Data and intelligence publisher Merit Group (LON: MRT) says full year revenues were £18.6m and EBITDA was one-fifth higher than expectations at £2.6m. The disposal of excess office space will reduce overheads this year. Net debt was £2.5 at the end of March 2023. The focus will turn to growing the business following a period of consolidation. The share price increased 34.7% to 48.5p.

Shares in Argos Resources (LON: ARG) have recovered 46.6% to 0.85p after yesterday’s fall due to plans to leave AIM and sell the PL001 production licences in the North Falkland Basin in return for 8.47 million shares in JHI Associates and £303,500 in cash. Most of the shares received will be distributed to Argos Resources shareholders.

Another company planning to leave AIM, Solgenics Ltd (LON: SGN) has also recovered because non-executive director Scott Fletcher purchased 19.5 million shares, taking his stake to 25.2%. The share price recovered 83.3% to 0.33p.

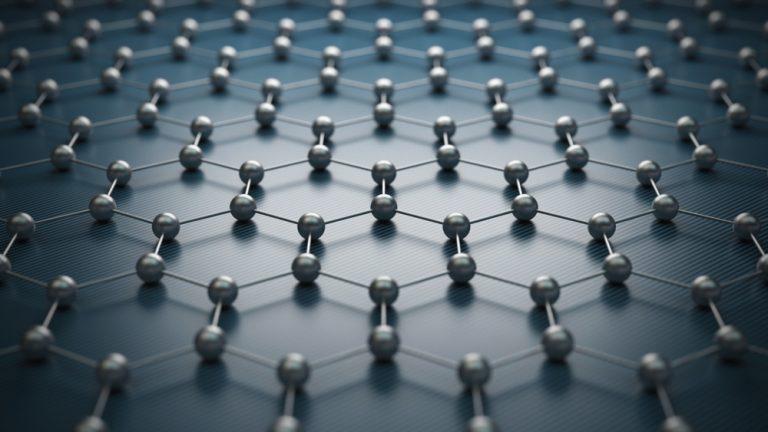

Computational drug development services company e-therapeutics (LON: ETX) says it is in a good position to advance its pipeline of preclinical RNAi candidates. A further four patent applications have been filed in 2023. There was £31.7m in the bank at the end of 2022 and this provides funds for at least 12 months. The share price rose 5.23% to 11.075p.

Supercapacitors designer CAP-XX (LON: CPX) has raised £2.5m at 1.3p a share. The share price slumped 37.1% to 1.4p. Anthony Kongats is stepping down as chief executive, although he has subscribed for shares. A retail offer that could raise up to £500,000 closes at 5pm today. The cash will fund product development and marketing.

Touch screen manufacturer Zytronic (LON: ZYT) has been hit by turmoil in its gaming market. This relates to destocking by a customer and new orders will be delayed until next year. Another customer Azure Gaming America has filed for Chapter 11 bankruptcy protection in the US and it owes £300,000. This means that full year revenues could be between £8m and £8,8m, Net cash was £5.4m at the end of April 2023. The share price dived 26.8% to 102.5p, which is the lowest level for three years.

Orosur Mining Inc (LON: OMI) says Minera Monte Aquila is reviewing its position on the Anza project in Colombia. The project has effectively been placed on care and maintenance. Orosur Mining is continuing early-stage exploration at the El Pantano project in Argentina. The share price fell 24.3% to 5.15p.

Mothercare (LON: MTC) beat the finnCap EBITDA forecast with an outcome of £6.5m-£7m in the year to March 2023. Excluding Russia, sales improved during the year. There is still destocking going on. The pension deficit has fallen to £39m and there is a full review in the autumn. The share price declined 18.8% to 7.15p.

Ex-dividends

AB Dynamics (LON: ABDP) is paying an interim dividend of 1.94p a share and the share price is unchanged at 1687.5p.

CentralNic (LON: CNIC) is paying a final dividend of 1p a share and the share price is 0.6p higher at 118p.

hVIVO (LON: HVO) is paying a dividend of 0.45p a share and the share price is unchanged at 16.5p.

LoknStore (LON: LOK) is paying an interim dividend of 5.75p a share and the share price is 1p higher at 871p.

Midwich Group (LON: MIDW) is paying a final dividend of 10.5p a share and the share price id down 7p to 455p.

Public Policy Holding Company (LON: PPHC) is paying a dividend of 9.5 cents a share and the share price fell 3p to 134.5p.

RBG Holdings (LON: RBGP) is paying a final dividend of 0.5p a share and the share price is 2p lower at 51p.

Safestyle (LON: SFE) is paying a final dividend of 0.1p a share and the share price is 0.8p lower at 23p. Shanta Gold (LON: SHG) is paying a dividend of 0.1p a share and the share price is down by 0.125p to 11.625p.