Medcaw Investments is seeking suitable acquisitions in the life sciences sector, particularly those companies involved in medical technologies or therapies. Because of the change in rules for the standard list that target must make the enlarged company worth at least £30m when it applies for readmission. Medcaw Investments was able to float, because it had already applied for a listing prior to the change in the rules on 3 December 2021.

The share price ended the day at 10.5p (9p/12p). There were no reported trades. Any buying interest could have an unwarrantedly large affect on the share pric...

AIM movers: Image Scan rises, but ScotGold Resources reduces production guidance

X-ray screening systems developer Image Scan (LON: IGE) has risen on the back of Braveheart Investment Group (LON: BRH) acquiring a 2.37% stake last week. Braveheart Investment bought 3.25 million shares at 1p a share. That was above the market price at the time. The share price has belatedly jumped by 23.1% to 1.2p. Image Scan is loss making, but Braveheart Investment believes it has medium-term growth potential.

Tekcapital (LON: TEK) subsidiary MicroSalt is partnering with US retailer Hannaford Brothers. MicroSalt will sell low sodium salt through the retailer, which has 185 stores. Zeus has been appointed as nominated adviser and broker for MicroSalt, which plans to join AIM in 2023. The Tekcapital share price is 10.5% higher at 18.5p.

Zephyr Energy (LON: ZPHR) is acquiring the remaining 25% working interest in the Paradox project for up to $3m in shares, as well as other non-operated near-term production assets in the Williston Basin for $2.9m in cash. An $8m working capital facility has been secured to finance the purchase and provide cash for development. The assets are in the US Rocky Mountains. Production rates are expected to treble to 4,800 barrels of oil equivalent/day by the end of 2023. The share price moved ahead by 8.26% to 5.9p.

Sanderson Design Group (LON: SDG) has signed a licensing agreement with Ruggable, through its Morris & Co brand. US-based Ruggable supplies machine washable rugs and will develop a range of rugs and cushions, which will also be sold in Canada and Australia. The share price rose 3.1% to 116.5p.

Scottish gold producer ScotGold Resources (LON: SGZ) more than doubled its loss for the year to June 2022 to A$10.5m and it has lowered production forecasts for the current quarter. Further development work means that production will be 2,000 ounces of gold, compared with a previous estimate of more than 3,000 ounces of gold. The share price fell 12.7% to 51.5p.

Infrastructure India (LON: IIP) has published its 2021-22 annual results and its interims to September 2022. The shares are down 11.1% to 0.4p, although they fell to 0.3p at one point. There are £181.7m worth of assets held for sale and disposal talks continue. There are net liabilities, but this does not take account of potential deferred consideration for one of the disposals.

Georgia-focused oil company Block Energy (LON: BLOE) says positive well testing news means that it will pursue the Patardzeuli full-field development. The share price declined by 8.16% to 1.125p.

Eurasia Mining (LON: EUA) is still trying to sell its Russian assets, but it had no significant progress to report in its latest trading statement. This year’s total production for 2022 will be around 77% higher at 200kg of raw platinum concentrate. There is still £4m in the bank. The share price slipped 2.94% to 4.125p, having fallen below 4p at one stage.

Bunzl on track to deliver strong growth

Bunzl have released an upbeat trading statement and confirmed positive growth throughout 2022.

Bunzl said revenue in 2022 is expected to rise around 17% year-on-year with both inflation and the impact of acquisition pushing sales numbers up.

Looking forward into 2023, the group said they expect group revenue to be resilient and slightly higher than 2022.

“Bunzl’s performance over the year has continued to demonstrate the strength and resilience of the Bunzl business model. Our teams have successfully navigated the inflationary environment and supply chain disruption experienced this year to ensure customers have reliably received the essential products they need,” said Frank van Zanten, Chief Executive Officer of Bunzl.

“Furthermore, we have continued to deliver on key strategic objectives, including supporting customers with innovative products that are better suited to a circular economy and have had our ambitious carbon emission reduction targets approved by the Science Based Targets initiative (SBTi). In addition, we have committed more than £280 million of spend to acquisitions over the year, with our pipeline remaining active and supported by our strong balance sheet.”

