With the fanfare attached to the breach of 8,000 fading into the rear view mirror, the FTSE 100 is failing to break much higher than the key psychological 8K level, which could open the doors to further selling.

UK equity bulls may start to become concerned if the FTSE 100 fails to establish a sustained presence above 8,000 in the short term. Technical resistance in the 8,010 – 8,020 region is a hurdle that must be overcome soon to avoid investors booking a greater amount of recent profits and sending the FTSE 100 back to 7,900.

The FTSE 100 dipped on Tuesday morning as market focus honed in on global growth and the precarious situation equities find themselves in.

“A tale of shrinking economic activity is still unfolding in countries across the world, adding fresh nervousness to investor sentiment which is already wavering over worries about the path of interest rates,” said Susannah Streeter, head of money and markets, Hargreaves Lansdown.

Having staged a monumental rally from the lows of 2022, equity investors now have to weigh the strength of the global economy and the trajectory of interest rates.

There is an argument equities have already priced in an interest rate ‘pivot’ to lower, and eventually no, rate hikes. This has shifted attention to growth and how central banks will react to economic data.

The reality is, central banks won’t reduce interest rates until economies show signs of pain. And that’s bad for stocks.

Some commentators are talking of a ‘soft-landing’ in growth in the US, but this is very hard to achieve in practise.

HSBC

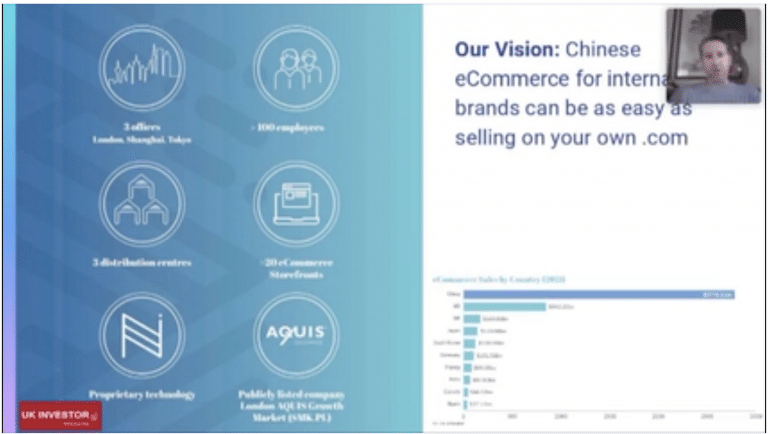

HSBC demonstrated the benefits of the recovery in China with a doubling in fourth quarter profits. HSBC noted an improvement the Chinese real estate sector as its said pre tax profits increased to $2.5bn from $5.2bn in the fourth quarter.

HSBC also hinted at a special dividend on the completion of the sale of HSBC Canada. Shares were 3.8% higher at the time of writing, helping to offset losses elsewhere in the index.

Cyclical shares such as the miners and housebuilders highlighted investors concerns about growth with Anglo American, Glencore and Persimmon among the top fallers.