and profits closely regulated,” said Aarin Chiekrie, equity analyst at Hargreaves Lansdown.

“SSE’s announced it’s staying the course with its pivot towards renewable energy. Turbo-charging efforts to renewables is a bold and admirable move. But the shift to renewables comes with a hefty dose of risk – they’re not always reliable. To some degree, it’s at the mercy of mother nature. That reality hit home last year as unseasonably calm and dry weather left the group’s renewable output lower than planned, meaning flexible gas-fired plants had to plug the energy shortfall. Fortunately, these are still part of SSE’s offering and helped to majorly boost profits – allowing the group to surpass its recently upgraded earnings per share (EPS) guidance.

“However, in a bid to free up cash to fund the renewables investment, SSE reiterated its plans to slash its dividend down from 96.7 to 60p next year. Investors reacted positively, with the shares showing small gains in early trading. As we move towards a net-zero world, the need for investment in renewables and networks is clear, and SSE’s ahead of the pack in this regard. But the transition will be costly, and it’ll likely be a long road until renewables can generate cash more reliably, which adds a layer of risk to SSE in the near-to-medium term.”

FTSE 100 steady as high-yield stocks rise

The FTSE 100 was broadly flat on Tuesday as debt ceiling talks progressed, but economic data signalled slowdowns in major economies.

The FTSE 100 swung between gains and losses on Tuesday. The index opened lower before improving through the session to trade positively. The US open coincided with London’s leading index giving up gains to trade flat at the time of writing. The S&P 500 opened up down around 0.5% before buyers stepped in.

Helping improve sentiment, debt ceiling talks in the US were showing signs of progress.

“Experience tells investors that these stand-offs always end with a last-minute deal so the market is mostly taking this saga in its stride, particularly given commentary from both sides seems to be increasingly conciliatory,” said AJ Bell investment director Russ Mould.

“Just how close Washington must push for there to be a genuine fear of default is an open question, but right up to the eleventh hour, or in other words the end of this month, the expectation is likely to remain that a deal will be done.”

The FTSE 100 outperformed other major European indices after a string of poor economic data released on Tuesday hit stocks on the continent.

The German and US manufacturing sectors have contracted faster than expected, raising fears the global economy was starting to slow. Services data was better than expected and suggested there were still areas of strength in the economy.

FTSE 100 movers

RS Group was the FTSE 100’s top faller after the electronics company said they ‘are mindful of near-term external challenges.’ RS Group’s operating adjusted profit grew 18%, and its operating margin expanded in 2023, but investors were clearly more concerned about performance in the year to come.

RS Group was down over 7% at the time of writing.

The IMF raised its forecasts for UK growth on Tuesday and now thinks the UK will avoid a recession this year. However, it suggested that rates would remain higher for longer than many thought.

The impact this may have was evident in FTSE 100 consumer stocks which were among the top fallers.

B&M, Frasers Group, JD Sports and Next were all down on Tuesday. Housebuilders were also suffering.

The FTSE 100’s top risers were dominated by stocks with substantial dividend yield suggesting investors were seeking income-bearing assets that could compensate for any potential downside in stock prices.

British Land, Vodafone, British American Tobacco and Kingfisher were the top risers on Tuesday.

Navigating uncertainty and robust dividends with abrdn Diversified Income and Growth Trust

The UK Investor Magazine was thrilled to be joined by Nalaka De Silva, Head of Private Market Solution at abrdn.

Nalaka is responsible for developing and implementing strategies across the Private Markets spectrum. This includes investments across Private Equity, Infrastructure, Real Estate, Natural Resources and Private Credit on a global basis.

The abrdn Diversified Income and Growth Trust provides investors with a structure and strategy usually associated with large insurance and pension funds. The portfolio is a mix of public and private assets delivered in a balanced approach to maintain a solid income and steady capital appreciation.

Find out more about the abrdn Diversified Income and Growth Trust here.

We discuss recent changes in the portfolio and how the team is navigating uncertainty around growth and rates.

Nalaka delivers deep insight into the trust’s weighting and recent changes in the holdings.

Advert:

Voted “Most Popular Broker” by TradingView in 2022, 2021, and 2020.

Trade with OANDA and get access to one year’s subscription to TradingView Pro.*

*Get TradingView Pro for 1 year when you start trading with OANDA and meet the minimum volume requirements.

Disclaimer:

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Topps Tiles – broker increases estimates by 7% after record first half revenues and looks for shares to double

This group is the UK’s premier tile specialist.

Topps Tiles (LON:TPT) is a market leading, omni channel domestic retailer serving homeowners, trade customers and contractors.

It is now celebrating its 60 years of trading, supplying tiles for everyone since 1963.

After announcing its first half results for the 26 weeks ended 1st April, it is now showing a return to profitable growth, especially as its second half year is the stronger trading period.

The £101m capitalised group, which like UK industry generally, was suffering from supply chain and recruitment pressures, however they now seem to be easing, with product availability and movement of goods normalised.

Adjusted operating expenses saw an increase of 7.4%, due to inflation, which were partially offset with store closure cost reductions.

The adjusted pre-tax profit was down as a result of inflation and some one-offs, however the group is confident of a materially more profitable H2 and in hitting full year expectations.

Group revenues were up 9.3% at £130.3m (£119.2m) while its adjusted interim profits before tax were down 38% at £4.4m (£7.1m), with earnings falling 44.5% to 1.57p (2.83p), while the interim dividend was actually increased 20% to 1.2p (1.0p) per share.

The group has a very robust balance sheet and ended the first half with an impressive net cash of £19.9m, together with a useful £49.9m headroom within committed borrowing facilities.

CEO Rob Parker commented that:

“As expected, our first half profitability reflects the impact of inflation year on year, including significantly increased energy costs, and a number of other one offs.

These effects are now reducing or will reverse in full in the second half, underpinning our confidence in a much stronger profit performance in the balance of the year.

Our strong trading, when combined with our successful strategy, world class customer service, leading product offer and strong balance sheet, gives us increasing confidence in our outlook.

We remain confident that we are on track to hit our 20% market share target ahead of schedule.”

Management Outlook

Profit in the second half is expected to increase materially, which should be driven by the growth of the group’s new businesses, by its improving gross margins, giving confidence that it will perform in line with current market expectations for the year as a whole.

Current market hopes are ranging from £10.6m to £12.3m adjusted pre-tax profits.

Analyst Opinion – Target Price 100p

Adam Tomlinson at Liberum Capital rates the group’s shares as a Buy, looking for 100p as his Target Price.

His estimate for the year to end September is for £261m sales (£247m), while profits ease to £11.3m (£15.6m), earnings fall to 4.0p (6.3p) but with a steady 3.6p dividend per share.

For the coming year he is going for £271m sales, £12.9m profits, earnings of 4.6p and a held dividend at 3.6p per share.

He clearly states that the shares are cheap, offering a double-digit free cash flow and a 7% plus yield.

Conclusion – a move above 60p looks inevitable

Topps is the largest specialist distributor of tiles and related products in the UK.

The majority of its revenues are generated from the domestic market for the renovation, maintenance and improvement of UK homes.

The Q3 Trading Statement is due to be announced in the first week of July at which time we can expect an update on the progress towards the end of its trading year.

Having faced some real struggles in the last couple of years this group is now back on the upward path, its shares now up 2% at 51.5p will soon reflect that growth.