MicroSalt partners with major US supermarket

MicroSalt is gaining significant traction in the roll out of their branded low-sodium salt shakers with an additional supermarket now partnering with MicroSalt for the distribution of their products through US stores.

Tekcapital portfolio company MicroSalt has announced Hannaford Brothers, the major US supermarket, will now be stocking both sizes of MicroSalt shakers.

“We are extremely excited that Hannaford Brothers has joined with us to provide low sodium solutions to its customers. This is a tremendous step in our march toward reducing excess sodium in the average diet. Our take-home shakers will let people salt their food to taste without excess sodium,” said Rick Guiney, CEO of MicroSalt®.

The development demonstrates the commercial progress MircoSalt are making ahead of a potential listing in London in 2023. MicroSalt announced just this week they had appointed Zeus Capital as their Nominated Advisor for the AIM float.

MicroSalt are fighting a global cardiovascular disease crisis that is being exacerbated high levels of salt in peoples diets. MicroSalt salt has 50% less sodium in than normal table salt.

Hollywood Bowl – this cash generative group encourages ‘strikes’

While ‘strikes’ abound around the country, it is well worth noting just how well this group is doing by encouraging more strikes.

But then this company, which has just announced its results for the year to end September, feeds itself upon its customers enjoying strikes.

I am not talking about industrial disputes but instead in terms known by any efficient bowler.

The Business – fun, safe and family-friendly

Capitalised at £393m, the Hollywood Bowl Group (LON:BOWL) is the UK’s largest operator of ten-pin bowling and mini-golf centres.

Since the closure of its centres due to the Covid hassles, this group is starting to score well again.

With its headquarters in Hemel Hempstead, this company’s estate includes some 73 centres operating both in the UK and in Canada.

Its AMF and Hollywood Bowl brand-names are highly visible across the UK, while it goes under the Splitsville tag in Canada and under Puttstars for its mini-golf.

Each ten-pin centre, of which there are 69, is equipped with 24 bowling lanes, while the four mini-golf centres have three nine-hole attractions.

Its large, high-quality bowling centres are generally located in ‘out-of-town’ multi-use leisure parks close to cinema and casual dining sites and with large retail areas.

Offering a complete family entertainment experience, each centre provides bowling lanes or mini-golf courses alongside its group on-site dining, licensed bars, and state-of-the-art family games arcades.

The group operates in quite a resilient part of the market, offering affordable low-price family entertainment.

It is well insulated from cost pressures, with its UK energy contracts into 2024. The group is managing to keep its prices low, while its headline price remains the lowest of all the branded bowling operators – with a family of four being able to bowl for less than £24.

A Strike or a Spare?

Just in case you are not up with ‘ten-pin bowling’ terms, please let me inform you.

When you bowl and knock down all ten bowling pins with your first ball, it’s called ‘a strike’. You get ten points for that, and then any pinfall points scored with the next two balls are doubled.

If it takes two balls bowled to knock down ten pins it is called ‘a spare’.

The Final Results and Outlook

The year to the end of September showed the group making excellent operational and financial advances, boosted by a programme of refurbishments, rebrands and new openings.

Total revenues rose to £193.7m (£129.9m), pre-tax profits £46.7m (£0.5m) while its net profit increased to £37.5m (£1.7m), generating basic earnings of 21.91p (1.05p) per share.

The interim dividend was 3.00p per share, while the final is 8.53p together with a special dividend of 3.0p per share for the year.

Very encouragingly the group’s net cash position at the end of September was £56m (£29.9m) and an undrawn revolving credit facility of £25m.

On a sales per business basis the group makes around 49% from bowling, 1% from mini-golf, some 25% from amusements and about 25% from food and drink.

Looking ahead, the company sees a significant opportunity to grow its business to more than 110 centres across its three experiential leisure brands: Hollywood Bowl and Puttstars in the UK and Splitsville in Canada.

The company has continued the momentum from the last year into the start of the current financial year, with strong demand and encouraging pre-bookings for the Christmas period.

Conclusion – excellent upside for 2023

The group’s strong balance sheet and cash-generative business model, together with its resilience to inflationary pressures, will enable it to capitalise on its organic and international growth potential.

The company’s shares in the last year or so have been as low as 161.5p, while its peak of 294p was scored in mid-January this year.

Currently trading at around the 230p level, the undervalued shares offer excellent upside for 2023.

Consider Power Metal Resources for green energy and battery metals exposure in 2023

Power Metal Resources has built a significant global portfolio of metals through their ‘Explore, Crystallise’ strategy which now spans North America, Africa and Australia.

In 2022, Power Metal’s strategy has had a notable focus on the growing demand for battery metals and minerals facilitating the clean energy revolution.

According to data from Benchmark Minerals, 300 new mines are needed by 2035 to meet demand for electric vehicles and battery metals.

These battery metals include cobalt, nickel and lithium – all constituents of the Power Metal exploration portfolio.

In addition to battery metals, Power Metal Resources is looking to nuclear energy and the potential increased demand for uranium.

Lithium

Lithium demand has become synonymous with the electric vehicle revolution and demand for the metal is set to enter a structural supply deficit within the next decade as EV manufacturing increases.

If demand has any chance of being met, a significant level of fresh lithium supply is required to come online through the establishment of new mines.

Power Metal Resources is planning to bring a number of these new mines to production as they undergo early evaluation of projects thought to hold economically viable lithium deposits.

These assets are located in Canada and Australia. They include the Selta Lithium Project in Australia, and the North Wind project and Authier North property in Canada.

Selta

The Selta project is held within Power Metal’s subsidiary First Development Resources. Power Metal Resources has a 58.59% interest in First Development Resources and the effort to list First Development in the near future is gathering speed. Selta is located in Australia’s Northern Territory and holds 700 potential outcropping pegmatites within a target area of circa 180km2.

North Wind

The recently acquired North Wind project in Ontario has found anomalous lake sediment ranging from 18.63 to 34.95 ppm Lithium and is undergoing further studies.

Authier North

The Authier North Property borders licenses holding significant lithium resources. Sayona Mining’s (ASX:SYA) Authier project located to the south west of Authier North has a JORC compliant reserve of 17.1 Mt at 1.01% Li2O. Sayona’s project has a NPV of CAD$216 million and a pre-tax internal rate of return at 33.9%. Power Metal will hope similar mineralisation will be revealed as Authier North is explored.

Nickel

Power Metal Resources has a 27.91% interest in First Class Metals which has encountered high-grade nickel at their West Pickle Lake joint venture with Palladium One. Assays from drill hole TK-21-070 revealed exceptionally high-grade 3.1% Nickel Equivalent.

Power has been increasing their exposure to nickel and platinum group metals by upping their stake in the Molopo Farms project in Botswana. A drill campaign has encountered nickel sulphides with results up to 1.69% Ni and works continue to further evaluate the project.

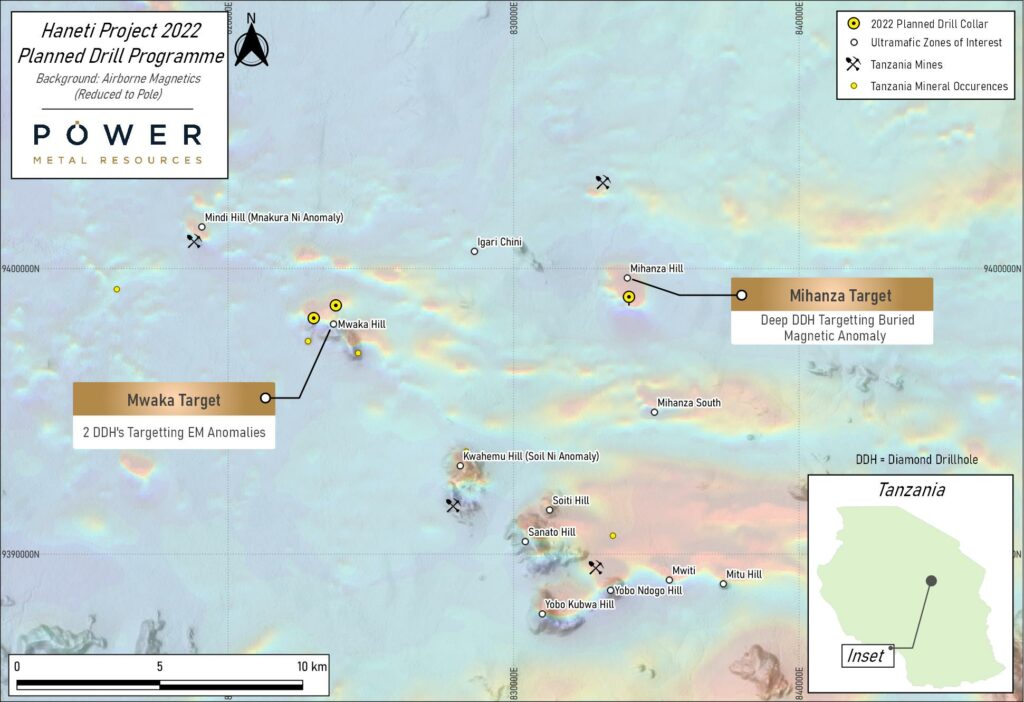

Power Metal Resources also has a 35% interest in the Haneti nickel sulphide project in Tanzania through an investment in Katoro Gold. The Haneti Nickel Project is highly prospective for nickel and is undergoing an extensive drill programme.

Cobalt

Power Metal Resources’ cobalt exposure is achieved through projects already discussed in this article in the Haneti and West Pickle Lake projects. Cobalt is typically found alongside nickel in sulphide ores such as those encountered at the Haneti project and West Pickle.

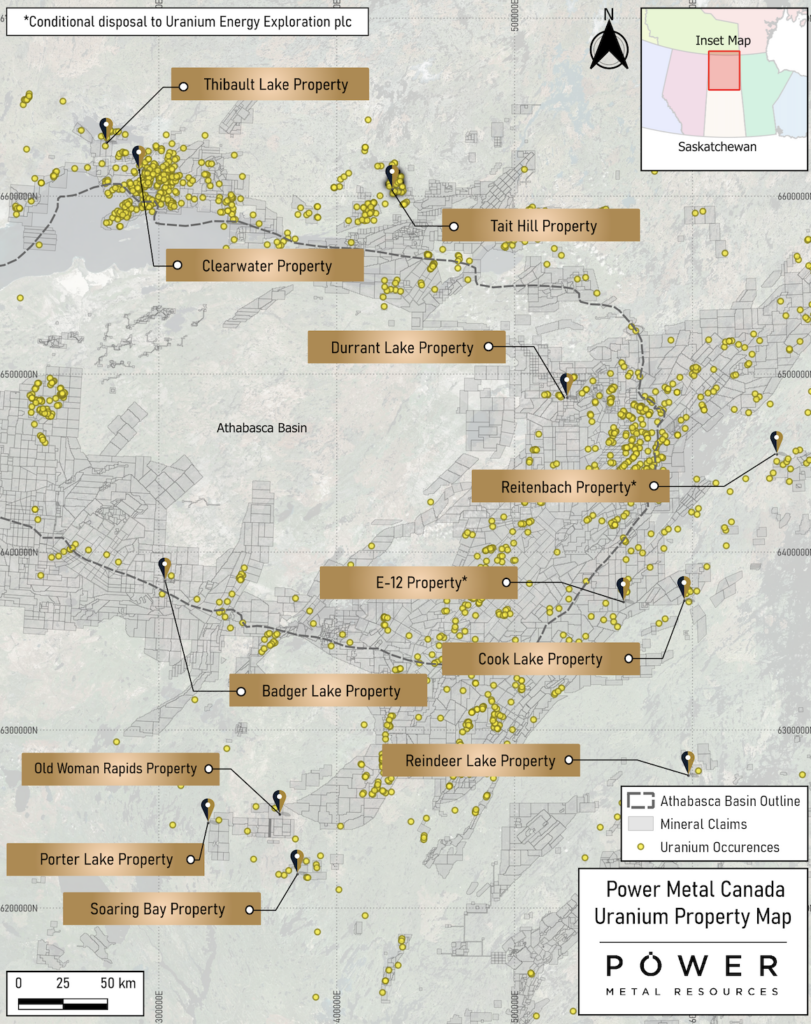

Uranium

Power Metal Resources are one of just a few companies listed in London with any exposure to Uranium. Uranium is not a metal associated with EVs and battery storage, but a metal that will power the generation of clean energy from nuclear power plants.

Power’s uranium assets are located in the Athabasca Basin, Canada. Power has been attracted to the area by high-grade uranium mineralisation results of 1.09% U308 over 10.7m at Thibault Lake, grab samples up to 3.54% U308 in Cook Lake, as well as soil samples up to 13,200ppb U at the Tait Hill property.

These had already been discover and were made available to Power through geological databases including airborne magnetics and government bedrock mapping. Power has identified new potential targets and the project now has 12 prospective properties.

AIM movers: Velocity Composites $100m US contract and potential bid for Xpediator

Composite parts kits supplier Velocity Composites (LON: VEL) has announced a $100m plus work package agreement with GKN Aerospace in Alabama, which provides a significant boost to its entry to the US market. This has sparked a 72.2% increase in the share price to 46.5p. The 2017 placing price was 85p. The GKN agreement covers five years. The new production facility opens at the beginning of 2023. GKN is an existing client in the UK. Velocity Composites expects to report 2022 revenues of £11.9m. A loss of £1.5m is forecast and it will not be much less next year. Once the US is fully up and running the company could move into profit in 2024.

Freight business Xpediator (LON: XPD) has received a bid approach at 42p a share and the board is leaning towards recommending the offer. A consortium is led by Stephen Blyth, the former chief executive of Xpediator, and involves Justas Versnickas, who runs the Delamonde Baltics subsidiary. It has the backing of private equity firm Baltcap. The offer would be in cash and involve a partial loan note alternative. The two largest independent shareholders have indicated their willingness to accept the offer. Along with the consortium stake, this would take acceptances above 50%. Discussions continue. The share price is 22.3% higher at 37p.

Cloud-based software supplier i-nexus Global (LON: INX) grew underlying monthly recurring revenues by 12% to £250,000. In the year to September 2022, fell from £3.64m to £3.13m due to non-renewing contracts. The loss was flat at £1.1m. There was £99,000 in the bank at the end of September 2022. The share price rose 11.7% to 3.35p.

Kazera Global (LON: KZG) has sold African Tantalum to Hebei Xinjian Construction for $13m and retaining a 2.5% payment of 2.5% of gross sale of lithium and tantalum for the life of the mine. A sale of a 49% stake for $7.5m was previously proposed. Kazera Global will focus on its heavy mineral sands project in South Africa, which has commenced production, and look for other opportunities. The hare price increased by 7.7% to 3.5p.

San Leon Energy (LON: SLE) is selling its non-core investment in the Oza oilfield to generate working capital. Management has delayed using the $50m facility provided by MM Capital because it believes there are better alternatives. This includes an issue of shares to a prospective lender. Discussions have dragged on and will not be concluded until next year. This means that San Leon Energy has not been able to make progress with its expansion plans. The share price slumped by 25.2% to 27.95p.

Oil and gas company Empyrean Energy (LON: EME) invested £1m in exploration and there was a £591,000 cash outflow from operations. There was $800,000 in the bank at the end of September 2022. The company plans to drill the Topaz prospect in China before June. The share price is 13.9% lower at 0.689p.

Beowulf Mining (LON: BEM) intends to raise £8.8m via a preferential rights issue of SDRs raising £6.7m and a retail offer of shares raising £2.1m. The funding will be priced in January. The cash will finance the development of the Kallak North iron ore project in northern Sweden. There was a 11.8% decline in the share price to 3.75p.

Premier African Minerals (LON: PREM) has intersected multiple thick high-grade zones at the Zulu lithium and tantalum project. The pilot plant construction is progressing. Spodumene production should start in the first quarter of 2023. The share price has fallen 6.1% to 0.495p.

Serica Energy expands in North Sea

Serica Energy (LON: SQZ) is using its cash pile to buy Tailwind Energy and this will make it one of the top ten oil and gas producers in the UK North Sea.

The deal values Tailwind Energy at £367m and comprises up to 111 million Serica Energy shares and £59m in cash. The value is based on a Serica Energy share price of 277.5p and it has slipped to 260p. There is also net debt of £277m included in the transaction.

Serica Energy should have cash of £320m in the bank at the end of 2022, prior to the acquisition going through. There is also £40m of hedging security. Cash continues to be generated so the cash pile will build up again.

Serica increased production to 28,977 barrels of oil equivalent/day in November and the full year average should be between 26,000 and 28,000 barrels of oil equivalent/day.

Tailwind Energy has six producing assets, and this should increase group production to between 40,000 and 45,000 barrels of oil equivalent/day.

The deal also adds tax losses to the group – $1.4bn of UK ring fence corporation tax losses and $1.2bn of supplementary charge losses. The Tailwind Energy management is staying on in the enlarged group. The target’s major shareholder Mercuria will own one-quarter of Serica Energy and it will appoint two non-execs.

A general meeting will be held in January and the deal could be completed in March.

Earlier this month, Serica Energy said that the North Eigg exploration well has not encountered commercial quantities of hydrocarbons. The well cost around £13m.

Petrofac shares sink as pandemic delay costs bite

Petrofac shares were in freefall on Tuesday as the energy engineering services company feels the pain of delayed contracts due to the pandemic.

Petrofac’s Engineering and Construction (E&C) unit is expected to suffered a full year EBIT loss of approximately $190 million for 2022. This sharp loss is a result of uncovered commercial settlements and the overrun of legacy contracts caused by the pandemic.

The disappointing performance in the E&C unit means Petrofac now expect a $100 group loss in 2022 and a drop in revenue to $2.5bn. Petrofac recorded $3bn revenue in 2021 and $4bn in 2020.

The loss of revenue has been a constant worry for Petrofac investors and their shares are down 44% in 2022 after diving 9% today.

“It certainly seems that incoming CEO Tareq Kawesh has his work cut out for him at Petrofac. Whilst legacy issues at Engineering and Construction should have less of an impact going forward, it seems that the division won’t return to profitability next year,” said Derren Nathan, Head of Equity Research at Hargreaves Lansdown.

“And the units that performed well this year are not expected to generate the same returns in 2023. That said the pipeline of potential projects across the Group is very strong at $68bn, but as ever the key will be not just conversion, but also securing strong commercial terms.

“Pricing discipline is essential, to avoid a race to the bottom. Whilst New Energy is continuing its momentum, Petrofac remains highly leveraged to the oil and gas market. The recent drop in prices means it will be making lower profits from its own production, and any further deterioration could see its clients in the industry think hard about commissioning new projects.”

Tekcapital shares rise after significant step forward in MicroSalt IPO process

Tekcapital have announced a significant step towards the initial public offering of their portfolio company MicroSalt® with the appointment of Zeus Capital as the Nomad for an AIM listing.

The announcement signals material progress in Tekcapital’s process to list the low-sodium salt company and raise capital to accelerate growth.

“We are very pleased to appoint Zeus as our Nominated Adviser and Broker, to assist MicroSalt in effectuating an AIM listing and to provide capital market guidance for our global growth strategy,” said Rick Guiney, CEO of MicroSalt®.

MicroSalt have already made notable progress in securing a number of partnerships and distribution channels including making their SaltMe crisps available in hundreds of Kroger stores in the US.

The MicroSalt IPO will be the next in a series of successful listings by Tekcapital that includes AIM-listed Belluscura and the NASDAQ listing of Lucyd earlier this year.

Tekcapital shares were trading up 6% at the time of writing.